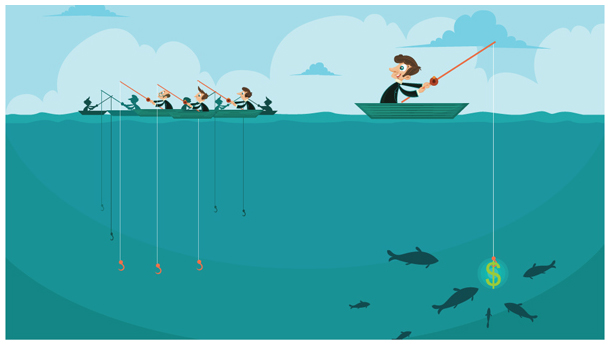

Superstorm Sandy may have provided the most persuasive argument yet for the benefits of insurance coverage designed specifically for the owners of high-value homes. Those who bought coverage from specialists in the high-net-worth niche—including ACE Private Risk Services, AIG Private Client Group, Chubb, Fireman's Fund and PURE—benefited from quicker service for tree removal, a broader interpretation of coverage for sewer and drain back-up, greater flexibility with flood and excess flood solutions and full replacement cost.

More more carriers and brokers specialize in this niche in the U.S., but the aggregate homeowners' market share of the five high-net-worth specialist carriers decreased for the fifth consecutive year in 2012.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.