The U.S. population is aging, but despite statistics that olderdrivers have higher claim rates, the overall number of collisionclaims is not expected to increase, says the Insurance Institute ofHighway Safety.

|In a recently released report, the IIHS says an analysis by theHighway Loss Data Institute (HLDI) shows there are factors thatwill counter the negative impacts of an aging population betweennow and 2030.

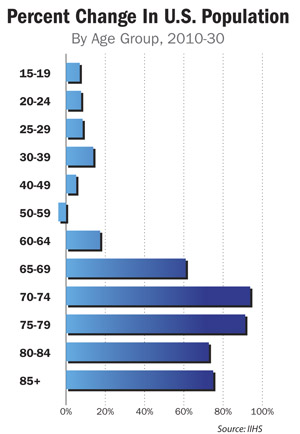

| People in their 70s and 80s have a higher claim rate thanthose in their 50s and 60s, IIHS says, but the percentage of olderdrivers is “predicted to remain relatively small” in relation tothe number of overall drivers.

People in their 70s and 80s have a higher claim rate thanthose in their 50s and 60s, IIHS says, but the percentage of olderdrivers is “predicted to remain relatively small” in relation tothe number of overall drivers.

In addition, while there may be more drivers 70 and older, therewill be a corresponding decrease in drivers under 30 “who have thehighest claim rates of all.”

|“Age-related impairments can affect a person's driving, soconcern over the country's changing demographic make-up isunderstandable,” says HLDI Vice President Matt Moore in astatement. “However, when we look at the overall number of claims,this isn't the looming crisis some have made it out to be.”

|Crashes by elderly drivers may catch headlines, but it doesn'tmean the elderly are causing more accidents, the reportasserts.

|Per mile driven, the report says, rates of fatal crashes and allpolice-reported crashes start to rise around age 70. However, thecrash rates have fallen faster in recent years for older driversthan for middle-age drivers.

|The rate of fatal crashes per licensed driver 70 and older fell37 percent from 1997 to 2008, according to an IIHS 2010 study, thereport notes.

|One reason given for this trend is that older drivers “tend tolimit the amount they drive, particularly at night or in othersituations they find challenging.”

|Predictions are that the total driving-age population isexpected to rise to 291 million by 2030, with the demographicsskewing older. However, not all those of driving age will becomelicensed drivers, the report notes. Statistics indicate that foreach demographic group, as it ages, the number of driversincreases, peaking at 60-64, then begins to decline.

|Claim frequency is highest for drivers 15-19, at nearly 70percent above average. The frequency rate declines with age,reaching its lowest level at 60-64. That rate then begins to rise“but never approaches the level of teenagers.”

|Over the next two decades, claim frequency is expected to beflat hovering around 6.12 and 6.16 claims per 100 insured vehicleyears.

|“In absolute numbers, there still may be more crashes in thefuture, but that is because more people will be driving, notbecause more of the drivers are older,” says the report.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.