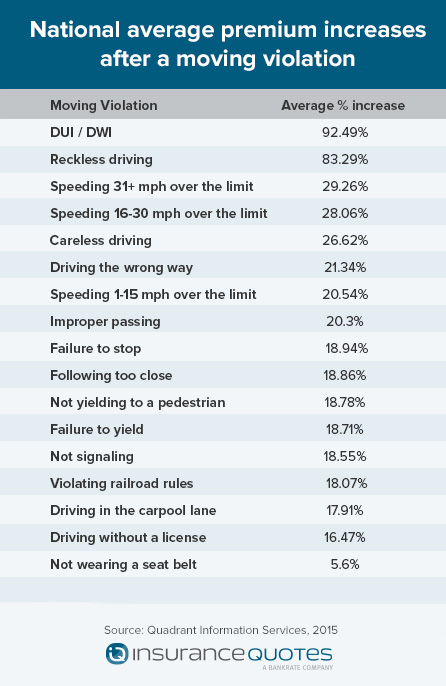

Most people know that any type of moving violation is likely toresult in an increase in your auto insurance. What you might notrealize is just how much of an impact that incident can have andhow long you’ll be paying for that mistake.

|Insurancequotes.com commissioned a study to look at the way a moving violation affects insurancerates across the country. The study tracked rate increases forserious infractions like DUIs (driving under the influence), DWIs(driving while impaired/intoxicated), reckless driving, travelingmore than 30 mph over the speed limit and improper passing, as wellas minor violations like not signaling, driving in the carpool lanewithout the correct number of passengers, driving without a licenseor not wearing a seatbelt. How much of an increase you’ll seereally depends on where you live and the type of violation.

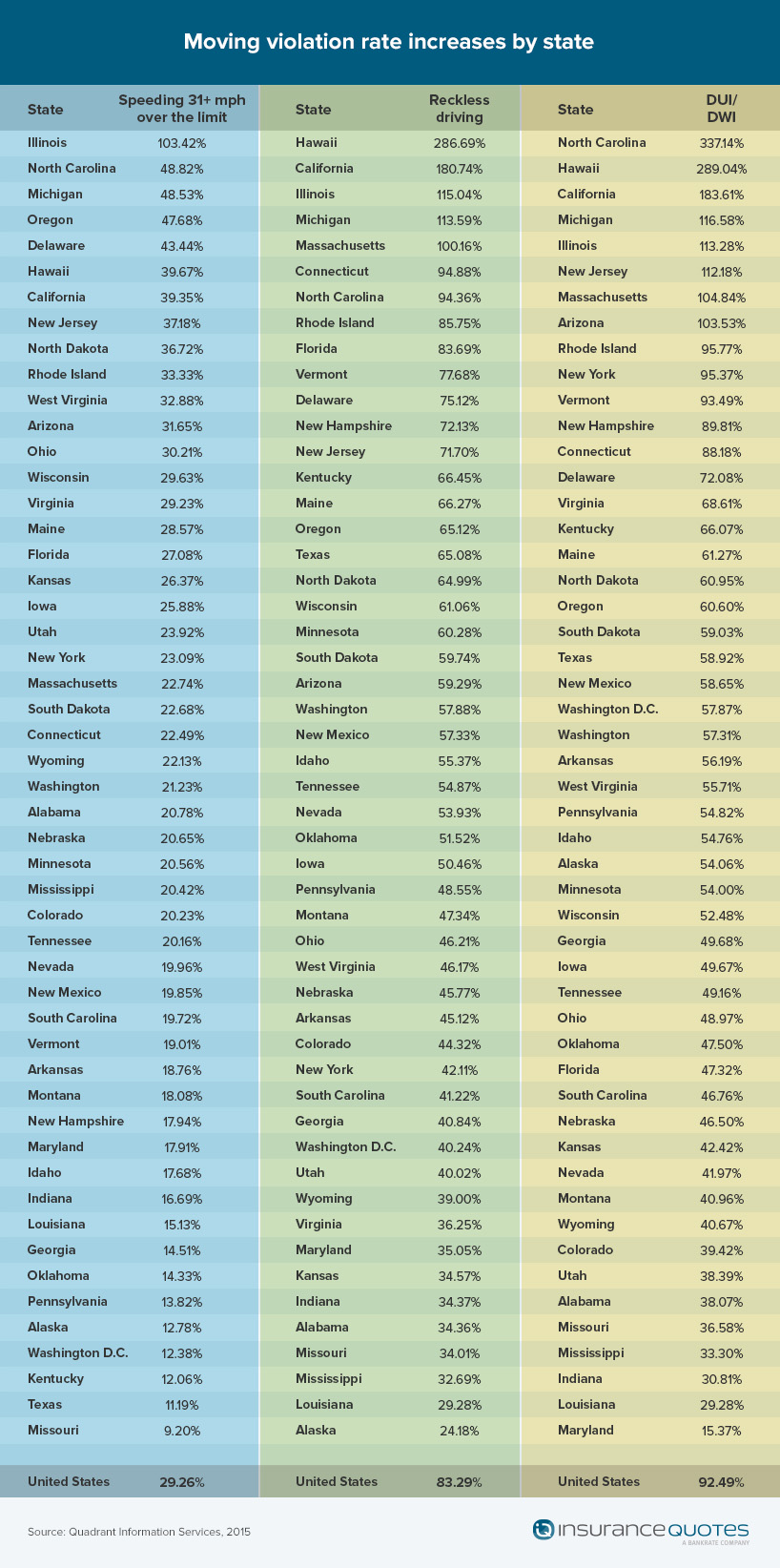

|Insurers are more likely to substantially increase rates forhigher risk violations like DUIs in which the likelihood of bodilyinjury or even death is significant. Although the average increasefor a DUI/DWI is 92%, drivers living in North Carolina are likelyto see the highest increases at 337%, followed by Hawaii at 289%and California at 184%. Michigan (117%), Illinois (113%), NewJersey (112%) and Massachusetts (105%) also are in tripledigits when it comes to increases. Maryland had the lowest increasefor a DUI arrest, coming in at just 15%.

|A look at the actualnumber of DUI arrests shows that these states don't have thehighest arrest rates for their populations. In 2014, North Carolinahad 49,599 DUI arrests or less than 0.51% of its population. Hawaiihad 5,812 arrests, 0.42% of its 1.3 million population, andCalifornia had 214,828 (0.5%), but its state population is 37.6million. Wisconsin had the highest number of DUI arrests, 40,549,for its 5.7 million residents, but a violation there will increaseinsurance premiums by only 52%. In Arizona, 0.61% of its 6.4million residents were arrested for DUIs and saw their ratesincrease by 103%.

||

The increases for reckless driving were slightly less, but notmuch. Hawaii residents can expect to see their insurance increaseby 287% after a reckless driving violation. California driverscould see as much as a 180% increase and Illinois drivers 115%.Even the states with the lowest percentages like Alaska (24%) andLouisiana (29%) saw double-digit increases.

|If you happen to have a lead foot, there will definitely be arate increase, but not to the same extent as some of the otherviolations. Offenders charged with exceeding the posted speed limitby 31 mph or more saw increases ranging from a high of 103% inIllinois to a low of just 9% in Missouri. The majority of increasesranged from 29% down to 11%.

|Why the disparity in rate increases? It depends on theinformation insurers can use to determine rates. “All states havevarying rules and regulations on what insurers are allowed to do ornot do with the rates in their states,” explains Laura Adams,senior insurance analyst for InsuranceQuotes.com. “Differentfactors will affect the rate.”

|For example, California’s Proposition 103 places severelimitations on what information can be used to determine autorates, basing them strictly on the insured’s driving record, thenumber of miles driven annually and the years of drivingexperience. Factors like credit scores, marital status, educationand income do not come into play at all.

||

Increases, the gift that keeps on giving

|An offending driver can expect to pay increased rates for thenext three to five years says Adams. “Each MVA has a limit on howlong the violation can stay on your record. Most are at about fiveyears. If you get a second violation within that period of time,the numbers could go even higher,” she adds.

|Drivers who have moving violations on their license are likelyto see a higher increase than if they file an actual claim. Adamssays this is because moving violations are an indicator of risk andsend a signal to the insurer that a driver may be a greater riskthan originally thought, and companies insure against thatincreased risk. Drivers who file a claim will usually see anincrease only if they are at fault. But insurers also knowthat when a driver files a claim, the chances increase that therewill be a second one within a given period of time.

|If you do end up with a moving violation on your record, thereis some good news. Adams says that most states allow you to go totraffic school or take a defensive driving course, which willremove the points from your license for a minor violation. Sheadvises that drivers go to a school in person or take a courseonline, which can cost as little as $25. “Once you complete thecourse, the points will be removed from your license and that’s thered flag to the insurer.” If you take action quickly enough, it’spossible that the points could be removed before the insurer iseven notified.

|Adams also advises drivers who see an increase on theirinsurance after a violation to consider looking at other insurers.“Every company has their own algorithm that they use. If you havean increase after a moving violation, that’s the time to shop foranother company, since each company factors it differently.”

|If you want to see how much a moving violation can affect yourinsurance rates, InsuranceQuotes.com has a calculation toolhere.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.