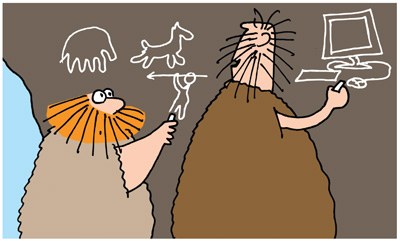

What seems like only a couple of years ago—but in reality may have been a decade or two—a claims adjuster could get his or her hands on a computer estimating program, prepare a detailed estimate in a matter of minutes, settle a property loss assignment, and move on to the next one. An adjuster's life was made easier by the software's ability to calculate floor, wall, and ceiling areas, and perform "extensions" to determine replacement cost value (RCV), depreciation, and actual cash value (ACV) amounts. Life was pretty good.

What seems like only a couple of years ago—but in reality may have been a decade or two—a claims adjuster could get his or her hands on a computer estimating program, prepare a detailed estimate in a matter of minutes, settle a property loss assignment, and move on to the next one. An adjuster's life was made easier by the software's ability to calculate floor, wall, and ceiling areas, and perform "extensions" to determine replacement cost value (RCV), depreciation, and actual cash value (ACV) amounts. Life was pretty good.

Using estimating software these days to handle property claims is not as easy.

Poor Training Yields Poor Results

Like many other technology based industries, estimating and property claims software has evolved into a more complex organism. Although the basic estimating function is the same (the quantity of material required multiplied by unit cost equals total repair cost), all of the additional tools, both software and hardware, have morphed the adjusting process into a high-tech ballet with the adjuster as the lead performer.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.