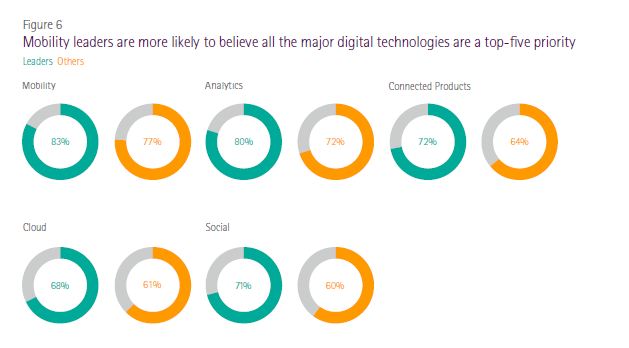

Mobility is the most important digital technology priority forlarge enterprises, according to a new global study by Accenture hasfound, as 77% of global C-suite leaders identify it as a top fivepriority. Big data analytics came next with 72% putting it in thetop five, followed by connected products at 65%.

|Technological integration is the foundation for success in anybusiness, and the insurance industry is no exception. Implementingtechnological advances, whether it is through mobile apps, cloudcomputing, social media or analytic tools, technology serves todrive market differentiation, business growth, innovation,adaptability, collaboration and profitability.

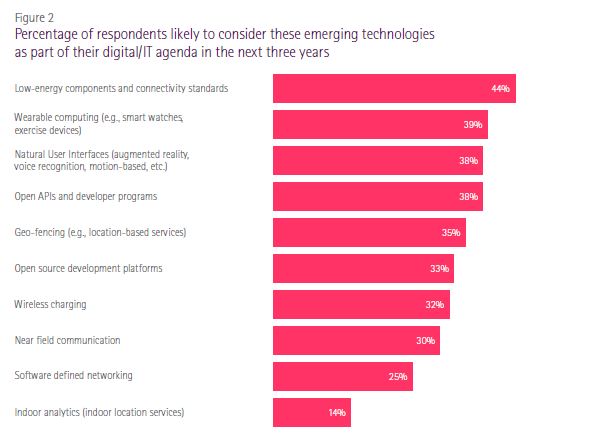

|To examine how companies are using digital technologies in atechnological age, Accenture surveyed nearly 1,500 C-levelexecutives at companies in 14 countries, including 150 insurers.Its research led to four identifiable conclusions about theintegration of technology in the business setting, listed in theAccenture Mobility Insights Report 2014:

- Strategic investment. Respondents viewinvestment in digital technologies as being strategic, enablingthem to engage with customers and promote growth, rather than beingan addition to preexisting IT landscapes.

- Aggressive adoption. Companies are moving toadopt mobile technologies and applications that help them achievespecific business objectives and developing strategies to guidetheir efforts.

- Mobility challenges. In many cases,organizational and operational shortcomings have made it difficultfor companies to take full advantage of mobile capabilities. Often,there can be a lack of formal metrics to measure effectiveness ofefforts, as well as insufficient funding for mobilepriorities.

- Mobility leaders. These “mobility leaders” aredistinguished in Accenture's research as companies that are moreambitious, strategic and implement a cross-company approach tomobility that is backed by involvement with senior leadership.Substantial monetary commitment is also in place to support thedevelopment of mobile capabilities.

Click through the following slides to learn more aboutAccenture's key findings.

|Mobility Challenges

|One of the greatest shortcomings in mobile integration amongcompanies, according to the report, is that companies have not madesubstantial progress toward mobile priorities that are important totheir businesses.

|The most prevalent shortcoming among companies is a lack offormal metrics, which enable companies to measure the effectivenessof their mobile initiatives. Eighty-five percent of respondents donot have analytical metrics in place.

|On average, just over 40% of companies have made at least “goodprogress” across their priorities. Less than half of respondentsdescribed their overall adoption and deployment of mobiletechnologies as effective.

|Companies also struggle to determine where and how mobility canhave the greatest impact. Eighty percent of respondents said thattheir organization does not have a formal process for evaluating,identifying and prioritizing the ways mobility can positivelycontribute to the business.

|Other issues stem from the inability to keep pace with newmobile devices, systems, and services, having no clearly defined,centralized ownership of mobility initiatives within theorganization, failing to develop new or redesigned businessprocesses to incorporate mobility, and a lack of internal andexternal skills.

|According to the survey, two-thirds of companies experienceshortcomings related to the actual rollout of mobile capabilities,and this is likely preventing further progress. Developing andmaintaining apps can also be one of the greatest struggles, aswell, as it can also impact the a company's ability to targetcustomers with their app, as operating issues might dissuadecustomers from using it.

||Keys to Success

|Despite that 86% of survey respondents have not yet seen apayoff for mobility initiatives, one in 10 respondents reportedhaving more than 100% return on mobility investments in the lasttwo years. This group was designated as “mobility leaders,” andAccenture highlighted some of the trends in their strategies thatstrongly correlate with return on mobile investments.

|The mobility leaders, however, are not the biggest or richestcompanies from the survey. Diversity in location and size of thesecompanies prove that effective mobile implementation can generatereturn on the investment for almost any company.

|The survey lists three traits of these tech leaders:

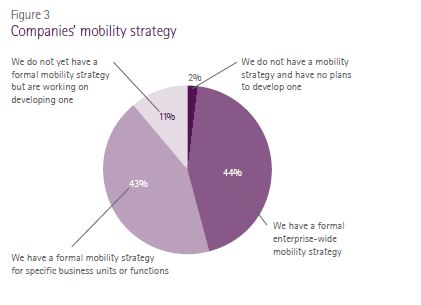

|A formal, enterprise-wide mobility strategy andmeasurement: Mobility leaders are ahead of the curveas 43% of enterprises on average were found to have developed aformal mobile strategy, a vast improvement on the 23% that claimedone in a similar survey carried out by Accenture last year. Leadersalso have a formal process for identifying, evaluating andprioritizing ways in which mobility can benefit business.

|These leaders are distinguished because of theirambitious, strategic and cross-company approach tomobility that is backed by active involvement of the company'ssenior leadership, and by substantial funding dedicated to mobiledevelopment. These companies also have a methodology in place fordeveloping and deploying mobile apps.

|Experiences of the mobility leaders suggest that success withmobility requires dedication of both resources and attention.Engagement with company leaders and commitment to buildingmobile capability as a core part of their operations haveallowed these companies to stand apart from the rest.

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.