NU Online News Service, Aug. 16, 1:18 p.m. EDT

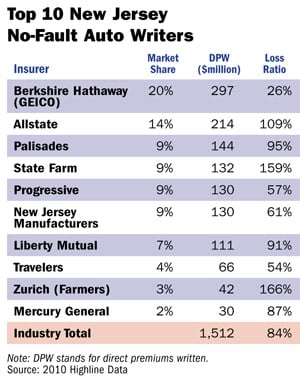

Proposed changes to New Jersey's personal injury protection (PIP) coverage would benefit insurers from a credit perspective as reforms would reduce legal expenses and clarify medical reimbursement for specific injury types, according to Moody's.

Proposed changes to New Jersey's personal injury protection (PIP) coverage would benefit insurers from a credit perspective as reforms would reduce legal expenses and clarify medical reimbursement for specific injury types, according to Moody's.

Earlier this month, the New Jersey Department of Banking and Insurance (DOBI) said it is looking to revise PIP regulations less than two years after prior reforms made their way out of legal wrangling. DOBI says it is considering about 3,000 additional codes to the current fee schedule. The last fee schedule, used to reimburse medical providers after treating patients from auto accidents, was adopted in August 2007 before getting tied up in a legal battle.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.