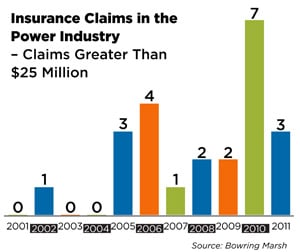

Power-generating companies have had at least one major loss in excess of $25 million each year since 2005, and the continuing trend could lead to price and capacity issues if insurers begin to leave the market, according to a report from insurance-broker Marsh.

“Insurers are reconsidering their stance on pricing and conditions for the global-power industry following sustained heavy losses arising from machinery breakdown, fire and explosion, natural perils and associated business interruption,” says Philippe Du Four, chairman of Marsh's Global Power practice in a statement. “Improving risk-management techniques to reduce claims frequency and costs should be a business imperative for power organizations.”

The power industry has a number of competing concerns that are contributing to the losses. While demand for power is up globally, requiring generating plants to perform efficiently, the Marsh report notes that the push for efficiency may lead operators to “ask insurers to cover new and allegedly unproven technologies” at new plants.

The power industry has a number of competing concerns that are contributing to the losses. While demand for power is up globally, requiring generating plants to perform efficiently, the Marsh report notes that the push for efficiency may lead operators to “ask insurers to cover new and allegedly unproven technologies” at new plants.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.