The other weekend I participated in a rite thatundoubtedly was repeated thousands of times across the country.While eating out, everyone in my group of friends questionedwhether they could risk ordering their favorite breakfast food —eggs over easy. Overhearing the conversation, the waitress at thisrestaurant tried to allay our fears with, “We don't get our eggsfrom those farms,” and then instructed us to order what wewanted.

The other weekend I participated in a rite thatundoubtedly was repeated thousands of times across the country.While eating out, everyone in my group of friends questionedwhether they could risk ordering their favorite breakfast food —eggs over easy. Overhearing the conversation, the waitress at thisrestaurant tried to allay our fears with, “We don't get our eggsfrom those farms,” and then instructed us to order what wewanted.

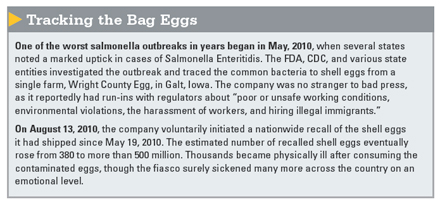

The recent salmonella outbreak involving millions of eggs isjust the latest in the seemingly never-ending debate about thequality and safety of the American food supply. From chicken potpie to pretzel dogs to imported prosciutto, the recalls have becomealmost a way of life. Sometimes the recalls are voluntary, butsometimes they are mandatory. Regardless of the scope of theproblem and the action taken, injury allegedly caused by taintedfood results in ripples of damage and injury that adjusters areleft to unravel in the end.

|When a tainted product is revealed in the media, the damageallegations tend to escalate. The product may be recalled, orclaims for sickness or damage may arise. At this point adjustersenter the picture, asked to decide whether there is insurancecoverage and, even if there, is, the issues and exclusions that maybe involved in settling the claims.

||Does CGL Apply?

|The first line of defense for processors and manufacturers inthese situations is the commercial general liability (CGL) policy.While notoriously broad in nature, the CGL form incorporates anumber of limitations and exclusions that must be considered whenadjusting these claims.

|First off is the requirement that there be either bodily injuryor property damage. The expectation of injury, no matter howcertain, is not enough to trigger coverage. So, in the case of thesalmonella-infested eggs, individuals who became sick after eatingthe eggs can allege “bodily injury.” They can also point a fingerat the egg processor and/or farm and file a claim. In situationssuch as this one, insurers for the farms and processors have, atminimum, the responsibility to defend such claims.

|However, when eggs are withdrawn from the market aftersalmonella is found in other eggs, there is no coverage for theloss of revenue suffered through the recall. It doesn't matter ifthe eggs were processed in the same place and in the same way aseggs that can be traced to people who were “injured.” The costsassociated with the recall are not covered by the unendorsed CGLpolicy.

|In addition to the requirement that there be bodily injury orproperty damage, the CGL includes an exclusion that is aimedspecifically at these types of situations. The standard CGL form'sexclusion “n” precludes coverage for damages claimed for any loss,cost, or expense that are incurred for the loss of use, withdrawal,recall, inspection, repair, replacement, adjustment, removal, ordisposal of the named insured's “product, “work” or “impairedproperty.” The exclusion applies if the product or work iswithdrawn or recalled from use by any person or organizationbecause of a known or suspected defect, deficiency, inadequacy, ordangerous condition in it.

||The exclusion — commonly known as the sistership exclusion —applies regardless of who withdraws the product or work from themarket. In the case of the salmonella outbreak in eggs, the Foodand Drug Administration (FDA) was able to request a recall, but theagency could not order one, and a voluntary recall resulted.Regardless of how the recall occurred, the sistership exclusionnegated coverage unless the producers had purchased product recallinsurance.

|As noted in an FC&S Online(R) discussion written byChristine Barlow and Kelly Maheu regarding the Toyota recall publicity, the sistership exclusion typicallyprecludes coverage for costs incurred when the named insured'sproduct is withdrawn from the market as a preventive measure.Courts have interpreted that the sistership exclusion applies toclaims for damage when, based on the failure of similar products,the insured's products are withdrawn from the market out of concernthat they may contain a defect or may cause bodily injury orproperty damage. For example, in Atlantic Mut. Ins. Co. v.Hillside Bottling Co. Inc., the court held that coverage forHillside's liability to beverage companies for contamination ofcarbonated beverages was barred by the sistership exclusion in theinsured's policy. The recall in this case was general and extendedto all beverages that bore the bottling company's plant code,whether they were actually contaminated or not. The court explainedthat the sistership exclusion excluded the cost of recallingapparently undamaged products to search for damaged componentsotherwise not yet discovered.

|However, the CGL policies of the egg producers, processors, andrestaurants that provided eggs that actually caused people to getsick would be triggered for, at a minimum, defense costs andmedical payments. If the injured parties are successful in theclaims against these insureds, then CGL should cover anysettlements or judgments.

||Defining Multiple Occurrences

|Once we get to the point, another feature of the CGL policy mustbe considered in adjusting the claims; namely, how many“occurrences” are involved in situations where groups of peopleeating at one restaurant during a similar period of time. Years agoI was peripherally involved in a situation where dozens of peoplebecame ill after eating at a Mother's Day brunch at a restaurant.This particular CGL policy has a per-occurrence deductible, so thequestion became this: Was the entire brunch on Mother's Day anoccurrence (one deductible), or was each person's trip through thebrunch line an occurrence (multiple deductibles)?

|The CGL policy defines occurrence as an “accident, includingcontinuous or repeated exposure to substantially the same generalharmful conditions.” Based on that definition, the injuries thatoccurred during that Mother's Day incident were considered to beone occurrence and, therefore, only one deductible was applied.

|As we've seen in other situations involving the question ofnumber of occurrences, however, some insureds would prefer thatmultiple occurrences be applied to avoid a problem of running outof limits. Therefore, insureds and insurance companies may switchtheir positions about whether there are one or multiple occurrencesdepending on the facts of the situation and the magnitude of theinjuries or damage.

|Diana Reitz, CPCU, is editorial director for the referencedivision of The National Underwriter Company. She may be reachedat [email protected].

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.