A trend is emerging that may put increased pressure on workers'compensation rates.

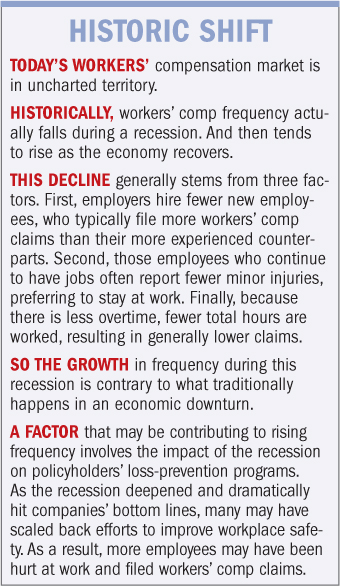

|Over the past two decades, the workers' comp frequency trendhas, with a few minor exceptions, been negative, which has helpedto offset positive severity trends. But during the recentrecession, the frequency of workers' comp claims began to rise.This trend was observed across all industry groups, with classes inthe construction industry being particularly hard hit.

| Liberty Mutual noted a rise ofmore than 5 percent in 2010 from 2009, and the National Council onCompensation Insurance reported an adjusted 3 percent increaseduring the same period.

Liberty Mutual noted a rise ofmore than 5 percent in 2010 from 2009, and the National Council onCompensation Insurance reported an adjusted 3 percent increaseduring the same period.

The effects of this growth in frequency are compounded byseveral other recent trends, such as increasing medical inflation(which often has far exceeded the standard Consumer Price Index)and generally lower investment returns for insurers in recentyears. Also, many experts fear current federal monetary policy mayspark inflation.

|All of these factors combined may put upward pressure onworkers' comp pricing, as the gap between workers' comp premiumsand costs grows and insurers seek to more accurately price policiesin light of greater actual claim costs and current macroeconomicconditions.

|In fact, a June report by Towers Watson noted that workers' comprates already did increase modestly in the first quarter of thisyear, while rates for other commercial-insurance coverages stayedflat.

|Brokers, agents, buyers and insurers should work closelytogether to fine-tune workers' comp programs to ensure both lowertotal program costs today—and an improved rate environment forbuyers tomorrow.

|COST-CONTROL SOLUTIONS

|Two best practices are critical to controlling total workers'comp costs and effectively positioning a policyholder for ratesthat accurately reflect their experience.

|The first is loss prevention. Prevent the injury, and thepolicyholder avoids the significant direct and indirect costsrelated to the workplace accident.

|Start by understanding the types of workers' comp claimsemployees file. Rank them by their impact on the company. Identifywhat can be done to prevent the most expensive injuries. Build abusiness case for continued investments in workplace safety byshowing the return on that investment, in terms of reduced claimcosts and more favorable pricing.

|The second best practice is to work closely with your insurer tomanage claims and medical costs when a workplace accident doeshappen. Obtaining maximum medical improvement for the injury andproviding return-to-work programs for the injured worker have beenproven to provide the best outcomes for both the injured worker andemployer.

|Understand how the workers' comp insurer identifies the smallnumber of claims that will drive total claims costs unless quicklygiven the right level of attention and resources. Review the impactof the tools used by the insurer to deliver quality medicaloutcomes cost-effectively, from selecting the providers most likelyto deliver the best medical outcomes to reviewing bills to makesure they reflect appropriate billing practices and feestructures.

|Rising workers' comp frequency provides a great opportunity forpolicyholders, brokers, agents and insurers to come together tomake sure workers' comp programs are doing everything possible tomanage total costs and protectemployees.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.