It's no secret that insurers are making a significant investment in technology.

|From apps and drones to software and artificial intelligence,insurers are incubating their own technology or partnering withcompanies on the forefront of development in multipledisciplines.

|And as much as policyholders may want to utilize new technologyin various areas of their lives, they're still not using it to itsfull capacity in the insurance space.

|A new J.D. Power 2017 U.S. Auto Claims SatisfactionStudy found that despite a significant advertising anddevelopment investment for mobile insurance apps, and the use ofdigital channels to purchase insurance (think Lemonade andEsurance), consumers have been slower to utilize them when it comesto reporting claims.

|Related: Here's how insurers can solve their 'low-touch'problem

|

While customers will purchase their auto insurance online,they still prefer to talk to a claims adjuster over the phone whenfiling a claim. (Photo: Shutterstock)

|Consumers don't file claimselectronically

The study found that while almost one-quarter (22%) of autopolicyholders might begin their communication with an insureronline, only 9% will choose to provide their first notice of loss(FNOL) through an app on their phone or an insurer's website. Aninteresting finding given the amount spent to develop and marketthese technologies.

|Related: Underwriting transformation in the digitalera

|"U.S. auto insurers have invested heavily in technology thatwill help them gain efficiencies in claims handling, but there arestill certain areas of the claims process where the human touch isproving difficult to replace," explained David Pieffer, J.D.Power's property & casualty insurance practice lead in a pressrelease. "As insurers continue down this path, it will be criticalthat communication with their customers is not negativelyaffected."

|The study found that the decision not to report a claimdigitally was not based on age or level of comfort with technology.Only 12% of Gen Y customers were likely to use digital channels toreport a claim, a two percent increase over 2016. In addition, thestudy found that overall satisfaction was 16 points lower (on a1,000-point scale) for policyholders who used technology to reportclaims versus those who opened their claim by phone.

|

Policyholders who follow the progress of their claimelectronically had a higher level of customer satisfaction. (Photo:Shutterstock)

|Digital updates provide more value

The numbers for those who choose to follow the progress of theirclaim digitally are more promising, with approximately 16% ofclaimants using mobile apps to upload damage photos and receivestatus updates. Overall satisfaction was actually 33 points higherfor those who selected electronic updates versus those who did not,although much of the usage depends on the age of the policyholder.Gen Y had a satisfaction score 26 points higher than last year,while satisfaction actually dropped among pre-boomers by 16points.

|Claims service matters

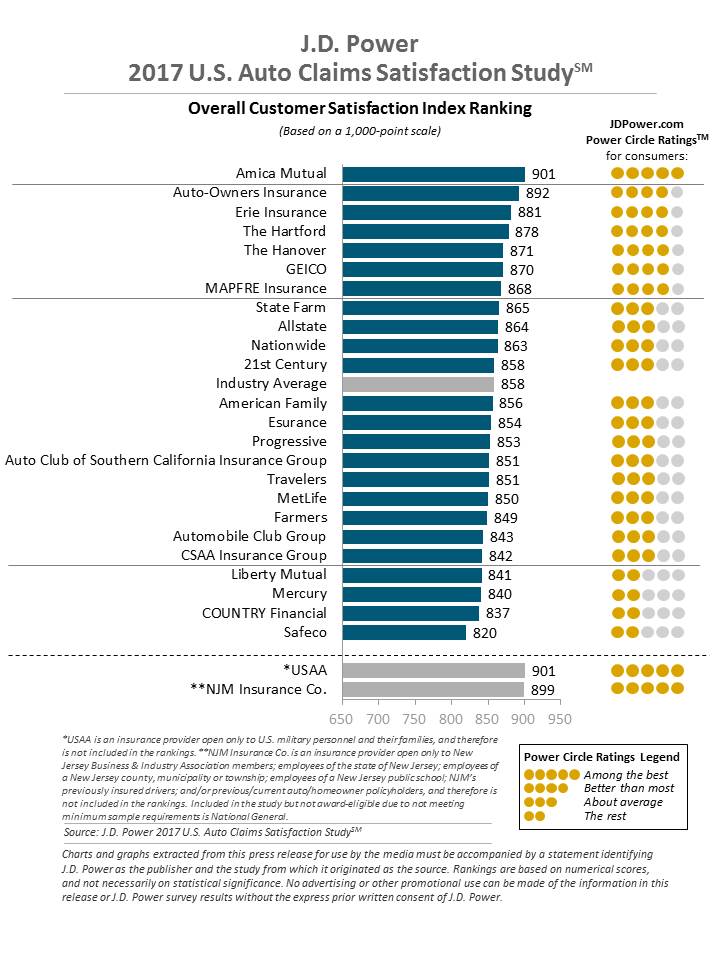

Insurers know that customers want their claims serviced andresolved as quickly as possible, because that is a crucial driverof customer satisfaction. This fact was confirmed by the J.D. Powerstudy, which found that 104 points separated the highest and lowestscores.

|Related: Customer expectations: 4 digital technologyimplications for insurers

|Amica Mutual scored the highest at 901 for customersatisfaction. Rounding out the top five insurers were: Auto-OwnersInsurance (892); Erie Insurance (881); The Hartford (878) and TheHanover (871).

|The results of the 2017 U.S. Auto Claims Satisfaction Study arebased on the responses from more than 11,000 auto insurancecustomers who had settled a claim within the six-month periodbefore the survey. Here are the full results of the study:

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.