NU Online News Service, Aug. 17, 1:21 p.m.EST

| Florida InsuranceCommissioner Kevin McCarty gives a bleak outlook of the state'sout-of-control personal injury protection (PIP) insurancesystem.

Florida InsuranceCommissioner Kevin McCarty gives a bleak outlook of the state'sout-of-control personal injury protection (PIP) insurancesystem.

Benefits paid on no-fault PIP claims has skyrocketed 70 percentsince 2008 though the amount of licensed Florida drivers hasremained steady and the amount of accidents has decreased.

|McCarty blames the massive rise in PIP payments—about $1.43billion in 2008 to $2.37 billion in 2010—on fraud and abuse.

|Rising medical costs can be blamed for some of the increase,“but not 70 percent,” McCarty tellsthe Florida Cabinet.

|The statistic—derived from a data call of 31 companiesrepresenting 80 percent of the market—struck Gov. Rick Scott, wholikened the increase to an $800-$900 million tax increase forFloridians.

|“Yes, it comes out of the pockets of Joe and Mary Lunchbox,”McCarty says. “And it could be through no fault of your own. Youcould be a very good driver.”

|Since the last round PIP reforms were implemented in 2007,fraudsters have “perfected a system of finding weak-points” in thesystem, he adds.

|To illustrate the point, McCarty charted PIP premiums for amarried 40-year-old woman and an unmarried 25-year-old man, bothwith clean driving records. Since 2005, premiums for each haveincreased at least 84 percent.

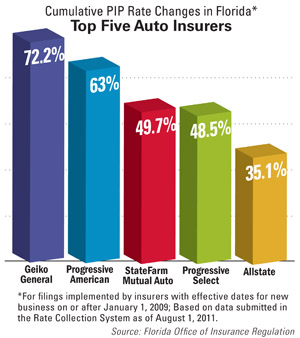

|Insurers have increased PIP premiums dramatically just to breakeven, but they are failing. Despite increases, every dollar a PIPinsurer collects goes directly to paying PIP medical benefits. Addin other costs, and the PIP combined ratio nears 140.

|“Obviously, that is not sustainable,” McCarty tells the Cabinet.He called the situation a “crisis.”

|“Companies are not going to lose money,” McCarty explains.Insurers are going to ask for even more rate or “find ways todeploy capital elsewhere,” he adds.

|Efforts by the state Legislature to curb PIP fraud have been“largely unsuccessful,” says the commissioner. Reforms are met withopposition from medical providers and attorneys, each of which hasa big stake in the system.

|This year during the Legislative Session, bills designed to beatback fraud and abuse in the PIP system were killed by a legislative committee. McCarty says he ismeeting with sponsors of these bills to once again discuss a planto reform the system.

|State Chief Financial Officer Jeff Atwater says the systemshould be abolished if lawmakers cannot fix it. Alternatives needto be considered if legislators won't work to come to a conclusion,he adds.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.