NU Online News Service, June 5, 2:55 p.m.EDT

|State Farm Mutual Insurance Co. spent more on lobbying than anyother property and casualty insurance company in 2011, according todata released today by SNL Financial.

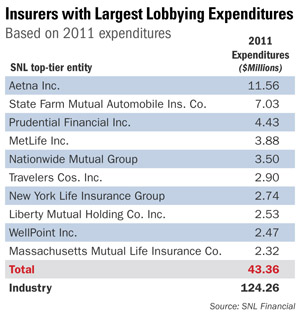

|The data, which shows the top-10 insurers across life andhealth and P&C ranked by their 2011 lobbying expenditures,was based on information insurers are required to file with theNational Association of Insurance Commissioners.

|Four of the top-10 were P&C companies.

| The data showed that State Farm, which ranked secondoverall on the list and highest for P&C, spent $7.03 million onlobbying expenditures in 2011, virtually the same amount in eachyear since 2008.

The data showed that State Farm, which ranked secondoverall on the list and highest for P&C, spent $7.03 million onlobbying expenditures in 2011, virtually the same amount in eachyear since 2008.

The second-largest political contributor amongst U.S. P&Cinsurance companies in 2011 was Nationwide Mutual, withcontributions of $3.5 million. While second among P&Ccompanies, Nationwide ranked fifth among insurance companiesoverall.

|Third among P&C companies was Travelers (sixth overall),with $2.9 million; fourth among P&C insurers was Liberty Mutual(eighth overall), with $2.53 million in politicalcontributions.

|Data provided by SNL reveals that the U.S. Chamber ofCommerce was a major recipient of the donations made by insurers.The issues on which it lobbies include tort reform.

|Other large recipients of donations by property and casualtyinsurers include the Property Casualty Insurers Association ofAmerica, which received $4.05 million in contributions;ProtectingAmerica.org, which received $1.4 million, and theAmerican Insurance Association, which received $690,000 incontributions.

|ProtectingAmerica.org predominately deals with catastropheissues. Its primary supporter is Allstate Insurance Company, whosecontributions did not make the Top 10 list.

|According to the data, the political contributions by State Farmand Travelers over the past four years have been consistent.

|For example, State Farm's expenditures have grown at a 4 percentannual rate, compounded, since 2008. Travelers compounded four-yeargrowth rate was 3 percent. Nationwide's growth rate was notavailable.

|However, Liberty Mutual's contributions have droppedconsiderably since 2008, down 15.2 percent in 2011 compared tocontributions in 2008, when the insurer spent $4.15 million.

|Regarding its spending efforts, a State Farm spokesman says viaemail, “State Farm's change in lobbying expense basically mirrorsthe change in the industry average over the past fouryears. We insure more motorists and homeowners than any othercompany in the U.S. We are regulated in each of the 50 statesand, increasingly, at the federal level. It is important we shareour views with legislators and regulators who make decisions onissues that may impact our ability to serve the best interests ofour customers.”

Nationwide says via email, “Our government relations officeengages with numerous policy makers at the local, state, andfederal level on a variety of issues important to our company,associates, agents, and members. “While we don't discuss our specific lobbying strategies indetail, we can tell you our focus is currently on retirement,insurance and tax issues. In 2012, one of our current areas ofinterest is on renewal and reform of the National Flood InsuranceProgram. At both the federal and the state level, we're focused onpublic policy solutions that maintain the availability ofaffordable protection solutions for consumers.”|The other P&C companies cited in the SNL report did notrespond to a request for comment from PC360.

None of the P&C contributions for 2011 approached Aetna's$11.56 million in expenditures for the year, up sharply from its$2.9 million in 2008, before the healthcare-reform lawpassed. An SNL Insurance analysis, written by Sean Carr and WayneDalton, reveals that Aetna gave $3.3 million to conservativeadvocacy organization American Action Network and $4.4 million tothe U.S. Chamber of Commerce in 2011.Updated with State Farm comments.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.