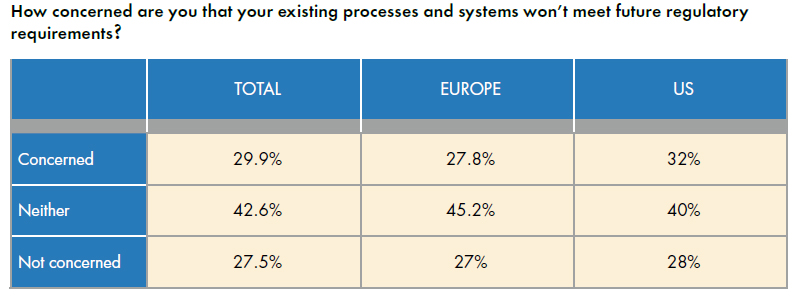

Nearly 30% of senior investment managers at global insurancecompanies say they are concerned about the ability of their currentlegacy systems to meet their future regulatory requirements,according to a recent survey by Northern Trust. The study highlights the challengesinsurance companies face with complying with the Dodd-Frank Act inthe U.S. and the Solvency II directive in Europe.

| Northern Trust surveyed more than 250 seniorinvestment managers at global insurance companies with more than $1billion in assets in the U.S. and Europe. The survey asked howinsurance companies are currently managing their investmentoperations infrastructure, and what they expect will be the bestway to meet future needs, particularly in an era of regulatorychange and financial pressure.

Northern Trust surveyed more than 250 seniorinvestment managers at global insurance companies with more than $1billion in assets in the U.S. and Europe. The survey asked howinsurance companies are currently managing their investmentoperations infrastructure, and what they expect will be the bestway to meet future needs, particularly in an era of regulatorychange and financial pressure.

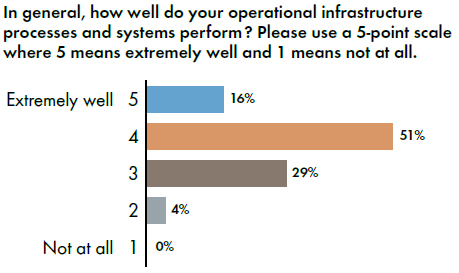

The study found 51% of respondents feel their currentoperational infrastructure processes perform well, while 16% feelthey perform extremely well. However, when asked about the abilityof their existing processes and systems to meet future regulatoryrequirements, 29.9% say they are concerned about their systemsbeing able to comply with Dodd-Frank and Solvency II.

|

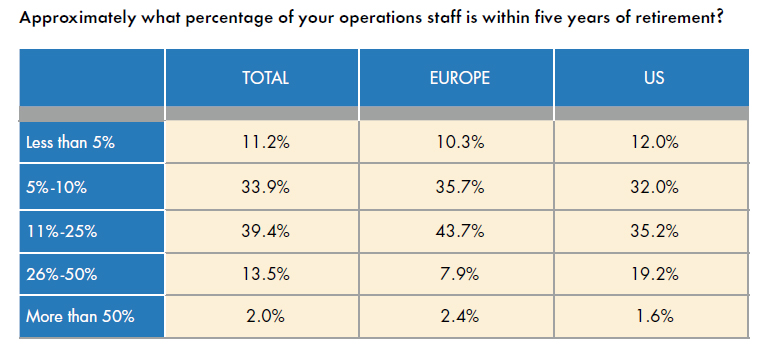

Fifty percent of respondents say their current systems are“customized with obsolete code.” Failing to give up legacy systemsis a two-fold problem because the majority of respondents expect upto 25% of their staff will retire within the next five years.Without the staff necessary to maintain those systems—which havebeen modified by multiple programmers over the years with littledocumentation—maintenance and adjustments to the new regulationswill be a major challenge.

|

With this in mind, 65% of respondents say they believe theyshould move away from customized and hard-to-manage softwarevendors and systems, and instead need to move to standard industryplatforms provided by the outsourcing industry.

|Download and read more about the survey from Northern TrustHERE.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.