The role of construction has changed dramatically in recentyears. Growth in the developing world, increasing numbers ofmegaprojects, large-scale investments in infrastructure andglobalization of the industry are adding complexities to projects.Fragmented and sometimes inadequate workforces, uncertainregulatory frameworks and political climates, and the inescapablerise of technology have resulted in a host of interconnected risklandscapes that impact each other in difficult and unpredictableways.

|To gain deeper insight into to this dynamic risk environment,Willis Towers Watson recently launched itsConstruction Risk Index, a boardroom view of the industry as seenby 350 senior executives from across the globe. As partof this comprehensive study, we asked the executives to rank thegreatest threats to their businesses – both today and ten yearsfrom now. We asked them about their attitudes toward 50specific risks from five megatrends. Subsequently, we conductedin-depth interviews to gain greater insight into the challengesthey face. The result offers a deep look into the concerns andexpectations of construction leaders and highlights the mostsignificant megatrends that will shape the future of theindustry.

|Related: Risk management and contracting after HurricaneIrma

|The primary risks

|

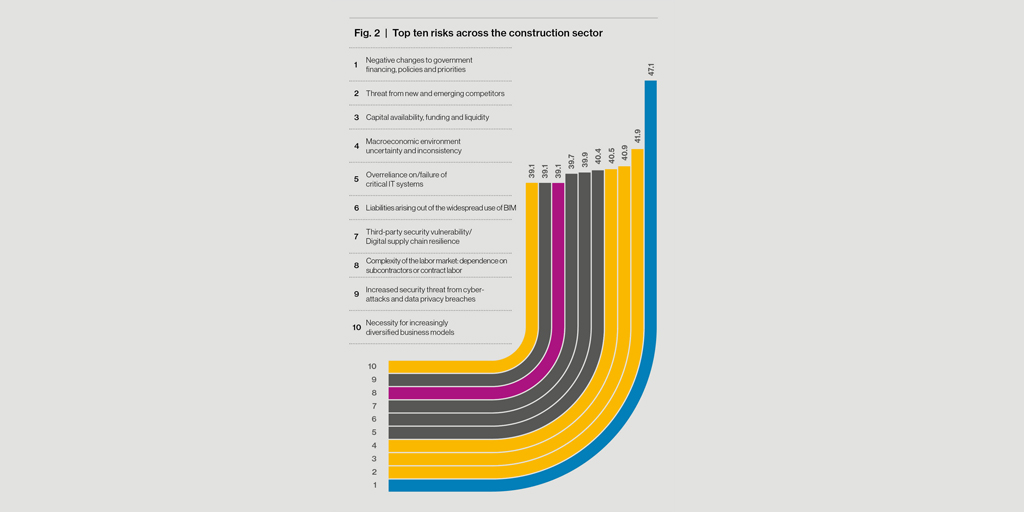

According to the data, the most prominent fears for constructionexecutives are the geopolitical instability and regulatory changesthat are manifesting across the globe in a sometimes volatilemanner. The top risk, "negative changes to government financing,policies and priorities", illustrates the industry's intimaterelationship with public spending and the impact of regulations.Geographically, executives are almost unanimous in their concerns.This risk ranks among the top three in every region except NorthAmerica, which identifies "capital availability, funding andliquidity" as the greatest threat.

|

The top risk, "negative changes to government financing,policies and priorities", illustrates the industry's intimaterelationship with public spending and the impact of regulations.(Photo: Willis Towers Watson)

|The construction industry can only be as effective as itsworkforce, so it's not surprising that the workforcemanagement and talent optimization megatrend ranks a closesecond. The industry clearly faces structural challenges related tothe workers it employs. Complex contracting decisions and aphysically dispersed labor pool add to inherent difficulties inmanaging people risks. Our index also uncovers concerns aboutincreasing competition, access to funding and macroeconomicuncertainty. Many executives told us how these factors are forcingthem to diversify their business models and operations.

|Consistent with these worries, the megatrend in third place isbusiness models and strategy challenges. Construction finds itselfhaving to deal with changes that sit outside the current boundariesof the industry, and this is having a profound effect on the way things get built.One such concern is the impact of technologies. Many constructionfirms have already made great strides in digitally enhancing theiroperations, most commonly through 3D printing, drones or BuildingInformation Modeling (BIM). In addition, the promise of increasedquality and productivity from emerging uses of modular methods andaugmented reality (AR) are just now gaining momentum, and they poseconsequential risks that cannot yet be accurately measured. Four ofthe top ten risks for the industry fall under the risks resultingfrom the digitalization and new technologies megatrend, indicatingthat there are challenges as well as opportunities to innovate.

|Related: 'Specialty Treatment': The state of the E&Smarket

||Rising competition for projects in more stable countries hasforced companies to explore new opportunities in regions with addedrisks and complexities. (Photo: Shutterstock)

|An interconnected world

|

The rapid growth in populations, continued globalization andincreasing scale of megaprojects will be key factors shaping thefuture of the industry. These changing market dynamics give reasonto be optimistic. Many governments appear keen to encourageconstruction as a driver for economic growth, and funding sourcesare seeking investment opportunities in construction. But makingpromises about infrastructure spending and then delivering on thosepledges are two very different things. Even the most effectivegovernments can struggle to get projects conceptualized andcapitalized.

|Emerging markets present the most likely source of growth.Rising competition for projects in more stable countries has forcedcompanies to explore new opportunities in regions with added risksand complexities. And while infrastructure development is crucialin many developing countries, unstable governments and threats tonational security can also be prevalent. As construction companiesenter new territories, they may find it more difficult to maintaintheir working cultures and find the expertise they need. Workforcemanagement remains high on their list of concerns. The industryfaces a persistent labor shortage, so key to success will be inboth increasing diversity in the current workforce and attractingthe next generation of talent. New technologies will also offeropportunities for progress, with sensors, data and analytics, andAR enhancing operations across the value chain. But as the industryembeds these tools, cyber-security will become a greater issue,forcing construction companies to protect themselves moreefficiently. Clearly, a cohesive, continually updated riskmanagement strategy is a top boardroom priority if constructioncompanies are to protect themselves from emerging risks and buildcompetitive advantage.

|Related: Construction could be the next target for cyberthreats

|Click on the graph below toenlarge.

||New technologies will also offer opportunities for progress,with sensors, data and analytics, and AR enhancing operationsacross the value chain. (Photo: Willis Towers Watson)

|Ten-year outlook

|

Our respondents' assessment of the biggest challenges to theirbusinesses over the next decade focuses on a few common themes:government priorities, diversification, talent management andinnovation. But the most worrying problem is uncertainty – notbeing able to predict a political crisis or cyber-attack – makingrisk management more crucial than ever. We hope the ConstructionRisk Index 2017 will help our clients, prospects and strategicpartners better understand the complex and connected world we workin, and the risks and opportunities that lie ahead.

|To access the full report visit http://www.willis.com/documents/Deconstructing_risk/

|Related: Are courts narrowing access to coverage in theconstruction industry?

|Paul Becker leads Willis Towers Watson's construction andengineering industry group globally working with regional leadersto provide services to clients worldwide. He can be reached at[email protected].

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.