The news for insurance agents & brokers concerning organic growth continues to be positive: According to the 129 producers who participated in Reagan Consulting Inc.'s most recent Organic Growth & Profitability Survey (OGP Survey), such growth continues to accelerate in 2012.

The news for insurance agents & brokers concerning organic growth continues to be positive: According to the 129 producers who participated in Reagan Consulting Inc.'s most recent Organic Growth & Profitability Survey (OGP Survey), such growth continues to accelerate in 2012.

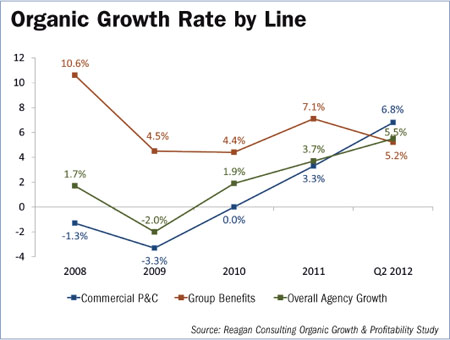

Through the second quarter, total agency organic growth totaled 5.5 percent—almost twice the organic growth achieved this same time last year. And here's the surprise: Commercial P&C is leading the pack. For the first time since the most recent soft market began in 2004, commercial P&C growth is on track to significantly outpace life & health growth by year's end.

Recent firming in P&C pricing fueled commercial-lines growth, which totaled 6.8 percent through the first two quarters of the year—more than three times the rate of growth at the same point last year (2.2 percent).

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.