NU Online News Service, June 29, 2:51 p.m.EDT

|While insurance executives typically do all they can to growtheir companies, Barry Gilway was hired to do a different kind ofjob as the new president and chief executive officer of FloridaCitizens Property Insurance Corp.

|Gilway will seek to reduce the size of what is meant to be thestate's last-resort insurer.

|Gilway, most recently CEO of Mattei Insurance Services, startedhis job at Citizens on June 18—just days after the Citizens board voted to hire him—but he says he can alreadyrecognize the “tremendous opportunity” for private insurers todepopulate Citizens.

| “I think there are definitely viable, profitable policiesto be had,” he tells PC360. He adds that he has meetings scheduledwith three or four potential “take-out” companies.

“I think there are definitely viable, profitable policiesto be had,” he tells PC360. He adds that he has meetings scheduledwith three or four potential “take-out” companies.

Depopulation programs, meant to reduce the exposure at thestate-run insurer, have been successful in the past, according to apresentation Gilway has already given to the state's FinancialServices Commission.

|Domestic start-ups, approved by regulators as take-outcompanies, were formed in 2006 and 2007, and essentiallycherry-picked Citizens' book of business.

|It worked to reduce Citizens' policy count from about 1.3million in 2007 to a low of just over 1 million in 2009. Sincethen, the policy count has risen and Citizens has far exceeded itspurpose as a last resort insurer to become the largest writer ofproperty insurance in Florida. At the end of 2012's first quarter,the policy count has risen to over $1.4 million.

|Therein lies a huge danger, creating another even more difficultproblem for Gilway to solve. Citizens currently competes with theprivate market because its rates—which were frozen by law forseveral years—are not actuarially sound, even after lawmakersapproved a glide-path for Citizens to begin raising rates.

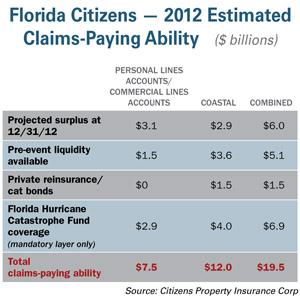

|With the ability to assess policyholders should a shortfalloccur, the wallets of Florida's residents are at risk.

|“I've got the commitment of Florida's leaders to change this,but it will take time; it's a delicate balancing act,” Gilway says.“The ultimate objective is to [at least] get on equal footing withprivate carriers.”

|Right now, though it varies by county, Citizens' coastal accountis about 45 percent inadequate and the personal lines account is 25percent inadequate, he says.

|“Any increases must be appropriate for customers,” Gilways say.“Increases can really affect a lot of people—some more thanothers.”

|But the 66-year-old, 42-year insurance industry professional whohas held positions such as president and CEO of Zurich NorthAmerica Canada and CEO of Maryland Casualty Group says he is up tothe task.

|“I find it a fascinating challenging—more challenging than anyposition I've held in the past,” he says. “What a better way to goout. What a way to make a contribution.”

|Gilway says he will immediately focus on the aspects of his jobunder his control. A survey is being done to determine whethercustomers understand the assessment mechanism of Citizens.

|“We want to be very, very clear with them,” Gilway explains. “Weneed to do a good job letting customers know the difference with astrong education program.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.