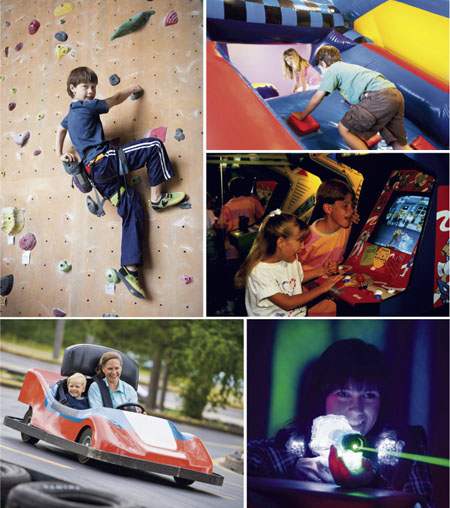

Batting cages. Paintball centers.Arcades. Go-kart tracks. Climbing walls. Laser-tag venues. Giantinflatable “bouncy houses.” Although each is a unique operation,all fall under the heading of family entertainment centers (FECs),sharing common risks and coverage requirements—andinsurance-placement challenges.

Batting cages. Paintball centers.Arcades. Go-kart tracks. Climbing walls. Laser-tag venues. Giantinflatable “bouncy houses.” Although each is a unique operation,all fall under the heading of family entertainment centers (FECs),sharing common risks and coverage requirements—andinsurance-placement challenges.

“Anytime you are dealing with kids, [placing insurance] will bea little more difficult” than insuring other risks, says MattStein, administrator of the Family Entertainment Center SafetyAssociation Insurance Program at Sterling & Sterling inWoodbury, N.Y.

|Insuring FECs also can be “difficult because you are dealingwith moving objects going 25 miles per hour, staffed by a teenager.Therein lies part of the problem,” says Mike Beckman of Berlin,Wis.-based Beckman Insurance, which specializes in go-kart risksand was recently acquired by indie broker Britton Gallagher.

|But while FECs can be challenging to insure, they can belucrative clients for producers—and thanks to macroeconomicconditions, business is growing.

|Beckman, who has more than 20 years of experience specializingin difficult-to-place amusement risks, reports that FEC businesscontinues to be a “money-maker” for the agency.

|And on the client side, Mike Peverill, president and CEO ofAldie, Va.-based Pev’s Paintball—which has been in business for 20years—says his business is better than it’s been in the past threeyears, a sentiment echoed by other FECs.

|Local businesses dealing in fun have actually benefitted fromthe hit taken by the “T&E” budgets of many families duringthese bruising economic times, according to Lorena Hatfield,marketing-resources manager for managing general underwriterK&K Insurance Group, which specializes in FEC policies. “Itappears the economy continues to play a role in the growth oflocally based activities offering families an entertainingexperience at a reasonable cost, as opposed to taking a lengthyvacation,” she says.

|Drew Tewksbury, vice president and FEC program manager ofBritton Gallagher’s Amusement Insurance Resources (A.I.R.) program,sees the FEC sector as a good one for retail agents to considerentering, to capitalize on the continued growth in the sector.

|“With the downturn in the economy, we are seeing that familiesdon’t have the $5,000-$10,000 set aside to go to the bigamusement-park destinations,” says Tewksbury. “You are seeing moneystaying local, seeing people take advantage of local amusement andentertainment, and seeing FECs growing,” he says. “It is a nice[business] opportunity” for agents.

|The FECs that have most benefited from this trend toward“stay-cations” are the ones that have continually diversified andupgraded their offerings. “Smaller centers that haven’t been ableto evolve with the times have gone away,” says Stein. “Ones thathave been able to become a family destination are doing quitewell.”

| TOUGHEST PLACEMENTS:WATER-WALKING, TRAMPOLINES

TOUGHEST PLACEMENTS:WATER-WALKING, TRAMPOLINES

But the increasing diversity of family-fun offerings has spawnednew risks. “Everyone’s looking for the new adventure, the newthrill,” says Tewksbury.

|And some of these new thrills verge on the edge ofinsurability.

|Whereas giant inflatables were all the rage over the past fewyears, the current hot trend among FECs involves wall-to-walltrampoline zones. “Right now there are about 100 of these acrossthe country, and I expect there to be about 200 by year’s end,”says Tewksbury, asserting that A.I.R. is one of the “select few”programs that can insure these risks.

| Long anathema to carriers in bothstandard and specialty P&C, trampoline risks are tough to placein part because of the potential for severe or even fatal injury:In February, 30-year-old Ty Thomasson died at a Phoenix trampolinepark after landing head-first in a foam pit and breaking his neck.And with the relative newness of these wall-to-wall venues,underwriters simply lack the experience and data to develop acomfort level with the class.

Long anathema to carriers in bothstandard and specialty P&C, trampoline risks are tough to placein part because of the potential for severe or even fatal injury:In February, 30-year-old Ty Thomasson died at a Phoenix trampolinepark after landing head-first in a foam pit and breaking his neck.And with the relative newness of these wall-to-wall venues,underwriters simply lack the experience and data to develop acomfort level with the class.

“We know what go-karts are all about. They’ve been around formore than 25 years. We don’t have the track record on new riskslike wall-to-wall trampolines,” notes Beckman.

|Lynn Houdek, program manager at managing general agent AxiomInsurance Managers, agrees policies for wall-to-wall trampolineparks are still “very hard” to place, but she believes they mayultimately find much more favor among underwriters. Why?

|Building a trampoline zone requires a fairly substantialinvestment, “so there is more of a commitment to the business thansomeone who just does inflatables on the side,” she explains. Withgiant inflatables, “you spend a few thousand dollars, and you canget into the business”—and those clients can fade just as quicklyas they arrived, she says. By contrast, someone who owns atrampoline park is likely to have more money invested in hisbusiness and be in it for a longer haul.

|Traditionally, any risks involving water have also beendifficult to place, and one of the most problematic but popular FECbusinesses to insure today: water-walking or “hamster balls”—large,inflatable spheres that roll on water with a person inside. Despitea Consumer Product Safety Commission warning issued in 2011 aboutthe dangers of water-walking, these risks still cross underwriters’desks.

|“It’s a popular new attraction, but safety standards are not yetin place, creating a potential risk-management issue,” saysHatfield at K&K. “The entertainment industry is in a constantstate of innovation, and insuring these ever-evolving risks can bechallenging.”

|CRAFTING COVERAGE

|The core program coverages for the FEC market are not dissimilarto those of many other small businesses and include GeneralLiability, Property, Crime, Inland Marine, Employee BenefitsLiability and Workers’ Comp. “There’s not a lot of significantdifferences in the creativity of coverage design; it’sunderstanding when and where to apply coverages and variousloss-control and education practices” that differentiate FECprograms, says Tewksbury.

|FECs that rent inflatables, for example, have a greater need forInland Marine coverage, whereas fixed-premise operations should besure to build in adequate Business Interruption limits in the eventa loss wipes out an attraction—or a whole season.

|Sizable underwriting differences exist between permanent FECfacilities and rental organizations (such as companies that makeinflatable houses available for a backyard party).

|“Permanent facilities generally have more exposures tounderwrite initially, but after the initial evaluation process, theannual review is less intensive unless changes to the operationshave been initiated,” Hatfield says. “However, rental businessesfor inflatables create unique risks inherent to the environment andto the experience level of the operator.”

|Municipalities or landlords often require higher excess limitsfor operations considered higher-risk, such as wall-to-walltrampolines. Water-based risks typically secure limited Pollutioncoverage. Beckman also recommends a Damage Control endorsement toprovide media-management resources for clients in the event of asignificant accident or injury at a park.

|Houdek says experienced underwriters know what they want to seein FECs: “Following standards. Requiring appropriate speed ongo-kart tracks and having remote shut-off systems. Keepingmaintenance logs. Having adequate staff who are trained in CPR.Using redundant fall-through netting and padding for trampolines.These are all things that any reputable FEC should be focusedon.”

| Axiom, adds Houdek, prefersfranchise businesses to independent owner-operators: “We feel thereare better rules and regulations and training [with franchise FECs]than places that just do it on their own.”

Axiom, adds Houdek, prefersfranchise businesses to independent owner-operators: “We feel thereare better rules and regulations and training [with franchise FECs]than places that just do it on their own.”

While the constant quest for new thrills presents plenty ofinsurance challenges, the FEC industry as a whole is placing agreater emphasis on safety and loss-control procedures.

|“You mention ‘amusement park’ and people conjure up the image ofa carnival coming to town with carnies smoking and drinking. That’snot the case—the industry has really cleaned itself up,” saysBeckman.

|For his part, Peverill appreciates the scrutiny of his insuranceteam’s loss-control resources. “[They] worked with us to ensure wehad proper netting, and they also provide refresher safety trainingto my staff every two years,” he says.

|Tewksbury says the FEC industry is sharpening its own image bycontinuing to exhibit transparency with underwriters: “People arereally concerned with protecting their clientele.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.