Sanjeev Kumar is the head of the insurance practice at SaamaTechnologies, a business analytics services company.

|Ten percent of the incurred losses and loss adjustment expenseseach year in the property & casualty insurance industry are dueto insurance fraud, according to an analysis by The InsuranceInformation Institute (III). Worse yet, the number of fraudulentclaims are on the increase—statistics from the National InsuranceCrime Bureau (NICB) show a 19 percent increase in questionableclaims from 2009 to 2011.

|However, most suspicious claims are paid by the insurers; it isestimated that today only one in five fraudulent claims aredetected or denied by insurers. Thus insurance fraud costsinsurers tens of billions of dollars each year in an industry wheremargins are thin, and as a result increases premiums foreveryone.

|P&C insurance fraud may be committed at different points inthe transaction, most typically by:

- Applicants when they misrepresent facts on an insuranceapplication.

- Policyholders as they file false or inflated claims (ordeliberately perpetrate a crime, such as arson).

- Third-party professionals, such as body shops, that provideservices to claimants through excessive billing of vehicle bodyparts or repair work.

- Employees, such as adjusters, who may be 'involved' in thegroup.

- Agents who may backdate a policy prior to loss date.

Fraud is not just limited to property and casualtyinsurance. According to the National Health Care Anti-FraudAssociation, up to ten percent of the nation's annual healthcareoutlay is lost to fraud and abuse. Fraud in the healthcareinsurance industry occurs in multiple forms, such as stolenphysician or patient identities, phantom providers and patients,up-coding, unnecessary cosmetic services, false bills, unnecessarydiagnostic services, overtreatment, stacked diagnoses and high-feeservices.

|If insurers can identify and deny fraudulent claims, they notonly improve their loss ratio (which increases margins), but moreimportantly, they also lower future increases in premiums (whichgives them a competitive advantage). Fraud analytics addresses thisissue by enabling insurers to identify fraud and alertinvestigators for further analysis.

|Fraud analytics and itsevolution

|Fraud analytics solutions use advanced analytics and datascience technologies to cull through transactions and flag the onesthat have clear and significant risk for further review. Theanalytics solutions are embedded in the normal workflow to identifypotential fraudulent claims as the first notice of loss (FNoL)comes through, without any delay in processing the 'good' claims.The flagged claims can then be assigned to the right claimshandler, while the rest can be paid quickly. This ability toseparate the two is critical because customers have relatively fewbarriers to switch insurers and an unsatisfactory claim experiencein the previous year can easily cause good customers to switch atthe time of renewal.

|Most insurers today use rules-based systems for identifyingfraud. Such systems test and score each claim against a predefinedset of business rules and flag the claims that look suspicious dueto their aggregate scores. Such business rules may include flagginga claimant who uses several post office boxes, a chiropractor usedrepeatedly in slip-and-fall incidents, or Social Security numbersassociated with more than one name. While such a system issimplistic and easier to implement, these business rules alsogenerate high false positive rates and quickly become obsoletebecause violators can easily learn and manipulate business rules totheir advantage.

|However, innovative insurance companies are now beginning to usemore advanced techniques, such as predictive modeling, text mining,geographic data mapping and social network analysis for fraudanalytics. Statistical-based predictive models analyzecharacteristics of known fraudulent claims. These characteristicsare strong predictors of fraud and are then applied to new incomingclaims to forecast the probability that a given claim is fraudulentand flag it. This method can provide adjusters with a quick andeasy way to distinguish between suspicious and meritorious claims,with fewer false positives than a simple business rulesmethod.

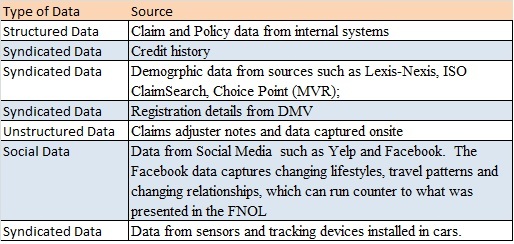

|Predictive analytics, however, are only as good as the data thatis fed into them. The quality of results from thesepredictive models can be improved by bringing together data frommultiple sources (see below), including syndicated data, such ascredit history and LexisNexis demographics data.

|

For example, research shows that there is a correlation betweencredit profile and insurance fraud-motivated arson and similarhazards. One scenario might be where a person with poor credithistory changes the collision coverage for an existing auto policyto a lower deductible and then reports a crash within a few days.Predictive models would indicate that the closer the incident is tothe date of the policy change, where a deductible is lowered andthe credit profile is not good, the higher the potential of asuspicious claim. The accident possibly may have already occurred,and the customer may falsely report the time of occurrence to be acouple of days after the deductible was lowered. Predictive modelsbuilt using past data are likely to flag this as a suspiciousclaim.

|Text mining capability allows investigators to factor inunstructured data, such as claim adjuster notes, as well as datacaptured onsite for additional clues of fraudulent behavior. In addition, advanced data mining techniques, such as SocialNetwork Analysis with advanced visualization is being used toprovide useful insight into large datasets and identify individualsand service organizations that are participating in fraud.

|Fraud analytics technology is not just for identifyingsuspicious claims, it is also helping underwriters validateinformation to help eliminate fraud policy application before itoccurs. To combat fraud in underwriting, it is important to catchinconsistencies between what the applicant reports and informationavailable from third-party sources.

|Fraud analytics allows underwriters to quickly access databasesand public records online to verify application details, confirmprior coverage, and discover undisclosed information. Socialmedia, as an example, should be tapped as a big source of inputinto fraud analytics, because it captures self-declared events,such as a move to a new place or a new driver in the family, whichmay be different than the information reported when purchasing apolicy or filing a FNoL.

|With such advanced technologies, today's insurers cananticipate, detect, and prosecute fraud more quickly andforcefully. And every dollar invested in fighting fraud can returnexponential savings to the bottom line.

|Next Steps Toward Advanced FraudAnalytics

|Insurance companies should take advantage of advanced fraudanalytics to anticipate and reduce fraudulent policies and claimsin order to improve loss ratios. Reducing fraud throughadvanced analytics will have a faster and deeper impact onprofitability than from improving operational efficiency. There are already some changes at work – innovative insurancecompanies are beginning to hire less ex-military/police personneland more statistical modelers in their Special Investigation Units(SIUs).

|However, as discussed above, comprehensive fraud detectionmodels incorporate multiple advanced analytics techniques—not justbusiness rules or traditional predictive models. This requiresexpertise in areas such as text mining, social network analyticsand data science. While insurance companies have deep expertise inskills such as actuaries and statisticians, they lack expertise intoday's advanced analytics areas mentioned above.

|Also, standard data quality approaches, often used by insuranceorganizations, need to be modified for fraud detection purposes orelse it is possible to wipe out the anomalies that are indicativeof fraud. In addition, these advanced analytics models must berefined periodically – usually one or two times per year atminimum—to maintain peak performance, since fraud schemescontinuously evolve. While some insurers can build suchexpertise internally, for others we recommend partnering withanalytics specialists. These specialists can help you buildand implement state-of-the-art fraud analytics models that arecustom to your environment, but can be deployed rapidly.

|Evaluate your analytics partners' ability to achieve fastcustomization by starting with a framework that contains apre-built data model that can include inputs from multiple sourcessuch as transactional, syndicated data and unstructured data, aswell as a fraud engine with predictive modeling and text mining. Itis also important that they have expertise in data science.

|Reducing underwriting and claims fraud is the next frontier ofsignificant operational improvement in the insuranceindustry. It can improve your loss ratios, but moreimportant, provide you a source of competitive advantage byenabling you to compete on premiums in your important segments andwin.

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.