Having an active, engaging social media presence is a must forany business looking to connect with existing and future consumers.This is especially true in financial services, where financialadvisors and insurance agents rely heavily on having an authenticand trustworthy personal brand.

|Creating and maintaining a strong social media following can bedaunting to professionals in the insurance industry, so many investin corporate digital marketing professionals and teams torecommend on-brand, relevant and compliant content to publish ontheir business social media profiles.

|But are these social media content programs effective? Whatcontent actually drives engagement from their followers? These arequestions companies must ask themselves from time to time.

|Hearsay, which provides digital clientengagement solutions for more than 150,000 advisors and agents,analyzed social media publishing data from leading organizationsacross wealth management, life insurance and the property& casualty (P&C) insurance industry. Social media contentwas categorized under lifestyle, industry or corporate.

|Here are the latest findings from Hearsay's 2018Social Media Content Study on the P&C's social mediapresence.

|Related: How busy insurance agents & brokers canleverage social media

|The hybrid model works

The P&C sector had an average of 548 publishes per suggestedpost, the highest amount of content published by advisors andagents. It also had the highest total number of touch points fromfollowers, as well as the highest average engagement rate acrossall types of content (39%).

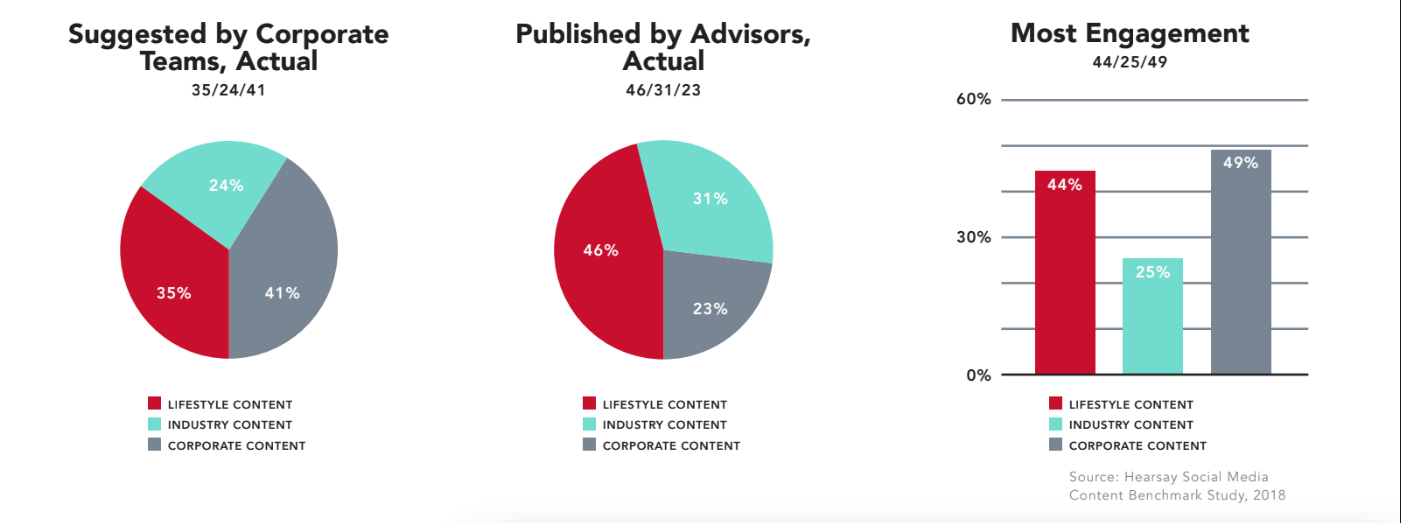

Rather than the traditional 70/20/10 percent rule — 70%lifestyle content, 20% industry content and 10% corporate content —many P&C insurance companies use a hybrid model for theirsocial media content strategy that more heavily promotes branded,corporate content, even at the local agency level.

|Related: 5 ways to make LinkedIn work foryou

|Tis the season

Hearsay found that the top content library search terms withP&C insurance agents were dominated by seasonal topics like“storm,” “boat,” hurricane” and “wildfire,” as well as holidays(“Memorial Day”) and special occasions (“graduation”).

|Since many of these types of events are recurring, P&Cmarketing teams and agents can save time by queueing up seasonalcontent in advance so they can be quickly both before and afterthese events occur.

|Related: 5 easy-to-implement social media strategies forbusy insurance agents

|Best practices for social media

While the P&C insurance industry's current social mediapractices clearly pack a punch, there's always room forimprovement. Here are four best practices companies can keep inmind when it comes to social media.

- Put an engaging spin on industry and corporatecontent: Advisors want and need a variety ofindustry-related content. Frame posts in a way that entertains orprovides a local context to make them more engaging and relevant.Lists and how-tos, as well as personal stories, are sure toincrease social media traction.

- Share more lifestyle content: The 70/20/10rule isn't necessarily the right approach to social media, butHearsay found that clients and prospects are most engaged withlifestyle content across all lines of business. Positioningoneself as an interesting and relatable person sets the foundationfor the advisor-client relationship.

- Maintain an open dialogue between corporate marketingteams and the advisory field: Advisor social mediainitiatives sometimes fail because of a lack of communication andinput between corporate teams and the field. A simple one-pagerthat states what advisors can and cannot do on social, especiallywhen it comes to lifestyle content, will increase the odds ofadvisor activation and success.

Social media is constantly evolving and companies must evolvewith it. A company's brand and customer engagement depend on it, soit is critical that companies continue to leverage social media tomake their presence felt.

|Related: 2 ways social media renewed my faith in theindependent insurance agent

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.