Here is a look back on a year's worth of The Chalkboard, arecurring infographic that appears in each issue of National Underwriter Property & Casualtyand every month on PropertyCasualty360.com.

|Focusing on the insurance industry's most pressing market linesand trends, stats and facts are brought to focus with illustrationsby Shaw Neilsen.

January

Slips, trips and falls are one of the leading causes ofunintentional injuries, according to the National Safety Council.Common areas for falls to occur are in doorways, ramps, clutteredhallways, unstable work surfaces, ladders and stairs.

|But how does this impact insurance? Click image toenlarge.

|February

Agents place a higher priority on keeping and servicing existingcustomers than on finding new business, according to the resultsfrom the Accenture Independent AgentSurvey. When asked to rate the most criticaloperational competencies, agents put "retaining customers" at thetop of the list, followed by "servicing customers;" "attracting newcustomers" was ranked third.

|Independent agents also say that the most valuable digitalcapability is effective carrier integration that is focused onweb-based service and quoting. Other factors driving carrierselection include claims process quality and speed, underwritingappetite and pricing consistency.

|Below, a summary of additional findings from the AccentureIndependent Agent Survey. Click image to enlarge.

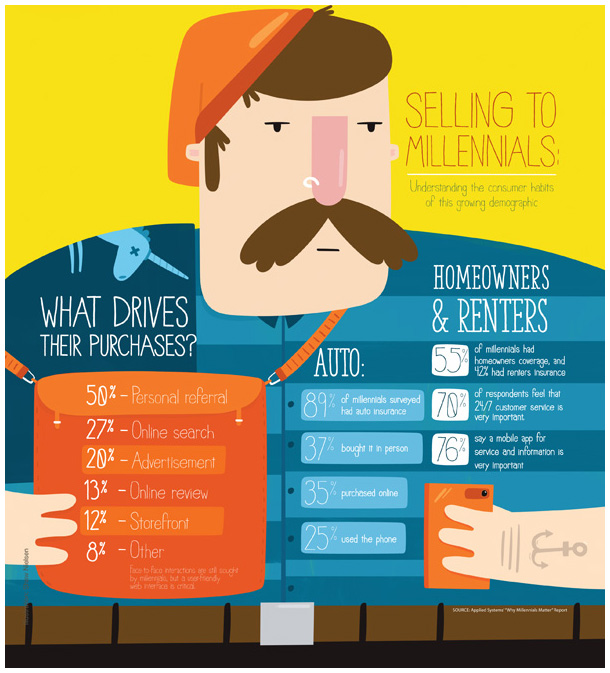

|March

At 76.6 million, there are more millennials (born between1981-1997, according to the Pew Research Center) than any other generation.Insurance agents need to know how to target this growingdemographic, which holds $1.68 trillion in purchasingpower.

|Millennial consumers want insurance companies that provide theclient-centric experience that they have become accustomed to,according to Applied Systems' "Why Millennials Matter" report. However,millennials still highly value in-person or over-the-phoneexperience with an agent. Below, a summary of findings from thereport. Click image to enlarge.

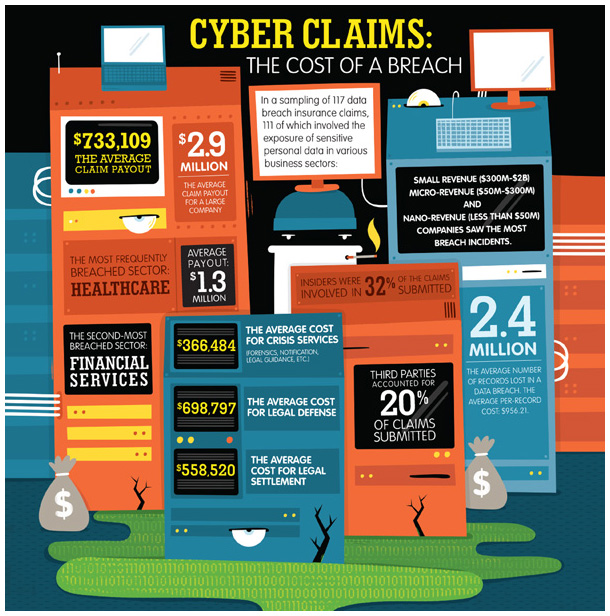

|April

Despite increasing awareness around cyber security and theincreasing frequency of data breach events, risk professionals andinsurance underwriters don't have a complete picture of the trueimpact of data security, as told by claimsdata, according to the NetDiligence 2014 Cyber Claims Survey.

|The cyber risk consultants sampled 117 data breach insuranceclaims, from carriers that include ACE, AIG, Chubb, Lockton,Liberty International Underwriters, OneBeacon, Philadelphia,Travelers, XL Group and Zurich NA.

|Below, a summary of the company's findings. Click imageto enlarge.

|May

Reducing medical costs can be one of the most effective ways tocontrol the high price of Workers' Compensationprograms, according to Marsh. Medical servicesnow contribute to more than 60% of Workers' Comp claims, in partdue to two cost drivers: physician dispensing and compoundeddrugs.

|Below, a summary of findings from Marsh, the California Workers'Compensation Institute and insurer WC Accident FundHoldings. Click image to enlarge.

|

June

According to the J.D. Power 2015 U.S. Insurance ShoppingStudy, many auto insurance customers are shopping fora new insurer, but surprisingly few are actually switchingproviders.

|Auto insurers increased rates by an average of 2.1% nationwidein 2014, following an increase of 2.5% in 2013. Those rate hikesare contributing to customers shopping for a betterdeal. However, while more customers are shopping for a newinsurer—39% in 2014 compared with 32% in 2013—only 29% actuallyswitched in 2014, compared with 37% in 2013.

|Below, a summary of the findings from J.D. Power. Clickimage to enlarge.

|July

To assess risk management strategies among its members, RIMSconducted its first cyber survey, asking aboutinsurance investments, exposures, cyber security ownership andgovernment involvement, as well as identification methods andresponse procedures. The survey was answered by 284 ofRIMS' professional members in the United States. The majority ofthe survey respondents represented organizations with more than $1billion in revenue (58%), from a wide-range of industries, withmost in manufacturing (16%) and financial services (13%).

|Below, a summary of findings from the RIMS cyber survey. Clickimage to enlarge.

|August

Insured losses in the U.S. for the first six months of the yeartotaled $8.2 billion, far below the past 15 years' average of $11.2billion, according to Munich Re's "U.S. Natural Catastrophes – First Half of 2015"report.

|The Eastern United States set a new record (in terms of originalloss dollars) in winter storm damage, with $2.9 billion.

|Across the country, severe thunderstorm events caused $5.1billion in insured loss.

|Below, additional findings from Munich Re's report. Click imageto enlarge.

|September

As much as $470 billion in life insurance and P&C insurancepremiums will be up for grabs globally as a result of decliningcustomer loyalty and the perceived commoditization of products,according to Accenture's report, "Capturing the Insurance Customer ofTomorrow."

|"The study data indicates insurers are not keeping up withrising customer expectations, leading to increased customerdissatisfaction with insurance providers," said said John Cusano,senior managing director of Accenture's global Insurance practicein a statement. "This has created a 'switching economy,' whichthreatens traditional insurers by giving the advantage to companiesmost successful at exploiting digital technologies."

|Below, a summary of Accenture's findings. Click image toenlarge.

|October

Four out of five millennials are "optimistic" or "veryoptimistic" that the insurance industry will evolve to attract thenext generation of insurance talent, due to productivity andefficiency gains from technology adoption, according to Vertafore'ssecond annual "Millennial Revolution" study.

|According to U.S. Census data, millennials outnumber babyboomers and are expected to make up half of the global workforce by2020. However, insurance needs to find a way to make the industryattractive and leverage this talent.

|Year-over-year comparisons show that work/life balance is theNo. 1 reason why millennials stay in this industry, according toVertafore. Nine out of 10 millennials also identify theircompany's use of technology, particularly mobile andsocial media, as key elements contributing toward jobsatisfaction. "Phones and tablets are the last thingmillennials check before bed and the first thing they check in themorning. There's no question they're able to increase theproductivity and throughput of employees, but there is acorollary—customers are also connected," Anthony Gomes, Vertafore'ssenior corporate communications manager, tells PC360. "Theskyrocketing use of mobile technology should serve notice toleaders in companies that consumers expect access to companies ontheir own terms in timelines they define for themselves, and thatmillennials are always connected, looking for ways to drive newbusiness through that technology."

|Below, additional findings from Vertafore's report. Click imageto enlarge.

|November

While Americans' overall perception of their level of riskremained the same from 2014, their concerns over cyber risk inparticular jumped by 21 percentage points, according to the resultsof the Travelers' 2015 Consumer RiskIndex.

|When it comes to risk perception, demographics such as location,gender, income and education matter to varying degrees. Accordingto the survey, the majority of people who think the world isbecoming riskier (57%) are women and individuals older than 40.Those with incomes above $50,000 see risk increasing.

|Below, a summary of findings from Travelers' 2015 Consumer Risk Index. Clickimage to enlarge.

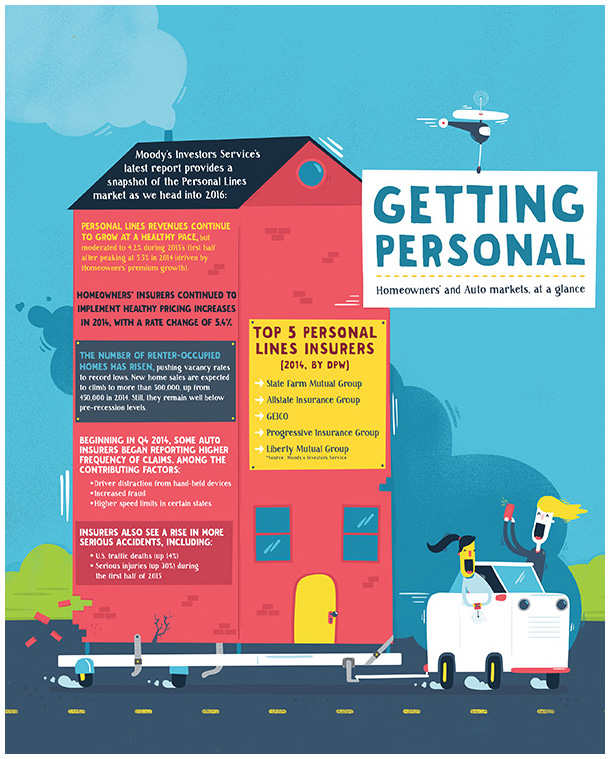

|December

A number of personal Auto insurers will implementmid-single-digit rate increases over the next several quarters, tooffset higher claim frequency and severity trends, according tothe "P&C Personal Insurance — U.S. Outlook"from Moody's Investors Service. Current severity trendsreflect new car sales at near-record levels, increased fraud,higher speed limits in certain states, pricier vehicle componentsand more serious accidents.

|Moody's says to also expect low-to-mid-single-digit rateincreases in the Homeowners' market, which will drive underlyingmargins and lower reinsurance costs.

|Below, a summary of the findings from Moody's. Click image toenlarge.

||Related: 2015′s best insurance pros under40 and Here are our top 5 insurance stories of2015

|Have you Liked us on Facebook?

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.