At a time when general property-casualty insurance is sufferingfrom poor economic conditions and a seemingly neverending softmarket, the program business niche is a “growing and vibrantmarket,” generating $17.5 billion in premiums with an estimated1,500 individual programs and 750 program administrators, accordingto “The State of Program Business 2011.”

|The baseline study, the first of what will be an annual surveyto track program trends, was conducted by Advisen and the TargetMarkets Program Administrators Assn. (TMPAA) and released atTMPAA's11th annual summit last week.

|The study of TMPAA members was conducted via an online surveyfrom July 14 to August 3. Respondents included 92 programadministrators and 34 insurers, roughly one-half of TMPAA's totalmembership.

|Among the key findings:

- Many administrators reported growth in their book and highretentions even in a declining marketplace.

- Program administrators are in sync when it comes to their viewof the components crucial to establishing a successfulprogram.

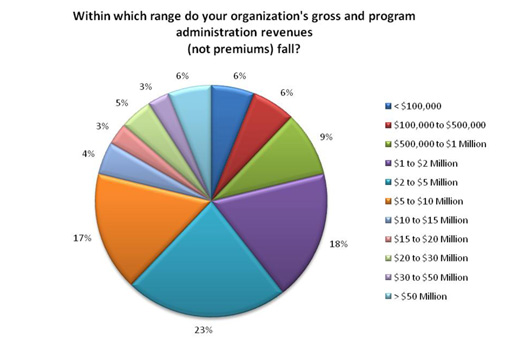

- The business includes many small companies with a few largerplayers. The average program administrator handles about threeprograms, has $20 million in written premiums and employs about16.

- Larger firms (administering more than $50 million in premiums)account for more than half of written premiums.

- Program administers report having relationships with 57carriers, with Lexington Chartis Programs, ACE, QBE InsuranceCorp., Amtrust Underwriters Inc. and Munich Re topping thelist.

- Although some insurers specializing in programs insure morethan 50 programs, most insure less than 20.

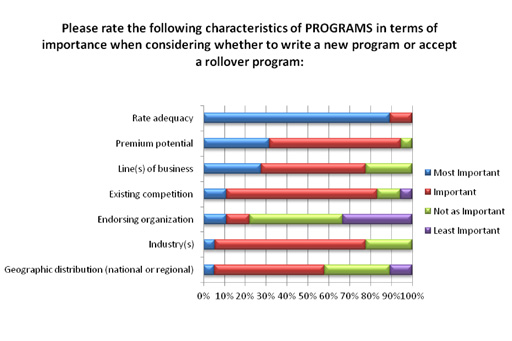

- Rate adequacy and premium potential top insurers' list whenconsidering whether or not to write a new program or accept arollover program.

- Delegation of binding and underwriting authority definesprogram administration: 100 percent of responding insurers delegatetheir underwriting functions, 61 percent delegate mostunderwriting, 22 percent say underwriting is fully delegated, and17 percent delegate some underwriting.

Click “next” to see charts on the findings.

|

The program administrator market seems to be thriving despitethe continuing challenges of the soft market. One survey respondentstated that “the PA underwriting/distribution model will continueto outpace the general insurance marketplace in terms ofprofitability and growth for the foreseeable future.”

||

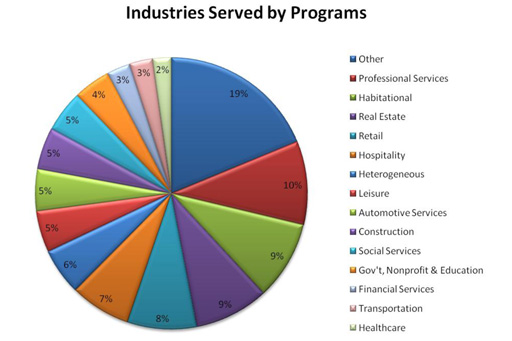

There is a large concentration of programs in professionalservices (10 percent), habitational (9 percent) and real estate (9percent). One-fifth of participants responded “others,” includingagriculture, aviation, emergency services, energy, fine arts, lifescience and recycling.

||

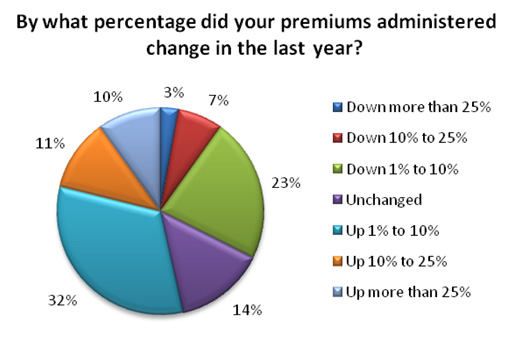

Asked to describe the change in premiums written in 2010, 53percent of program administrators saw increases, one-third sawdecreases in premiums while 14 percent reported no change.According to the study, “This may be indicative that programadninistrators are making the best out of the bad. The commercialproperty and casualty business has been facing a particularlydifficult and unpredictable environment.”

||

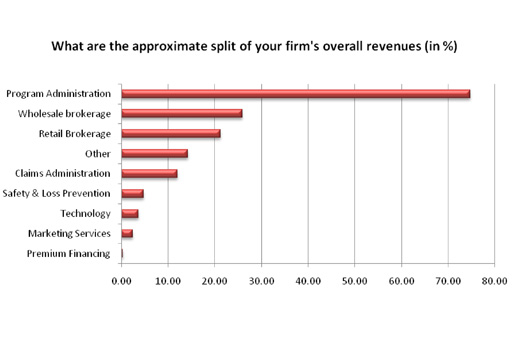

A very large percentage (75 percent) of the respondents'overall revenues come from program administration. Othersignificant portions include wholesale brokerage and retailbrokerage.

||

The TMPAA study asked carriers about what they look for whenconsidering a new program or accepting a rollove program. Onecarrier commented that his company looks for “a knowledgeable,subject matter expert PA who has competent staff that handle theirbusiness on a timely basis and work closely with the carrier toadjust filings and processes as needed to ensure profitability.Also, a PA that is 'future oriented' and tuned to growth.”

||

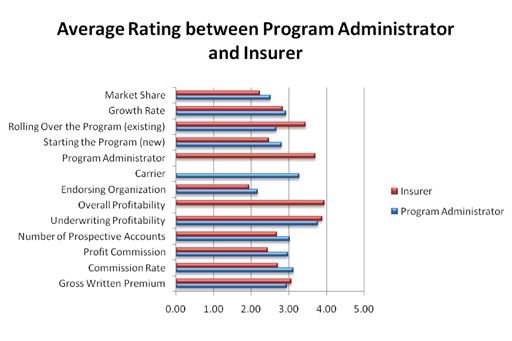

The long-term success of relationships between programadministrators and carriers depends in large part on agreement asto the criteria for successful programs. On a scale of 1 to 5, with5 as the highest possible rating, program administrators andinsurers are in sync when it comes to their view of the componentscrucial to establishing a successful program. Both groups putunderwriting profitability first, with other key factors includinggross written premium, commission rate and growth rate.

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.