In Part One, we introduced you to the Monte Carlo analysis, atechnique by which an auto collision is evaluated multiple times using a mathematicalmodel. After outlining the basics, we explored an example involvingpath intrusion from a side street. In the final section of thistwo-part series, we apply the method to determine liability in ascenario involving a left turn with approaching traffic.

|Let's suppose an insurer's claims organization is investigatingthe following incident:

|Failure To Yield?

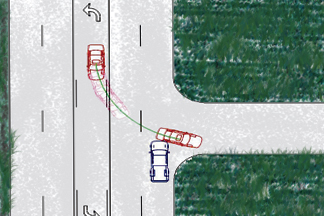

|The policyholder enters the southbound left turn lane and isstopped waiting until there is a safe gap in northbound trafficwhich would allow him to turn in front of opposing traffic and intothe parking lot. He's been stopped about 10 seconds and observesthe claimant approaching in the right lane. The insured feels thatthere is a safe gap and proceeds from a stop, turning acrosstraffic. The claimant states that he was approaching in the outsidelane between 40 and 45 miles per hour and never saw the insuredvehicle before striking it in the right quarter panel.

|The claimant thought the speed limit was 45 miles per hour;however, the police report stated that it was 35 miles per hour.The insured was cited for failure to yield the right of way whileturning left. The claimant adjuster demanded 100 percent of hisdamages. Your claims adjuster offered 80 percent, alleginginattention on the part of the claimant driver.

|

The Monte Carlo analysis shows that 36 percent ofdrivers traveling at or around 35 miles per hour would haveavoided this collision. Because the claimant was speeding,the probability of a collision increased by 6 percent. It alsoshows that the claimant's response time was slower than 99percent of all drivers. Had the claimant been traveling atthe speed limit, only 40 percent of the population wouldhave attempted a left turn. Because he was traveling 10mph faster than the normal flow of traffic, however, 62percent would have attempted a left turn.

|Because of the claimant's unlawful speed, the not only did thelikelihood of a collision increase, but also the probability that avehicle would attempt to turn. The simulation shows that asignificant portion of the population could have successfully copedwith this hazard. The claims adjuster now has tools that not onlysupport a 20-percent offset, but perhaps also something larger.

|While this isn't a substitute for an adjuster's judgment, itdoes represent a way to give that individual an objective andscientific means to examine a driver's actions. In order to make anargument about a driver's negligence, the insurer must know what,if anything, the policyholder did wrong.

|Until now, you were stuck with opinions and uncertainty. Thetruth is that Isaac Newton is often your best witness. He isimpartial, objective, and consistent. He also forces the argumentover liability into a forum that fairly compares the driver'sperformance to everyone else.

|Uncertainty is the largest obstacle facing the adjuster when itcomes to liability. How fast was the car reallytraveling? Did the car accelerate normally or rapidly from astop? Did that car even stop? It's easy to just raisethe white flag of surrender under the assumption that there willnever be enough information to figure this out. Monte Carlotakes care of that. Does it matter if we know exactly howfast the car was going? No, because that variable is modeledwith a range of values. We have the advantage of taking intoaccount almost every possible solution, mathematically. Amore complete and scientific understanding of the collision isavailable without collecting any more information than you wouldfind in a police report, satellite photo, statement or vehicledamage photo. If you have this minimal level of information,you have enough to get an answer.

|Traditionally reconstructions were reserved for high exposurelosses like fatalities. The hourly costs of a technicalanalysis made it cost prohibitive for anything less. But,times have changed. The technology has improved to a pointwhere these standard models can be adapted to an individual caseand provide a meaningful analysis very economically. Costs toreplace or fix vehicles are not declining. This, incombination with the increasing probability of disputes, makesnon-injury, physical damage claims a significant source ofpotential savings. An insurer wouldn't think twice aboutflat-rating a damage estimate in a subro demand from a competingcarrier. Now that an economical tool is available, why notgive liability disputes the same attention? Take a lookat how much money and time you're losing on unsuccessfulnegotiations, or arbitrations. A new approach may revealopportunities you never knew existed

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.