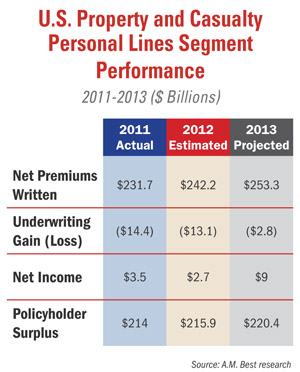

More frequent and severe weather-related events are creating a volatile business environment for the property-insurance line, but favorable results in auto are offsetting some of the negative impact, leading A.M. Best to maintain a stable outlook for the personal-lines segment.

“Although property line volatility continues to be a drag on overall results, it has not materially weakened the segment’s overall capital position, and auto results continue to be stable despite some margin compression,” says A.M. Best in its latest Review/Preview analysis.

“Although property line volatility continues to be a drag on overall results, it has not materially weakened the segment’s overall capital position, and auto results continue to be stable despite some margin compression,” says A.M. Best in its latest Review/Preview analysis.

For the property line, A.M. Best says it expects more of the same with respect to the weather. “Whether it’s an issue of frequency, severity, or sometimes both, the expectation is that regardless of the underlying causes, the erratic and volatile weather patterns experienced over the past few years will continue, and significant rate increases cannot be the only action taken to stabilize results.”

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.