Today's insurance marketplace is highly competitive. With anumber of companies to choose from, consumers are not tethered toany one company these days. While this is great for policyholders,carriers of all sizes are sure to feel the effects of a lostcustomer in their bottom line.

|LexisNexis Risk Solutions, a subsidiary of RELX Group,has released a new report, Acquire with Retention inMind, filled with insights to help carriers identify ways tomaintain policyholder retention rates.

|It's much more profitable to retain and defend existing clientsthan acquiring new ones. In fact, LexisNexis Risk Solutions notedthat research suggests that it can take as many as seven newpolicies to cover the value of one tenured policy.

|Attracting clientele is one thing, but keeping them around forthe long haul is a whole new ballgame. With this in mind, here arethree tips carriers can use going forward when it comes to customerretention.

|Related: Insurance marketing: It's not about piling upstrangers' email addresses

|Identity verification matters

More complete and accurate identities are indicative ofhigher-scoring prospects who are more likely to convert and remainwith the company as long-term policyholders.

|Identity verification confirms the following criteria:

- Is this prospect an actual person?

- Is the prospect an existing customer?

- Are all the contact points factual and reliable

Related: 4 steps to writing a great cold-callingscript

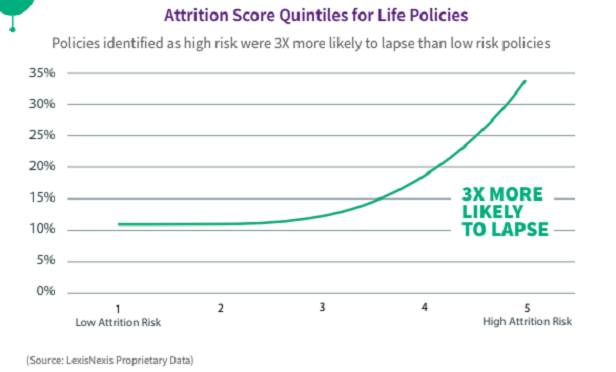

|Advanced analytical models are highly predictive

Advanced analytical models that predict risk and the likelihoodof attrition have proven to be highly effective in terms ofidentifying prospects who are more likely to to be retained beyondthe first renewal period.

Insurance-specific analytic models are proprietary models basedon demographic data such as gender, home ownership, length ofresidence and the number of moves in recent years, combined withfinancial data such as wealth, income, bankruptcy and number ofopen trades.

|Related: 5 things insurance agents can do to hedge againstdigital disruption

|Know your prospect in real time

After identifying a high-scoring lead, agents and brokers canprioritize and route the lead accordingly. Duplicate and fraudulentleads, along with existing customers, are filtered out in theprocess. The result is a higher degree of customer satisfaction,which can translate into long-term customer retention.

|Carriers have addressed customer retention in a number of ways.For example, some leverage third-party data to supplement in-houseinformation and use that data to aid in targeting and segmentation.But third-party data may not be insurance specific, and so it lacksthe necessary relevance and detail that insurance carriers need toreally gain an edge on the competition.

|Today's insurance marketplace relies on data like neverbefore, and so the right data and robust analytics can make thedifference. Customers will always be the lifeblood of the insuranceindustry, and so carriers must find new and innovative ways tokeep them around for the long haul.

|Related: Agent Study 2018: What technology devicesdoes your agency use/allow?

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.