The aviation market was once considereda 'quiet sector.' (Photo: Fotolia)

The aviation market was once considereda 'quiet sector.' (Photo: Fotolia)

Overcapacity, soft pricing and attritional losses havetransformed the aviation market from a reliably profitable sectorinto a no-man's land of virtually no margin for the last few years,with little relief in sight.

|Experts in the field note that despite high-profile incidentssuch as theApril 17 disaster of Southwest Airlines Flight1380 (in which an engine failure resulted in onepassenger's death), too much capacity remains in the market foreven a sustained string of major catastrophes to spur pricing.

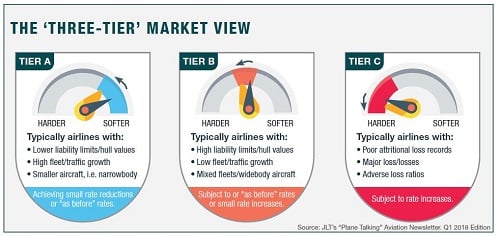

|Terry Rolfe, global head of aviation for New York brokerIntegro, says that catastrophelosses in other marketplaces — namely, some $100billion in insured losses from Hurricanes Harvey, Irma and Mariaand the devastating California wildfires and flooding in Houston —are pushing insurers to raise rates wherever they can, even inaviation. "We are looking at small increases of 1% to 3%, dependingon losses. Until we see a significant consolidation of capital, wewill not see a hardening of this market."

|"The biggest issue is that reinsurance hasbeen flowing freely into aviation for a long time," explains ShanRogers, director of the national aviation practice forChicago-based wholesaler RT Specialty. "Aviation has a reasonableloss rate, which makes it an attractive reinsurance market. So themoney flows in, everything is cheap and the prices drop." Mostcarriers, he adds, are looking for rate increases of 5% to 15% thisyear, but not all will find them thanks to continued competitionfor high-quality accounts.

|Paul Tuhy, chief underwriting officer of global aerospace for XLCatlin, remains cautiously optimistic that rates will increasein the near future. "People have utilized redundant reserves tomaintain their head above water until attritional losses catch upto the market," he explains. "Now, they have added up." Across theboard, he predicts rates to range from flat to a 5% increase,depending on loss history.

|"Universally, across the market, everyone agrees that rates aretoo low. Everyone says that. The carriers, the brokers, even theinsureds themselves," says Steve Allen, head of aviation at Sydney,Australia-based insurer QBE. "In our discussions with brokers andinsurers, we expect 5% to 10% rate increases from 2018, and we aregetting little to no pushback on that."

Cyber coverage gaps

Whether it's business interruption caused by the hacking of apassenger booking system, physical damage caused by taking certainmechanical processes offline, or reducing the value of a fleet ofaircraft by compromising their electroniclogbooks, cyberexposures have become aviation risks.

|"There is a high degree of awareness in the airline industryabout this risk. What is lacking is the insurance market," saysJoshua Motta, CEO of Coaliton, a San Francisco-based cybersecurityand cyber insurance provider. "The aviation underwriter has verylittle awareness of howcyberattacks work, who the actors are, or what controls to putin place to prevent a data breach or physical cyberattack.Meanwhile, the underwriters who do specialize in this risk don'tprovide coverage for some of the risks that the aviation industryhas."

|The real issue lies in policy wording: Most aviation policiesdon't specifically exclude losses from cyber risks, andmost cyberpolicies don't specifically exclude physical aviationlosses. That creates a gray area in coverage.

|Steven Anderson, product executive, privacy and network securityfor QBE, heads that company's cyber business and works closely withSteve Allen in aviation to provide seamless coverage. But it's noteasy.

|"What a lot of carriers pitch, especially with aviation andcyber, is that you'd like to have the same carrier on the samepolicies," Anderson notes. "It's like having Home/Life/Auto withthe same carrier — you're more likely to get more attention, fasterclaims payments, better terms, etc."

|The take-up rate with cyber is increasing amongaviation clients, he adds, and insurers are focusing on providingcreative risk management solutions — such as data breach response,forensics, legal and PR — to help their clients better manage riskon the front end.

|Still, the capacity glut can be felt here, too, and theCoalition's Motta notes that they're seeing rate increases of up to5% for smaller clients.

|Drones are a game-changer

Eventually, the Federal Aviation Administration will allow droneoperators to fly their aircraft beyond line of sight. When thathappens, says Rogers, thedrone market will expand dramatically.

|"We're talking about multimillion dollar drones that can fly to80,000 feet, and essentially act like near-Earth satellites withoutthe launch costs and can fly for months at a time."

|Drones acting as satellites will require data links between dronesand ground facilities, as well as additional facilitiesthemselves to hangar, maintain and operate the equipment. "Dronescan get really expensive really fast, and the system costs areoften five to 10 times the cost of the drone itself," Rogers says,pointing to potentially huge insurance opportunities.

|At the moment, though, mostdrones are personal devices still best folded into aHomeowners policy, says Tuhy. Larger drones that are part of acommercial fleet might fold into specialty coverage for theindustry they serve, such as construction firms using them tosurvey build sites, or energy firms using them to inspect equipmentor transmission lines. Ultimately, the market will segmentize itaccording to type of use.

|"We have to wait and see what the future guidelines are ondrones," says Tuhy. "Then, it will become similar to underwritingaviation risk and [asking] who is flying them. What are theircredentials and experience?" While this is still an evolving marketwithout a lot of loss experience to draw upon, Tuhy said that ifforced to choose between writing drones and writing helicopters (asegment that has suffered a large number of big losses recently),"I'd take the drone."

|The M&A factor

The $4.28 billion merger of XL and Catlin in 2015 could havebeen a bellwether event for the sector, but both sides of thattransaction maintained their relative books of aviation business.Even now, as AXA and XL enter into a $15.3 billion merger, sourcessay it's still too early to tell what kind of changes said unionwould really have on the market.

|"Therehas been significant consolidation since 2015," says QBE'sSteve Allen, referring to mergers and acquisitions between ArthurJ. Gallagher & Co. and NationAir; Ace and Chubb; and Willis andTowers Watson, in addition to XL, Catlin and AXA. "You'll continueto see smaller specialty brokers being acquired by a few of thelarger ones."

|In the nichemarkets space, such as drones and excess, the biggestrecent shakeup was Aerospace's straight purchase of Meadowbrook in2016, says Shan Rogers at RT Specialty. Since then, Aerospace hasmerged with Hallmark, reducing the niche aviation markets to justtwo players: Aerospace and Great American.

|According to Integro's Terry Rolfe, soft market conditions arepushing brokers that might otherwise be content with their book ofbusiness to buy smaller specialists on the premise that a futurehardening of the market will justify the investment.

|Making hay in a soft market

For now, the antidote to soft pricing lieswith sharperunderwriting. But that is easier said than done, says Integro'sRolfe, who notes that in any prolonged soft market, underwritingskill tends to erode: "We have an entire generation that have comeup without having to deal with any real consideration ofunderwriting. They are not having to have those difficultconversations about why a product costs what it costs."

|"In a soft market, it is really incumbent to be disciplined inyour underwriting approach. You do not want to be caught in a deathspiral of decreasing premium," says QBE's Allen. He cautionsagainst placing top-line deliverables on underwriters, which addspremiums on the books in the short term but will cause problemsover time with unsustainable loss ratios. "If you can focus onprofitability, the bottom line, and walk awayfrom underpricedrisks, that's how you can mitigate a soft market."

|"A big thing for us is looking at analytics and how that canhelp us better underwrite the general aviation market," says Tuhy,who points to deeper data sets and artificialintelligence to better evaluate pilot behavior andother operational factors that can help to price risk.

|He notes that the advent of ADS-B technology, which isessentially a GPS transponder that IDs planes at all times, ratherthan just when they are in the air, is also a big step not just formore detailed underwriting, but for overall safety. All U.S. planesmust feature ADS-B sets by 2020, but as the tech itself has droppedto $3,000 per kit, aircraft owners are installing itproactively.

|"Five years from now," Tuhy adds, "we will not underwritegeneral aviation risk the way that we have in the past."

|Bill Coffin is an award-winning content, corporatecommunications, and media relations executive.

|See also:

||Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In