There is a change in the data collected by Celent for its annualsurvey of insurance IT leaders. A new word—innovation—has made itsway into the title for the recent survey: 2012 U.S. InsuranceCIO Survey: Pressures, Priorities—and Innovation.

|Among the findings, according to Donald Light, senior analystwith Celent and co-author of the report with Craig Weber:

- CIOs have three top-of-mind challenges: delivery; IT strategyand resource management; innovation and emerging technologies.

- Business is asking IT to focus on growth andprofitability.

- Several emerging technologies will grow significantly over thenext three years including: social media for marketing, forinternal users, and for claims; and mobile apps for mobile staffsand for customers.

Light explains that delivery challenges and resource managementare perennial issues for insurance CIOs.

|“Delivery becomes easier with more resources, but you only getthe resources you can afford,” said Light. “Growth is fairlyoptimistic. The year-after-year growth in budgets is optimistic for2012.”

|Part of that growth is because insurance IT departments haveimproved their execution, according to Light. Agile development isone such area carriers are turning to for next projects.

|“The newer theme is innovation and emerging technology,” saysLight. “We are banging the innovation drum. Mobility is hot and wethink it is going to remain hot. BYOD (bring your own device) has alot of challenges from a network security point of view and fromversioning—between Apple's iOS and the Android and Microsoftjoining the group. Several different platforms have to be addressedfor one mobile app.”

|Mobility has opened demand and raised the expectation of changeand pace of change for insurers, points out Light.

|“Mobility between iPhone and iPad is quite rapid,” he says.“Adoption even among mid-level business users has been quiteremarkable.”

|Light enjoys hearing the optimistic nature of the insurance CIOssurveyed.

|“We're looking forward to 2013 to see if good times get better,”he says. “We'll know from the national economy and the electionthis year. There is modestly renewed hope and optimism.”

||.jpg) Availability of InnovationTools

Availability of InnovationTools

Some insurance organizations have a research and developmentgroup operating within IT, but Light believes that is a luxury forcompanies with less than under a couple of hundred million indirect written premium.

|“Once you get into the $500 million area or certainly the $1billion level in premium, you darn well ought to have [R&D],”he says. “It may not be called R&D, but there should be one ortwo people thinking about R&D.”

|Innovation has not been a demand for 90-plus percent of theinsurance companies in the U.S., according to Light. Companiestraditionally hire, retain or fire staff because of execution. Witha change to innovation, Light feels carriers have to change theirincentive structure, hire the right people, and utilize the rightskill steps.

|“To me this is a slightly pleasant surprise,” says Light of thefocus on innovation.

||

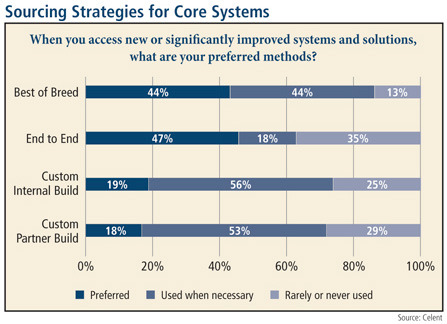

Sourcing Strategies

|While many feel the build vs. buy debate was settled severalyears ago, insurers occasionally find the need to build anapplication for their systems. As Light points out, the kind ofcompanies doing builds are really large, tier one carriers.

|“It is awfully hard to rip and replace legacy systems,” saysLight. “The IT departments that know how to build with a sense ofcontinuous improvement are either the ones who built 15 years agoor have been maintaining [the system] ever since.”

|The other debate in the area of sourcing strategies centers onbest of breed vs. end-to-end solutions. Again, Light believes it isthe size of the companies that is most important.

|“Above the tier-three line, companies don't see end-to-end as agood solution because those companies have IT skill sets in termsof integration and success with vendor management,” he says. “Ifyou go below $500 million, it's kind of scary to integrate sevensystems or manage seven vendors. That's not a good choice for a lotof companies.”

||

Business Growth

|An interesting change in the 2012 survey is that the businessside has asked IT to focus on growth and profitability, replacingexpense control and cost reduction as the prominent themes.

|“This is a big change,” says Light. “Profitability can be readas growing the top line or lowering the cost structure, but it alsocan be read as getting smarter—using business intelligence oranalytics for pricing, underwriting or claims. [Growth andprofitability] is an interesting charge for IT because it's notsomething that immediately translates to what they do.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.