The purchasing habits of millennials are difficult to figureout, and as the largest generation in the U.S., your insurancebusiness’ future depends on your ability to reach them.

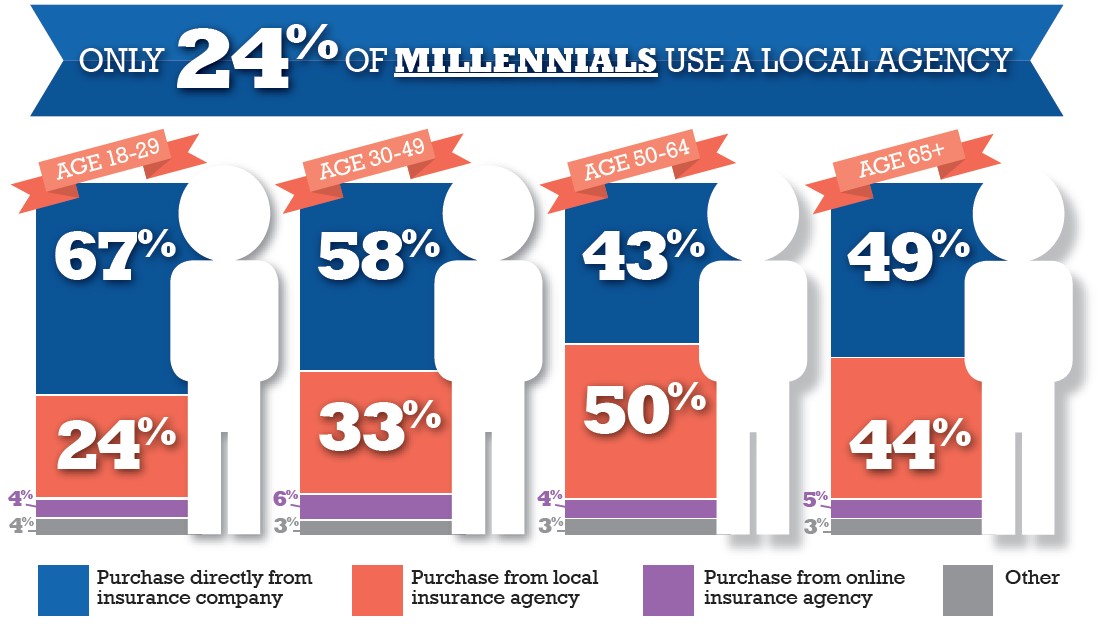

|Revealed in a recent study commissioned by Effective Coverage and performed by ORC International, what we do know about millennialsis that they aren’t likely to purchase home and renters insurancefrom local agencies. In fact, 18-29-year-olds are 50% less likelythan their parents to purchase from local representatives. Of allthe groups surveyed, millennial renters were the least likely topurchase policies from individual agents. Forty percent of all agegroups surveyed purchased home insurance policies from localinsurance agencies, yet only 24% of millennials followedsuit.

|

Instead of working with local agents to find the right coverage,67% of millennials are purchasing directly from insurancecompanies, leaving agents out of the picture. Before trying to winthem over, we need to understand why local insurance professionalsaren’t reaching this important demographic.

|Related: 5 ways for insurers to attract millennialsonline

|1. Millennials want immediacy - Millennials arethe on-demand generation and they don’t remember life before theInternet, nor do they want to. Clothing, television shows, and evendating are just a couple of clicks away. The convenience of doingeverything from the comfort of their living rooms has developedinto a way of life. Unless the benefits of doing things differentlyare evident, there aren’t many occasions that will enticemillennials to trade an instant shopping experience for thetime-consuming task of driving somewhere and “dealing” with actualpeople. If a millennial is looking for a new pair of shoes or eveninsurance coverage at midnight, there are only two places to go:the Internet or the call center of a direct writer.

|How to overcome: You can’t keep youroffice open 24 hours, but you may be able to provide extendedhours, conduct meetings that are convenient for them (try localcoffee shops), and utilize online tools and resources to reachthem. At Effective Coverage, we recently filmed over 100 videosanswering questions about renters insurance. Why? Because whenmillennials have questions, they want answers immediately.Answering those questions on their terms is a good start tobuilding a relationship and eventually offering them insuranceproducts.

|2. Millennials are hard to find -Millennialsare elusive and don’t often travel in packs. They don’t ask theirfriends or peers for referrals. They go online to social media andreview sites to learn about products and to get a feel for a brand.If they’re comfortable with products or services after doingresearch, they’ll purchase immediately from where they currentlyare—online.

|How to overcome:Create online and social media profiles so millennials can findyou. From advertising on social media, to providing your customerswith easy ways to share information online with their networks, ifyou use technology to reach millennials, you’ll be a couple ofsteps closer to landing new policyholders in this demographic.

||

(Photo: Shutterstock.com)

|3. They have their own communication style -Millennials don’t want to spend extra time speaking to someone inperson or over the phone to complete a transaction. They want tosend a text or press submit, and then receive receipts sentdirectly to their inboxes in case they ever need proofs ofpurchase. Upselling makes them uncomfortable, and they don’t seeany benefit to sitting in offices for an hour filling outpaperwork.

|Related: The 5 rules for winning over millennialcustomers

|How to overcome: Every good insuranceadvisor approaches each prospect differently to cater to theirneeds and preferences. The easier you can make their decisionswhile keeping the pressure low and giving them access toinformation—the better off you are. Even if your standard salespitch is 20 minutes, create a five-minute version. If you’rerequired to upsell every customer, find a low-pressure way topresent potential options to younger clients that won’t have themrunning for the exits.

|4. Millennials don’t like outdated and poorly designedwebsites - Have you ever seen a commercial or billboardthat just doesn’t speak to you? Millennials have learned to trustwell-designed and easy-to-understand ads and websites. Just look atthe rise in popularity of infographics. An outdatedwebsite is like a lighted restaurant sign with half of the lightbulbs burnt out.

|How to overcome: Update your website’stext and design. If it is in the budget, hire a creative agency orfreelancer that specializes in targeting the younger generation tocreate marketing materials and help overhaul your website.Remember: if your website doesn’t look good, you won’t gain theirtrust.

|5. They aren’t mobile-ready - You’ll behard-pressed to find a millennial who doesn’t own a smartphone. Infact, more than 85% of millennials own one, and one in five millennials access the Internetsolely from mobile devices. If your website isn’t mobile-ready,you’re killing your chances of reaching the millennials. And it’snot just millennials who want your website to be compatible ontheir smartphones. Google does too.

|How to overcome: Ensure your websiteis mobile-friendly. You don’t need to change your entire brand, butyou need to offer potential customers the ability to access yoursite from both their computers and mobile devices.

|Times are changing, and in order to reach the next generation ofinsurance customers, you have to update your practices. Bydedicating more of your efforts to cater to millennials, you canincrease revenues and grow significantly as this generationages.

|Eric Narcisco is the CEO of Effective Coverage, a nationalonline renter's insurance provider. Narcisco suffered an apartmentfire while uninsured—which sparked his dedication tohelping renters get covered.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.