A highly competitive market pricing environment alongwith a shifting claims landscape is having an adverse effect formany professional liability underwriters, particularly in Directors & Officers (D&O) liabilityinsurance.

|Though representing only 1% of total industry direct premiums,D&O insurance comes with a notoriety that belies its size.Sizeable D&O claims arise from events such as corporateinsolvencies, large stock price declines, financial reportingirregularities or regulatory investigations. D&O insurance isintended to cover the directors and officers of an organizationagainst allegations of negligence, misleading statements orwrongful acts that lead to litigation. Leading underwriters in theD&O insurance segment include AIG, Chubb Limited and XL GroupLtd.

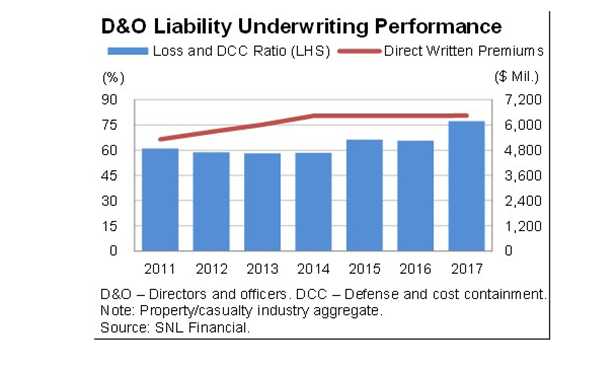

|D&O specific direct underwriting results are reported byinsurers in statutory supplemental filings since 2011. Followinginitial years of steady growth, unyielding market competition hasstalled premium growth over the last four consecutive years.Industry direct written premium volume held at approximately $6.4billion in 2017.

|Related: D&O liability trends

|

Underwriting results have shown a more pronounced deterioratingtrend. D&O insurers saw their direct underwriting results takea sizeable hit last year by posting a 77% direct incurred loss anddefense and cost containment (DCC) ratio in 2017, 11 points higherthan the prior year. This figure represents the worst-ever resultssince D&O supplemental data was first recorded in 2011. Acloser look shows larger players like AIG and Zurich AmericanInsurance Group reporting much higher 2017 direct loss ratios andmany other market participants reporting deteriorating results.

|This movement is not altogether surprising because D&Oinsurance is by its nature a more volatile product line than manyother P&C products. However, premium rates in the D&O spacedo not appear to be responding to weaker results as revealed byinsurance broker reports and other market surveys. Aon plc'sfourth-quarter 2017 D&O Pricing Index indicates thatD&O primary policy renewal rates have fallen steadily since2Q15. Willis Towers Watson's Marketplace Realities 2018report predicts that D&O pricing overall is likely to see flatto 7% lower rate changes in 2018.

|Related: 5 things to know about Side A D&Ocoverage

|Increasing number of D&O class action suits

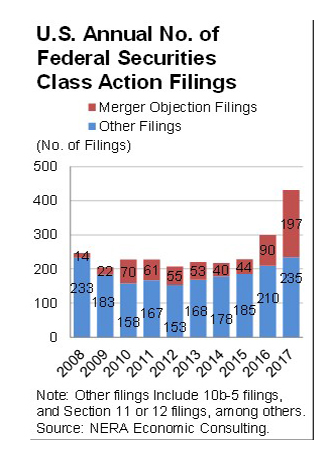

Several recent claims trends also point to D&O underwritingchallenges going forward. Federal securities class action lawsuits increaseddramatically in 2017 and were a pivotal factor behind the growth inincurred losses for D&O insurers. A recent NERA EconomicConsulting report reveals that class action filings increased by44% in 2017 to 432, representing the highest level since 2001,which in and of itself saw a tremendous litigation spike from IPOladdering claims.

|Securities class action filing growth is largely attributable tothe expansion of merger  objection claims. Allegations ofmisrepresentations or inappropriate disclosures, or a failure byboard members or corporate officers to meet fiduciary duties andsell at an inappropriate price, are nearly inevitable followingacquisition announcements. The volume of these suits more thandoubled in 2017, and merger objection claims represented more than45% of all class action filings for the year.

objection claims. Allegations ofmisrepresentations or inappropriate disclosures, or a failure byboard members or corporate officers to meet fiduciary duties andsell at an inappropriate price, are nearly inevitable followingacquisition announcements. The volume of these suits more thandoubled in 2017, and merger objection claims represented more than45% of all class action filings for the year.

These claims are typically not subject to lengthy courtproceedings and tend to settle quickly without large payments.Still, in past years, merger objection claims represented a sourceof claims frequency that can generate significant expenses fordefense and settlement costs.

|The NERA report also notes that the number of publicly tradedU.S. firms declined by more than 40% since 1995. Combining thisphenomenon with the spike in filing activity raises class actionsuit frequency to 8.2% of all public companies in 2017,highlighting the omnipresent risk publicly held firms have oflitigation.

|The NERA report does note, however, that case dismissals andclosures are occurring at a more rapid pace. What's more, therecent lull in the number of larger class action settlements islikely an offsetting positive influence on recent D&Ounderwriting performance. Recent analysis by Cornerstone Researchindicates that the total value of class action settlements lastyear was $1.5 billion (the second lowest number in adecade) with no individual settlement exceeding $250 million.This result may be attributable to smaller class sizes andsettlement time frames for the specific cases settled in 2017 andmay not reflect an enduring trend.

|Related: Directors, officers, creditors beware: D&Ocoverage narrowed in bankruptcy cases

|More employment-discrimination claims

Public company executives' liability exposure continues toevolve broadly. A greater inclination for courts to seek to holdexecutives individually accountable for corporate misconductfollowing the 2015 “Yates Memorandum” from the Department ofJustice adds to this personal exposure, spurring demand forcoverage.

|Boards and management are facing more liability exposure inseveral employment-related areas, including discrimination andsexual harassment claims that could fall underan employment practices liability (EPLI) coverage, but morefrequently include allegations of a lack of board and managementoversight of employee training or organizational culture. Theseexposures are meaningful for private companies and nonprofitorganizations as well.

|Cyber risk represents another growing risk exposure for theD&O space. Increasing dependence on interconnected informationsystems is leading to a greater incidence of hackers breaking intoan organization's computer networks to disrupt operations or stealsensitive personal or financial information as evidenced bynumerous high-profile 2017 ransomware attacks.

|The expanding chance for cyber events that impinge corporatereputations or generate financial or share value losses could leadto D&O liability allegations that ineffective or negligent riskmanagement practices, corporate governance and board oversight werecontributing factors behind inadequate systems defenses andbreaches. More cyber incidents and the subsequent increase in cyberinsurance coverage that addresses D&O risk will create morepotential for cyber-related D&O claims going forward.

|Not much improvement on the horizon

Continued weak pricing trends suggest that underwriting resultsare unlikely to improve for the D&O insurance segment in thenear term. Market underwriting capacity remains abundant andthere are few signs of any individual insurers retreating from theD&O space. Potential remains for further profit deteriorationhinging largely on how the influx of recent claims settle. Larger settlement trends are difficult to predict and can hinge onchanges in judicial norms, juror sentiment and other unforeseenfactors.

|James B. Auden, CFA, is managing director, Insurance, forFitch Ratings. He can be reached at [email protected]. Formore information about the 2017 D&O liability insuranceunderwriting results, check out the full report, “U.S. Director andOfficers Liability Market Update,” available at www.fitchratings.com.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.