At 232, the number of insurance agency mergers and acquisitionsin the first half of 2016 came in just one less than 2015's recordfirst half of 233 deals, accordingto data from Chicago-based OPTIS Partners, an investmentbanking and financial consulting firm specializing in the insuranceindustry.

|First-half M&A activity this year also extended the streakof 100 or more transactions to seven consecutive quarters. The lastthree-month period when brokers did not complete at least 100 dealsoccurred in the third quarter of 2014.

|“Buyers and sellers continued to feed their hearty appetites fordeals and push up the M&A activity trend line,” said Timothy J.Cunningham, managing director of OPTIS and National UnderwriterP&C editorial advisory board member. “We anticipate therecent strong industry-consolidation trend will continue for thenear term as acquisitions are an important growth strategy for manyfirms, especially those backed by private-equity capital.”

|Who's buying, and who's selling?

|OPTIS’ data covers U.S. and Canadian agencies selling primarilyproperty & casualty insurance, agencies selling both P&Cand employee benefits, and those selling only employeebenefits.

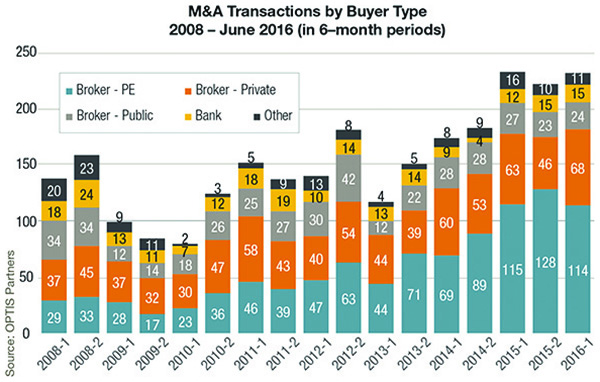

|During the past four years, agency M&A has climbed steadily,with strong buyer interest pushing up prices. The OPTIS reportsegments buyers into five groups: private-equity (PE) backedbrokers, privately held brokers, publicly traded brokers, banks andothers.

|

PE-backed brokers were the most active group, contributingtoward 114 of the 232 transactions. Privately held brokersfollowed, with 68 deals, which is five percentage points higher(29% in first-half 2016) compared to the same period in 2015.

|Publicly traded brokers came in third, with 24 deals, which isdown three deals from 2015's first half, while banks had 15 deals,up three compared to the first half of 2015.

|P&C firms have remained the dominant seller group. In thefirst half of 2016, they accounted for 53% of all transactions (124announced transactions), slightly down from 2015's 57%. Benefitsfirms announced 43 deals, while P&C/benefits brokers came in at40.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.