Passage of landmark health care reform legislation last March isforcing participants in the insurance industry, especially agents,to mobilize in efforts to secure changes to the legislation thatensure they have a role in the industry going forward.

| Efforts will focus on threebattles, according to property and casualty insurance underwriterand agent/broker trade groups, reacting to the law, known as thePatient Protection and Affordable Care Act.

Efforts will focus on threebattles, according to property and casualty insurance underwriterand agent/broker trade groups, reacting to the law, known as thePatient Protection and Affordable Care Act.

o Repealing a provision that requires any business to file aseparate 1099 form with the Internal Revenue Service forexpenditures paid to a single vendor totaling $600 or more duringany year. The provision goes into effect in 2012.

|o Seeking a legislative or regulatory exemption for agentcommissions from a provision that imposes a relatively low 15-to-20percent limit on administrative costs as a proportion of healthcare premiums, the so-called "medical loss ratio" provision.

|o Protecting the interests of agents and brokers in the healthcare exchange system that goes into effect in 2014, the keyprovision of the legislation.

|At the same time, officials of the National Association ofHealth Underwriters said they will be promoting legislation in thenew Congress that would provide options to people who joinedMedicare Advantage (MA) plans on a trial basis that have been shutdown under the new law.

|As of Jan. 1, 2011, Medicare beneficiaries in MA plans arelimited to disenrolling from those those plans to enroll intraditional Medicare. Before the PPACA was enacted, beneficiarieswere allowed to enroll in, change or disenroll from a MA planduring a 90-day period, NAHU officials said, explaining that theyare seeking a rollback to the old policy.

|"NAHU urges Congress to restore the prior open enrollment periodfor Medicare beneficiaries and supports H.R. 6502/S. 4040, theMedicare Beneficiary Preservation of Choice Act of 2010," officialssaid in a statement.

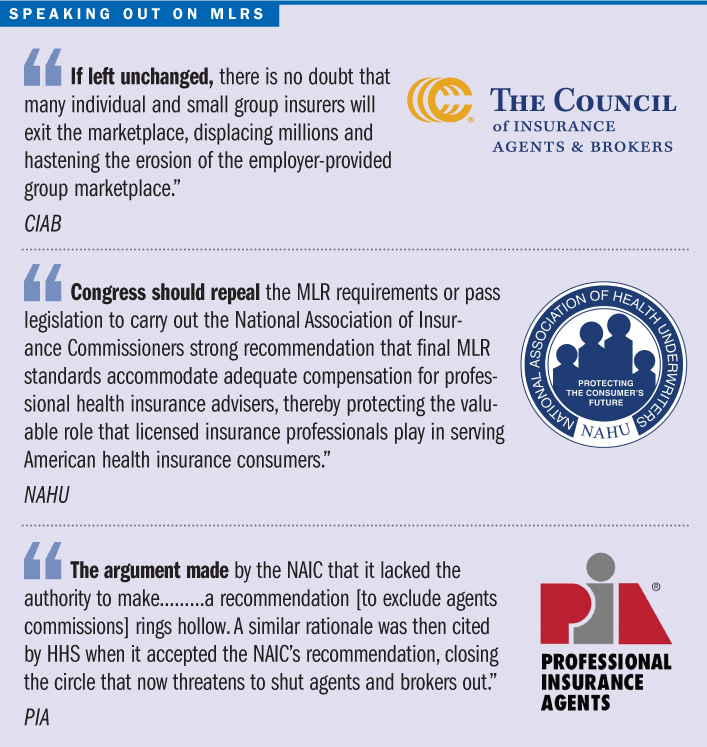

|On the MLR issue, NAHU said: "Congress should repeal the MLRrequirements or pass legislation to carry out the NationalAssociation of Insurance Commissioners strong recommendation thatfinal MLR standards accommodate adequate compensation forprofessional health insurance advisers, thereby protecting thevaluable role that licensed insurance professionals play in servingAmerican health insurance consumers."

|"Truly guaranteeing consumers get the most out of their premiumdollars requires that they have access to professional benefitspecialists, who each and every day help millions of Americansnavigate the health care system, advocate on consumers' behalf andempower them to be smart shoppers of health coverage andservices."

|Joel Wood, senior vice president, government affairs for theCouncil of Insurance Agents & Brokers, said CIAB's "topmission" in the upcoming Congress is to resolve "the marketplaceconfusion" and potential erosion of group health insurance policiesthat has been caused by the MLR provision.

|Mr. Wood calls the MLR a "government price control" that wentinto effect Jan. 1. He said it will have "the perverse effect" ofserving as a disincentive for health plans to lower costs.

|"In other words, the bigger the health insurance premium, theeasier it is to make the numbers work–80 percent MLRs for groups ofunder 100, 85 percent for larger groups," Mr. Wood said.

||"If left unchanged, there is no doubt that many individual andsmall group insurers will exit the marketplace, displacing millionsand hastening the erosion of the employer-provided groupmarketplace," Mr. Wood said.

|"There are many aspects to the PPACA that we believe are unwise,but the MLR provisions are the worst," he said. "Repealing them, orchanging them, will be CIAB's top legislative priority," he said."Even with the Republican surge of 2010, though, this is going tobe exceptionally difficult to accomplish," he said.

|Meanwhile, he said, CIAB is also doing doing everything it can"to respond to the countless requests for guidance from our memberson implementation of the new law," Mr. Wood said.

|Officials of the Independent Insurance Agents and Brokers ofAmerica agreed. They said they are "working on a wide array ofissues associated with the reform law and its implementation. The"most pressing issues" that will be addressed in 2011 are theapplication of the MLR formula and the 1099 tax form provision,IIABA said.

|"These two provisions of PPACA will directly harm smallbusinesses, and will lead to job losses," IIABA said. We will beurging Congress to fix these provisions legislatively," groupofficials added.

|Regarding the 1099 provision, Jimi Grandi, senior vice presidentof federal and political affairs for the National Association ofMutual Insurance Companies, noted that "despite widespreadopposition to the provision, Congress was unable to pass a repeal,either before the November elections or during the lame ducksession that followed them."

|"No one will admit being the source of it, and neither sidewants to let the other take credit for repealing it," Mr. Grandesaid. This "should be an easy problem to solve," but because ofpolitical gamesmanship, so far Congress can't seem to get the jobdone," he said.

|Leonard Brevik, executive vice president and CEO of the NationalAssociation of Professional Insurance Agents, added that theexpanded 1099 provision will impose a substantial reporting andpaperwork burden on small businesses, "which are the economicengines that power our economy."

|In addition, Mr. Brevik said, "state and local governments, aswell as nonprofits, will see dramatically increasing costs."

|Gearing up for another effort, Charles Symington, IIABA seniorvice president of government affairs, said the trade group willwork with the Department of Health and Human Services, the NAIC andthe National Council of Insurance Legislators and individual stateson the creation of health benefit exchanges in anticipation of the2013/2014 deadlines as laid out in the law.

|For its part, the PIA contends the NAIC missed an opportunity toprotect agents' interests when it submitted its recommendations onMLR to HHS without an amendment that would have excluded agent andbroker compensation from MLR calculations.

|"The argument made by the NAIC that it lacked the authority tomake such a recommendation rings hollow," PIA officials said.

|They added that "a similar rationale was then cited by HHS whenit accepted the NAIC's recommendation, "closing the circle that nowthreatens to shut agents and brokers out."

|PIA officials said they will also be working with regulators andstate legislatures as many states move to set up health insuranceexchanges by 2014.

|"PIA is still battling to make sure agents are fairlycompensated for their services, but so far we're not sure how muchwe'll be paid if we sell policies offered through the newexchanges," said Thomas Adderhold, PIA president-elect. "PIANational's regulatory staff is engaged with federal and stateofficials to ensure that agents don't get squeezed out," Mr.Adderhold added.

|At NAHU, officials speaking to broader efforts related to healthcare reform mandates, said that they working with policymakers andother stakeholders to ensure that implementation of PPACA "iscarefully crafted and measured" to mitigate near-term premiumincreases and does not undermine reasonable private sector healthplan innovations aimed at health promotion, patient safety and costcontainment.

|NAHU also said coverage requirements must be crafted in such away that employers are not incentivized to drop their insuranceofferings, and "dump" their workers into the exchanges.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.