The disruption in the pattern of between 16 and 17 million newvehicle sales that coincided with the recession created a break inthe historic sales cycle that essentially led to a greaterdisparity within the vehicle fleet. With fewer new carssold, the average age of vehicles increased,therefore leading to a historically older vehicle population.At the same time, new vehicle sales have ramped up, creating amodest surge in the number of new vehicles on the road.

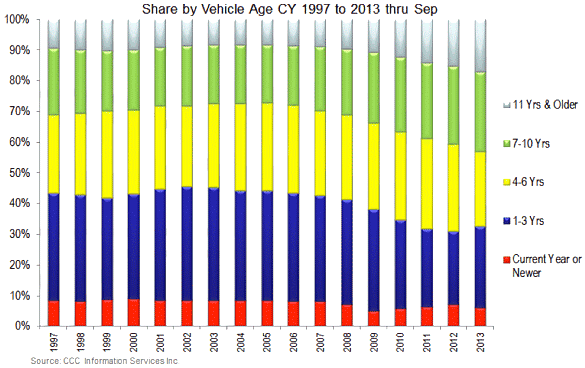

|The breakout of repairable vehicle appraisal data by the age ofthe loss vehicle underscores the shift that has occurred in thelast several years to a markedly older mix. Nearly 42 percent of allrepairable appraisals were for vehicles aged 7 yearsand older during the 2013 calendar year—the highest everrecorded in the last 15 years, and more than 15 percentage pointshigher than in 2005.

|A comparison of annual change in U.S. new vehicle sales tocurrent model year vehicles' share of repairable appraisal volumeunderscores the relationship of new vehicles sold to the age ofinsured vehicles with claims. When U.S. new vehicle sales slippedin 2001 and 2002, the appraisal count share of current model yearvehicles also fell. A similar, yet more severe pattern can beseen in 2008 through 2010 (see below).

|

Over the last 4 years (2010-2013) new vehiclesales grew, and their share of the repairable appraisal volume alsogrew. The implications of a newer fleet are essentially the reverseof an aging fleet: more replacements versus repairs, lowernon-OE parts utilization, and an increase in total laborhours per appraisal, all of which lead to higher repaircosts.

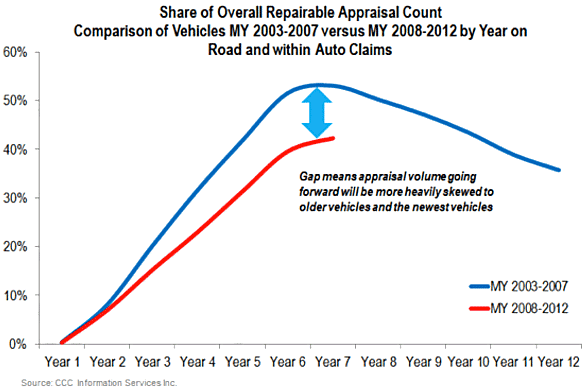

|The industry has also begun to experience the impact of thesignificantly fewer new vehicle sales between 2008 and 2012 interms of those vehicles' share of repairable appraisal volume. Acomparison of the share of repairable appraisal volume from firstyear of introduction for the five model years prior to vehiclemodel years 2008 through 2012 illustrates the lower share the 2008to 2012 model year vehicles contribute to the overall repairablevolume.

|

The assumption made here is that much fewervehicle sales of these model years is what drives this gap involume share when compared to the historical trend typical forvehicles as they age. Subsequently, the remaining share willbe made at first of mostly older model year vehicles, but will alsoover time see more of the newer model year vehicles.

|New Vehicles Are Increasingly Complex

|As automakers race to meet the ever stricter corporate averagefuel economy standards, one of their key challenges is to reducethe overall weight of the vehicles themselves. This has driven upautomakers' use of lighter-weight substrate metals, such asaluminum and magnesium. As technology reduces the cost and speed ofvehicle development through advances in electronic modeling and CADsystems, manufacturers can select different materials and joiningmethods within a single vehicle body structure. The result is apotential combination of materials: ultra-high strength steel, highstrength steel, mild steel, aluminum and tailored blanks all usedin a single vehicle structure.

|Over the years, automakers have added a great many features totheir vehicles to protect the vehicle occupants during a crash.This has resulted in more and more airbags added to their vehicles.And while the benefits of these occupant safety features has beenwell documented, a great deal of focus today is on how to avoid theaccident altogether. Automakers have begun adding technology to thevehicle itself to either warn or over-ride the driver to avoid acrash. These include systems such as forward looking radar,lane departure warning, blind spot detection, andvehicle-to-vehicle communication. The effectiveness of thesesystems has been tested at length by the automakers and safetyorganizations, and show dramatic reductions in accident frequencycan be achieved—the Highway Loss Data Institute projects as many asone in three fatal crashes could be avoided.

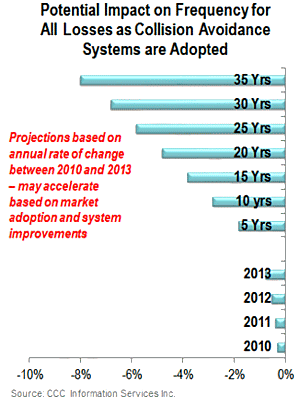

|The cost of many of these crash avoidance systems has also comedown in the last several years. Lower costs will increase adoptionamongst automakers and consumers; and while it may not eliminateevery accident, it should help reduce the severity of the crash.However, data released by the Highway Loss Data Institute inSeptember 2011 showed that it typically takes up to threedecades before 95 percent of the vehicles on the road havea given safety feature offered as either a standard feature oravailable option. For example, 95 percent of all registeredvehicles will finally have frontal airbags by 2016. This comes manyyears after manufacturers began adding them in meaningful numbersin the mid-1980s.

|Analysis of the share of vehicles by model year and by losscoverage, as well as an estimation of the 'take-up' rate of crashavoidance systems based on availability and consumer purchasesuggests the impact on auto claims to date has been relativelysmall.

|

So while there is certainly an anticipated reduction inautomotive claim frequency over the next 25 to 35 years because ofthe introduction of crash avoidance systems and themuch-anticipated emergence of self-driving vehicles, the primaryquestion remains 'how fast will it happen?'

|A rapid ramp up in new vehicle sales where more are equippedwith these systems could dramatically shift into overdrive thistrend. However, economic growth is still slow, auto sales areanticipated to peak at 16 million annually, and scrappage rates areat historic lows. Of the numerous factors that have helped drivedown frequency over the last 20 years—such as aging drivers, fewermiles driven, more growth in urban areas, emergence of car-sharingprograms, the recession, and so forth—the adoption of these systemshas the likelihood of a sharper ramp up the decline inautomotive claims frequency.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.