Recently, I was flipping through the television channels when I noticed the current influx of insurance company commercials. You've seen them and can probably quote all of the hook phrases and themes. It seems that every big insurance company now has its own brand of spokesperson, mascot or catchy jingle. Most of them are very creative, and I applaud the marketing efforts of their respective advertising departments.

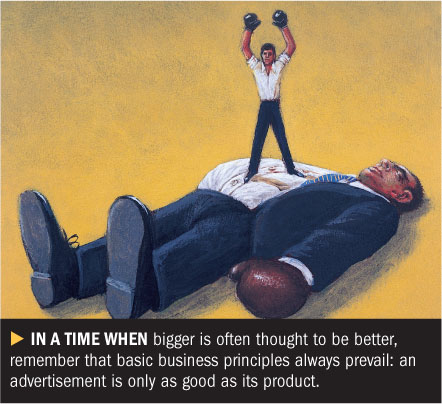

But in watching these, I have to ask myself, “Where does this leave the smaller insurance companies? What avenue do we have for advertising our services?” With these questions pending in my thoughts, I am reminded of a particular claim that our small county mutual handled a couple of years ago.

But in watching these, I have to ask myself, “Where does this leave the smaller insurance companies? What avenue do we have for advertising our services?” With these questions pending in my thoughts, I am reminded of a particular claim that our small county mutual handled a couple of years ago.

It was late on Christmas Eve night, and I was traveling on the interstate from Kentucky to East Tennessee. My wife and I had just spent the afternoon celebrating Christmas with my side of the family. My mobile phone rang, and it was Carol, our company's office manager, on the other end of the line. She told me some damaging winds had just swept over the mountains into the valley where our community is located. Since our office phone was being forwarded to her personal one during the holidays, she had received a call from a policyholder who had a wind claim. I knew that it had to be extensive damage for someone to call us on Christmas Eve.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.