An "Atmosphere of pessimism" has taken hold of the "downstream" energy-insurance market after two poor underwriting years, and while capacity has not been impacted yet, one or two exits by leading insurers could trigger a wider withdrawal, a new report says.

An "Atmosphere of pessimism" has taken hold of the "downstream" energy-insurance market after two poor underwriting years, and while capacity has not been impacted yet, one or two exits by leading insurers could trigger a wider withdrawal, a new report says.

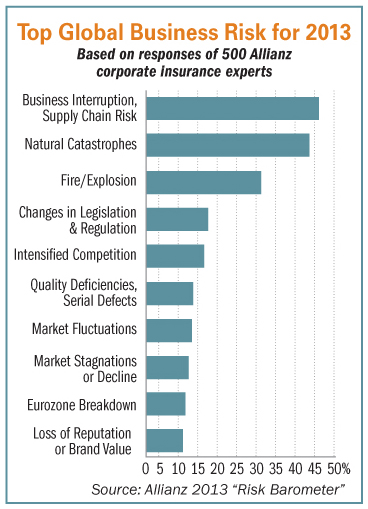

In its recent "Energy Market Review," Willis says the downstream energy market, which involves refining, selling and distribution, endured losses from Superstorm Sandy in 2012 after a loss-filled 2011 that included 10 major losses over $100 million.

Some insurers may now be on the cusp of withdrawing from the market, after Superstorm Sandy, in conjunction with historically low rating levels, led to mild hardening of the market. "An atmosphere of pessimism seems to now hold sway following two poor underwriting years in succession," Willis says.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.