SliceLabs is becoming pivotal to the story of technology anddisruption in the insurance industry.

|The New York City-based startup topped InsurTech headlines inrecent months with its high-dollar capital campaign, major insurerpartnerships, and ultimately the U.S. launch of on-demandpolicies tailored to such sharing economy insurance consumersas Uber drivers and Airbnb hosts.

|Here, company CEO and co-founder Tim Attia talks with PC360about the coverage gap that Slice is looking to fill,and how the company aspires to scale their product beyond theinternet's market niches.

|Related: When worlds collide: Insurers andInsurTech

|This interview has been edited and condensed forclarity.

|PC360: In your view, what's the lay of the land inthe insurance industry, and where does Slice fit into thatlandscape?

|

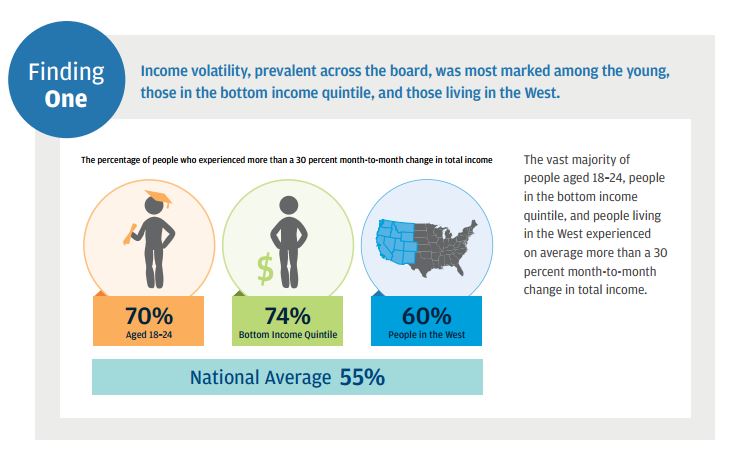

JP Morgan Chase did a study last year to get toknow everybody's salaries. There were four (groups) they looked atwhere people's salaries varied up to 30% from month to month. Thismeans people are making money in non-traditional ways. The McKinsey Institute also did a bunch of studieslast year showing 20% to 30% of all workers in the EU and U.S. aremaking money in this way. We call this the new economy.

|So the lay of the land is that we're trying to do insurance in anew way. We're trying to simplify it, take out all the friction,make it a lot easier, remove a lot of the fat and the waste and thecost, but also focus on the new economy…

|A lot of people are coming up with new ways of doing insurance,but they're [using] a standard homeowners' or renters' policy. Sothey're not addressing a new risk. We wanted to address a new risk…We wanted to focus on this on-demand worker, people who are using apersonal asset — their home, their auto — to make money.In the new economy, you have someone using a personal auto like abusiness. So you're in this situation where the property side ispersonal, but the liability side is commercial, and that's new.

|Related: 3 InsurTech updates to the underwritingprocess

|Our view was, the only way to get there was to re-thinkinsurance. We couldn't rely on any existing system or process. Sowe designed a new policy form. We came up with a new set ofunderwriting and pricing. And we don't have an insuranceapplication at all.

|PC360: What processes take the place of atraditional policy application?

|Attia: Take our home insurance policy. Someonegoes online, and they have to register with an email address. Weask them for their [property] address, and they register with theiraddress. Then we come back with a quote. We have all the data weneed. We know the property's construction type, roof type,projection costs. We know the size of the property. We've gatheredeverything. We just don't ask you to tell it to us in anapplication and sign at the bottom. We think the application isreally just a tool that agents use to get facetime with people. Butif you can accurately get all the information and data for thequote, the application is just not needed.

|

Graphic is from “Paychecks, Paydays, and the Online PlatformEconomy: Big Data on Income Volatility,” published in 2016by The JPMorgan Chase Institute.

Continue on…

|

Slice marketed its on-demand products to people like LaviniaOsbourne, who rents out home-office space in her London residencethrough Spacehop.com, by appealing to their sense ofcommunity. (Photo: AP Images)

|PC360: How is the messaging different for youraudience than it might be for the traditional, mainstream,incumbent insurance consumer? Does the new economy require newmarketing and communications?

|Attia: We knew it would be hard to get to the consumer. So we're doing acouple of things. Our hypothesis is, people in the on-demandeconomy act like a community. They went to the Airbnb meetups, theyhave open Facebook pages, and they see themselves as a community.They all read the same websites and blogs. Many of them work withvacation management companies. There are a lot of interestingaggregation points when you target a community.

|Related: Protecting clients who participate in the sharingeconomy

|In the early days, I flew into a city like Denver, and went to apub downtown where a whole bunch of AirbnbSuperhosts were meeting up, and we sat there in our jeans,bought them beer and told them about insurance policies. I rememberone day, we were at an Airbnb meetup during rush hour, and therewas a snowstorm outside. Still, this woman came running in saying:“Is this the place where I can get insurance?” That'swhen we really knew we were on to something.

|Now, you can't become GEICO or Progressive on community alone, butit's a great way to start.

|Then we were kind-of stuck. We thought, “How are we going toscale this?”

|We are in an insurance distribution gap. So we thoughtsome large direct writers would be interested in distributing ourproduct, because they know people are using their home policy torent or be on Airbnb, or driving for Uber on their personal autopolicy.

|PC360: Given your take on the new economy, whatthoughts do you have for independent insuranceagents?

|Attia: Distribution is owned by a lot of peopleincluding independent agents. Right now, in the distribution puzzle, it's very, verydifficult. If I were an independent agency, I would try tobring in as many younger people as possible and try to make a bigenvironment attractive to the younger generation, because they'regoing to be in a better position to figure out how their peers aregoing to buy. If they want to take a step ahead, they have toremember that technology is in front of people all the time.

|I would try to attract the next generation, if you ever want tofigure out where to (sell to) their friends. I haven't seen anybodycome up with a magic wand for distribution. I know that directwriters are doing very well, but they're also spending well over abillion dollars on advertising.

|PC360: So many people who rely on technology forbusiness are still reeling from the reach of the WannaCry virus.How serious is the threat of malware and ransomware to a companylike Slice?

|Attia: It is interesting, because all of thesetech-enabled startups have basically decided to put an insurance company in the cloud. The thingsthat can happen to you are not the same things that can happen whenyou have a physical data center. I mean, they can still happen toyou there, but there are more things that can happen [in thecloud]. Nobody is going to come and change all the locks on yourdoors and lock you out of a physical data center. But in the onlineworld, they can just lock you out. They can just change all thelocks on you, and that's pretty scary.

|There's a whole bunch of stuff you have to do to take itseriously. But I guess the first rule of security is, don't talkabout your security.

|See also:

||Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.