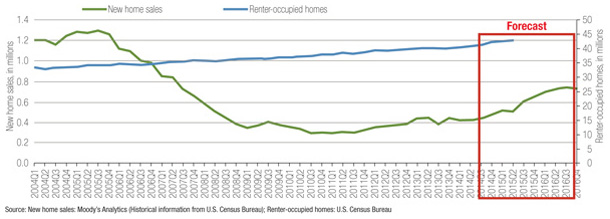

With home ownership remaining an unattainable goal for many,rental property construction is up as more people are rentingrather than buying. And with this increase comes opportunity forproducers schooled in the process of insuring these units.

|Multifamily apartment starts rose 55% in June year-over-year,according to the U.S. Census, and the supply of apartment unitsremains far lower than demand. Apartment occupancy, meanwhile, hita near-record high of 95.2%.

|For now, insurers are observing an increase in renters andrental-property construction. “Data suggests that there is moremulti-family construction,” says Angi Orbann, second vicepresident, Personal Insurance, at Travelers. “There's a focus onapartments because of demands from the rental population.”

|Much of that increase in construction depends on region: GeneSandy, director of marketing at Millennium Alliance Group, anindependent insurance agency in Syosset, N.Y., says construction inthe Long Island area continues because a need for affordablehousing: “We're seeing more and more condos being built for people55 and over.”

|Loretta Worters, vice president of communications for theInsurance Information Institute (I.I.I.), says in urban areas likeNew York, condos are being built every day, and there is anincrease in high-rise units in Miami.

|In Boston, Dick Lavey, president, Personal Lines, for theHanover Insurance Group, says he's seen an increase in demand forrental properties from a “young professional population looking torent rather than own,” and apartment buildings are going up to meetthat demand.

|Related: Most young renters uninsured: Nationwidesurvey

|When insuring rental properties, pricing depends primarily onlocation and the type of construction, says Sandy, noting thatrates have been consistent for properties of better construction.“When you're talking about, say, high rises, rates have been levelthroughout the years,” he explains, adding that rates could berising for frame construction or properties close to water.

|Lavey also says construction and geography are the two biggestconsiderations when it comes to pricing, but he notes an additionalfactor: Large apartment complexes are more subject to the pricingcycles seen in Commercial Property and the broader commercial linesmarket. “When you think about property coverage for those types ofcomplexes, that's a commercial policy,” he says. “It's not owned byan individual, it's typically owned by an entity or a business. Andthose do face the same kind of pricing cycles that commercialproperty does.”

|Jim Auden, managing director at Fitch Ratings, says results havebeen good overall in commercial property, “but rates have gottenreally soft there with the lack of catastrophe losses in the lastfew years, and I think that will continue until there is anevent.”

||

By contrast, individual or two-family homes used as rentalstypically follow the trends seen in the Homeowners' insurancemarket, which Lavey notes is less cyclical and tends to move withthe Consumer Price Index, inflation trends and cost of materials,in addition to being impacted by weather events.

|As for the greater number of renters themselves, and whetherthey present an opportunity for insurers, I.I.I. President BobHartwig says there has been some progress in demonstrating thevalue of Renters' insurance. He says that while only about 40% ofrenters have a policy today, that's up from around 27% five yearsago. Still, this compares to about 90% of homeowners who areinsured. Hartwig also notes the dollars involved are not as largefor Renters' policies.

|But selling a Renters' policy, he adds, does allow an insurer toget its foot in the door and potentially sell customers on aHomeowners' policy if they decide to purchase a house later.

|Orbann says the greater number of renters does present anopportunity for agents to initiate conversations about coverage,particularly as they are discussing Auto insurance with customers:“We're making efforts to allow agents to reach out to customersthrough social media, e-mail, website content … we definitely seeit as an opportunity for our agents.”

|Related: Millennials are finally leaving basements, movingto apartments

|But, like Hartwig, Orbann believes the trend toward more renterscould turn. “I think what we're seeing is definitely an impact ofthe recent economy,” she says. “In the past, typically the firstpurchase of the home was happening earlier in life stages than itis now. Some of those coming out of college are saving more,renting longer and waiting to purchase that first home untillater.

|“We expect them to eventually purchase homes,” she adds. “But asfar as when that happens, it'll be interesting to watch.”

|And despite the recent trend toward more renters and rentalproperties, insurers do not appear to be making major changes inhow they conduct business. “It's not making us dramatically shiftour strategy,” says Lavey. “We still work on the full account,where we attempt to have the Homeowners' policy, as well as thedwelling and fire policy on a property a customer is going to rentout to other people.”

|Homeowners' market

|According to a recent Moody's Personal Lines Outlook,Homeowners' insurers were profitable through the first half of 2015after two straight profitable years in 2013 and 2014. Homeowner'sinsurers have benefitted from continued rate increases, althoughMoody's notes these increases are slowing — from 7% in 2013 to 5.4%in 2014, to about 4% expected in 2015, partly because of lowercatastrophe reinsurance costs.

|Those lower prices, which stem from an influx of capital intothat market, are driving different strategies among Homeowners'insurers, says Lavey. For some, the savings are going right totheir bottom line, while others are buying up more reinsurancebecause it's so afforable. “The implication of that isn't that it'sflowing down and we offer cheaper rates,” he explains. “It's thatwe can think of taking on more risks.” When considering aneffective aggregation-management strategy, he adds, morereinsurance means being able to have a bit more aggregation incertain pockets.

|Insurers have also been helped in recent years by no majorhurricane losses or other single major events, although Fitch'sAuden notes Homeowners' insurers have been “getting blasted” bymore incremental losses from hail, winter storms, tornadoes andother weather events.

||

The Moody's report notes that insurers have been adopting “moresophisticated by-peril rating plans to better align premiums tospecific perils,” such as wind, fire, hail, lightning and theft.“Assuming it is well-executed,” the report continues, “themultivariate approach should improve pricing efficiency and reduceearnings volatility.”

|“Most major insurance carriers that write Homeowners today havemoved to a by-peril rating approach, as opposed to an all-perilrating — and we are in fact doing the same,” says Lavey. “We're inthe process of building that, and will be introducing it into 2016and 2017.

|“It's akin to what happened in the auto industry: You're justgetting more refined pricing segmentation, and when you think aboutit, it really is the right way to price Homeowners,” he continues.“You want to match the risk — the peril — to the geography.” Laveysays by-peril rating is an option today because of the greateramount of data available, and ultimately it allows insurers toapply discounts based on where a home is located.

|“Arguably, those who don't move to a by-peril approach couldface adverse selection,” says Lavey, “because those who have asophisticated pricing approach will be able to offer the best pricefor that risk,” whereas insurers that price all risks as one willnot get the best risks in that given geography.

|Another strategy Auden mentions is an increasing focus oninsuring higher-end homes and customers, which gives insurers anopportunity to capture more coverages, as such customers willlikely have more to insure and typically purchase additionalpolicies such as umbrella. He cites the ACE/Chubb deal as anexample of carriers sharpening their focus in this area.

|As insurers identify trends and refine their approach toHomeowners' insurance, they do so in a favorable environment. AsAon Benfield notes in its recent “Homeowners ROE Outlook,” “For anationwide, personal lines insurer, the overall outlook for theHomeowners line of business continues to be positive,” citingwidely available reinsurance capital, continuing rate increases andthe move toward by-peril rating plans: “In a world of persistentlylow investment yields, our country-wide prospective after-tax ROE[return on equity] estimate is 8.6%, up from last year's 7.9%.”

|Room for improvement?

|While home ownership is certainly being delayed for themillennial generation, I.I.I. President Hartwig said he believesthe pendulum is expected to swing again.

|“You do have an increased proportion of the population renting,but I think that reflects the fact that just about everything themillennial generation is doing is happening with a delay — in partbecause of the deep recession,” he says. That modest pace, he adds,has led to a “mistaken view that people don't want to own homesanymore.

|“Coming out of the recession, growth was slow in manyindustries, particularly in the area of homeownership,” Hartwigadds. “Many people had their credit damaged, and many people werestill underwater with respect to their homes.”

|As a result, he says, “People married later, and are havingchildren later. But the next generation will live in their ownhomes, they will reproduce, and the human species willcontinue.”

|And with rent costs rapidly increasing, Hartwig believeshomeownership will soon become a better deal than renting.

|Related: 5 reasons millennials aren't buying insurance fromlocal agents

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.