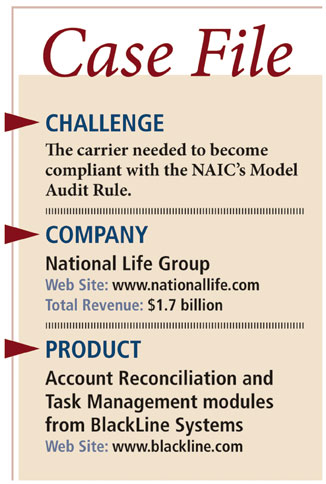

When the National Association of Insurance Commissioners approved the Model Audit Rule in 2006—the industry's version of the Sarbanes-Oxley Act for non-public companies—it mandated internal control reviews. For the National Life Group, that meant improvement was needed in its manual processes for accounting review, according to Paul Brissette, director of corporate accounting for National Life.

“Prior to 2007, all of our account reconciliations were don e on paper with approval signatures required on the paper copies,” says Brissette.

e on paper with approval signatures required on the paper copies,” says Brissette.

Handling all that paper was a fulltime job for a member of the accounting team, gathering hundreds of accounts, tracking down the required signatures, making copies, and organizing everything into three-ring binders.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.