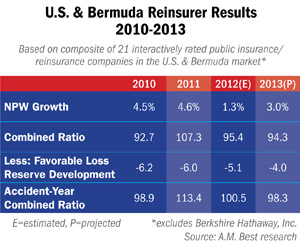

The U.S. and Bermuda reinsurance sector has its challenges, particularly when it comes to living up to previous years' returns on equity for investors, but ratings agency A.M. Best is maintaining its stable outlook due to reinsurers' strong capitalization and enterprise risk management practices, as well as a stable pricing environment.

A.M. Best notes that in 2009, its U.S. and Bermuda reinsurance market composite posted a 16 percent ROE. In 2006, it posted a 19 percent ROE. "At that time," A.M. Best comments in its latest Review/Preview analysis, "most market participants and observers knew that 2006 was likely the high- water mark for property and casualty returns. What most didn't know then was that by the end of 2012, the U.S. and Bermuda reinsurance market would struggle to post the round number of 10 percent and would be challenged to post double-digit returns over the intermediate term."

A.M. Best notes that in 2009, its U.S. and Bermuda reinsurance market composite posted a 16 percent ROE. In 2006, it posted a 19 percent ROE. "At that time," A.M. Best comments in its latest Review/Preview analysis, "most market participants and observers knew that 2006 was likely the high- water mark for property and casualty returns. What most didn't know then was that by the end of 2012, the U.S. and Bermuda reinsurance market would struggle to post the round number of 10 percent and would be challenged to post double-digit returns over the intermediate term."

The ratings agency says it expects the segment to hit that 10 percent mark for 2012, noting that the figure seems relatively attractive in the post-financial-crisis world.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.