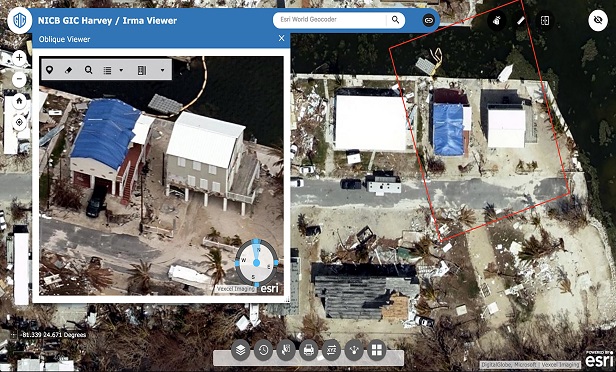

Accurate images of damaged areas following a catastrophe can help expedite the claims process for carriers and their insureds. This photo shows damage after Hurricane Harvey. (Photo: NICB/GIC)

Accurate images of damaged areas following a catastrophe can help expedite the claims process for carriers and their insureds. This photo shows damage after Hurricane Harvey. (Photo: NICB/GIC)

Following a disaster like Hurricane Florence or the wildfires in California, data is essential to efficiently identifying, verifying and paying claims. For carriers, there is a different option for obtaining this information. The Geospatial Intelligence Center (GIC) is a new endeavor from the National Insurance Crime Bureau (NICB). In partnership with Vexcel, a global leader in capturing photo imagery, and Esri, a geographic mapping system, the GIC is able to capture high-resolution images from a number of perspectives, allowing carriers to have a bird's-eye view of properties both before and after a catastrophe.

The GIC is a paying consortium for NICB member companies, and members must join the consortium in order to utilize its services and benefits. The data does come with a significant price tag, however, the amount of detail available in these images allows carriers to gather they information they need for any storm-related claims.

Recommended For You

"NICB, through the GIC and its partners, have the capability to gather the highest quality aerial views of impacted areas, and provide that information in a platform that insurers can incorporate into their existing systems to quickly view and assess damage to their policyholders' homes, businesses and even vehicles," explained Jim Schweitzer, chief operating officer of NICB.

"This allows insurers to make claims decisions that will help put customers back on the road to recovery sooner. This same imagery will also be used to mitigate potentially fraudulent claims months after the event. Finally and just as exciting, is that this same imagery is also being provided at no cost to emergency personnel to assist them in their response efforts."

This is a photo of an area in Napa, California before the wildfires. (Photo: NICB/GIC)

This is a photo of an area in Napa, California before the wildfires. (Photo: NICB/GIC) Street image access

Vexcel has imaged much of the U.S. and Europe, capturing areas in three-dimensional maps down to 30cm resolution, collecting over 3 million streetscape miles.

Through the Blue Sky Program, the GIC has been able to capture streets throughout the U.S. (pre-damage images), providing carriers with a 360-degree street view. The goal is to fly the entire U.S., particularly the top 100 cities, using vertical (top down) and oblique (45-degree view) imagery to help providers with underwriting properties.

This is the same area in Napa after the wildfires swept through. (Photo: NICB/GIC)

This is the same area in Napa after the wildfires swept through. (Photo: NICB/GIC) The Gray Sky Program allows carriers 24/7 monitoring with 360-degree street level imagery, and NICB air and land teams have priority access following a major catastrophe. Images can be uploaded to the system within 24 hours of the drones landing, providing insurers with almost instant access, allowing them to expedite claims adjudication and enhance fraud prevention, described Schweitzer.

Insurers are already aware of the benefits of using drones following a catastrophe, however, the information gathered through the GIC allows carriers to quantify the severity of a loss, accurately triage claims handling efforts, create a post-catastrophe analysis and measure the impact of claim more accurately.

There are new ways to use this technology as well. The GIC program gives carriers the ability to streamline the underwriting process, validate properties listed on policy applications, and potentially identify underinsured policyholders or other factors that could affect coverage, all without leaving the comfort of the office.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.