NU Online News Service, April 30, 1:02 p.m.EST

|Fewer auto-insurance consumers are shopping their coveragetoday, but those who do shop seem more willing to switch providersthan in years past thanks to competitive quotes, according to J.D.Power and Associates.

|In its 2012 U.S. Insurance Shopping Survey, J.D. Power says 25percent of consumers shopped for a new auto insurer in the last 12months, the lowest figure in the past five years and an 8-percentdecline from last year's survey.

| Jeremy Bowler, senior director ofthe global insurance practice at J.D. Power, notes that thecustomer-retention rates are increasing at a time when autoinsurers are spending more money to encourage switching. He notesthat advertising expenditures increased 12 percent in 2011 comparedto 2010

Jeremy Bowler, senior director ofthe global insurance practice at J.D. Power, notes that thecustomer-retention rates are increasing at a time when autoinsurers are spending more money to encourage switching. He notesthat advertising expenditures increased 12 percent in 2011 comparedto 2010

“The industry spent $5.7 billion on advertising and allowancesin 2011, but this increased spend does not appear to have generateda commensurate increase in market churn,” observes Bowler.

|Asked why fewer consumers are shopping this year, Bowlersuggests insurers may have exhausted the appetite of “serialshoppers.” He notes that those who have shopped in recent years onthe promise of saving hundreds of dollars might have found suchsavings initially, prompting them to shop again the next year.However, upon shopping a second time, those consumers may havefound that they did not save hundreds more. This, Bowler suggests,may make them hesitant to try shopping a third time.

|Bowler also says customer satisfaction could impact shoppinghabits. In J.D. Power's last auto-insurance-satisfaction survey, Bowler says overallcustomer satisfaction was 790 on a 1,000-point scale. That was a13-point increase over 2010. He points out that when industrysatisfaction improves, the rate of shopping tends to decline.

|However, for those consumers who did shop over the last 12months, 43 percent switched providers, the highest rate since 2008,when J.D. Power began measuring retention, and a 3 percent increaseover last year's survey.

|“The increase in the proportion of shoppers actually switchingsuggests that fewer price-checkers are gathering quotes they areless likely to act upon, perhaps a direct result of the lowertypical savings derived from switching, which has decreased from anaverage of $412 in 2010 to only $359 in the past 12 months,” saysBowler.

|Regarding how consumers are shopping, J.D. Power says 52 percentof consumers start their auto-insurance-shopping process online,and 73 percent visit at least one insurer's website at some pointduring the shopping experience.

|“More significantly,” says J.D. Power, “32 percent of customerssolely obtain quotes online, and today 34 percent of all recentshoppers state they would most prefer to purchase their new policyonline.”

|Bowler says consumers today expect to be able to visit aninsurer's website and then complete their purchase in the samevisit. “In most cases, shoppers can compare many policies onlineand narrow down their search field entirely via this self-serviceparadigm,” he says. “From that point, they can then decide if theyneed to speak with an agent or to continue their online purchaseprocess.”

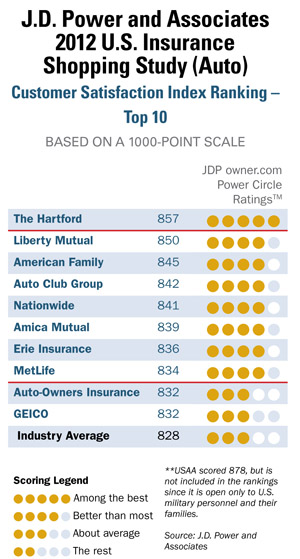

|As for consumers' satisfaction with their shopping experience atdifferent auto-insurance providers, The Hartford ranked highest onJ.D. Power's 1,000-point scale with a score of 857. J.D. Powersays The Hartford “performs particularly well in policyofferings and price.” Liberty Mutual scored second with 850,followed by American Family (845), Auto Club Group (842), andNationwide (841).

|The industry's average score was 828.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.