While 2016 reached a 10-year high in terms of catastrophic events, for insurers it was anopportunity to show what they do best, and policyholders agreed, asoverall customer satisfaction among those who filed a claim rose1.5 percent. This was especially good news since the 2016 survey showed the first drop in fiveyears.

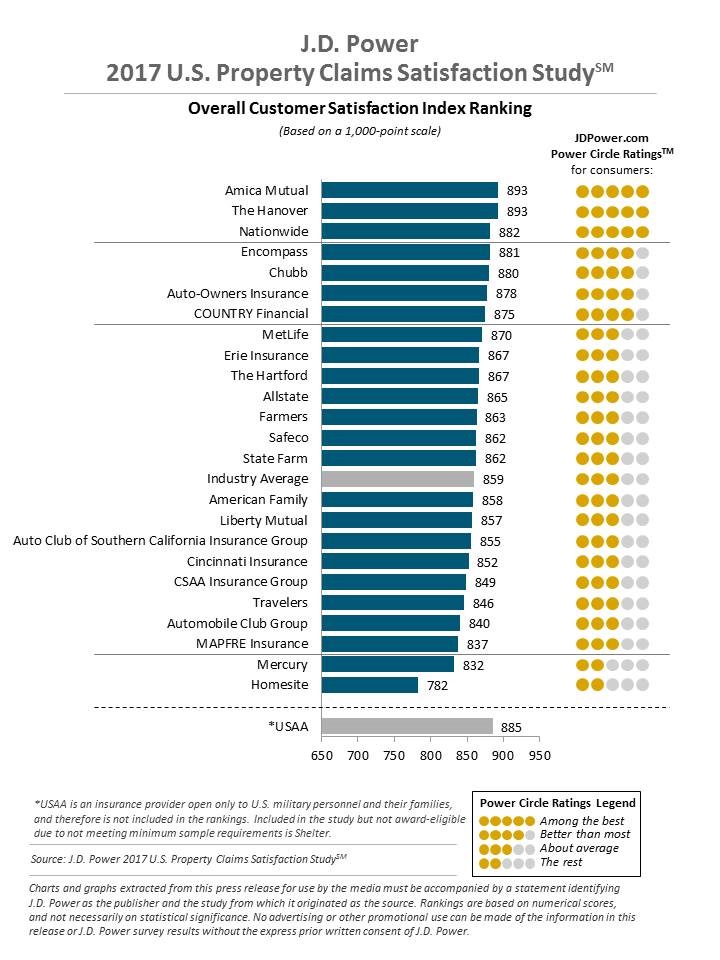

|The J.D. Power 2017 U.S. Property Claims SatisfactionSurvey asked 6,645 policyholders who filed a claim in 2016about their experience. Satisfaction with the process was measuredusing five different areas: settlement, first notice of loss,estimation process, service interaction and repair process based ona 1,000-point scale.

|'All-time-high'

The overall satisfaction score rose 13 points to 859 from 2016to 2017, which J.D. Power says was an “all-time high” for thestudy. Driving the increase was the settlement factor, whichcomprises the settlement amount, estimation process and serviceinteraction. These satisfaction levels were comparable to thosefound with auto claims, which has traditionally scored higher thanproperty claims.

|“Following the significant declines in customer satisfactionfound in the 2016 study, property and casualty insurers haveredoubled their efforts to improve the settlement process andfine-tune their customer interactions, efforts that have beenclearly recognized and appreciated by homeowners who experiencedsignificant losses this past year,” said Greg Hoeg, vicepresident of U.S. insurance operations at J.D. Power in a pressrelease.

|“Still, despite the overall improvement, problem areas areevident, most notably in water-related and other complex claimsthat take a long time to settle and that cause significantlifestyle disruption. Insurers that manage to get the settlementprocess and customer interaction equation right in these types ofdisruptive and often catastrophic scenarios are those that raisethe bar for the industry.”

|How quickly a claim is resolved matters

The survey found that how quickly a claim is resolved matters topolicyholders. Water-related claims seem to take longer to settleand scored lower (as much as 39 points) compared to other types ofclaims such as wind and hail.

|Read on to see which companies scored the highest in the 2017U.S. Property Claims Satisfaction Study.

|

(Photo: Shutterstock)

|10. The Hartford

|The Hartford saw a 14-point increase from 2016 and tied with the9th-place company.

|Score: 867

|

9. Erie Insurance

|Despite a four-point increase over last year's number, Erieactually dropped four spots from fifth to ninth place.

|Score: 867

|

(Photo: Rick Kopstein/ALM)

|8.MetLife

|The company made a significant 23-point jump from last year,moving from 16th place to eighth.

|Score: 870

|

7. COUNTRY Financial

Dropping a few spots from third place in 2016, COUNTRY Financialstill improved 12 points.

|Score: 875

||

6. Auto-Owners Insurance

|Last year, Auto-Owners Insurance came in below the industryaverage of 846 with a score of 843, but all of that changed in2017. The company jumped 12 positions and improved its score by 35points.

|Score: 878

|

5. Chubb

|Chubb did not make the top 10 companies last year, but jumpedseven slots in 2017 and improved its score by 29 points.

|Score: 880

|

4. Encompass

|The company showed how consistent their service is by placing inthe same position as last year, but still improved 18 points.

|Score: 881

|

(Photo: iStock)

|3. Nationwide

|Jumping seven spots from last year, Nationwide also raised itssatisfaction score by 29 points.

|Score: 882

|

2.The Hanover

|Showing the most dramatic improvement over 2016, The Hanoverwent from not even making the top 20 to tying with the number onecompany and improving its score by 40 points.

|Score: 893

|

(Photo: Amica Mutual Insurance)

|1. AmicaMutual

|Taking the number one spot for the sixth consecutive year, AmicaMutual actually dropped five points from 2016. The company scoredhighest in settlement, estimation process and the repairprocess.

|Score: 893

|Related: Natural hazards created havoc in2016

|Read on for the list of the top 20 companies with the highestoverall customer satisfaction ratings.

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.