This may be a very good decade to be a catastropheadjuster. At least, such men and women will apparently be fullyemployed. Claims ranging from the Deepwater Horizon oil spill in 2010 to the blizzards this pastwinter and the tornadoes in the spring—estimated at an insured lossof $2.5 billion—and the flooding in the Red River and LowerMississippi basin, from Missouri to Louisiana, loss, insured, andotherwise, will cause gray hair in the underwriting departments andfatter wallets in the independent claims industry.

This may be a very good decade to be a catastropheadjuster. At least, such men and women will apparently be fullyemployed. Claims ranging from the Deepwater Horizon oil spill in 2010 to the blizzards this pastwinter and the tornadoes in the spring—estimated at an insured lossof $2.5 billion—and the flooding in the Red River and LowerMississippi basin, from Missouri to Louisiana, loss, insured, andotherwise, will cause gray hair in the underwriting departments andfatter wallets in the independent claims industry.

Who would have dreamt the mess Mother Nature would inflict inthis year's annual tizzy? Drought in the West, tsunamis in California, wildfires inTexas, floods in the North and South, and powerful windstorms,accompanied by vicious hail, from Oklahoma to New York.

|What will be next? Some religious groups had predicted the endof the world by May 21, but those thoughts are being reconsidered.They cited all the catastrophic situations emphasized by globalmedia networks, where we first hear about disasters. Krakatoa'sexplosion and tsunami in 1883 was the first such major disaster togain worldwide attention due to the invention of the underwatertelegraph line. Before that, such an event would simply have beenconsidered some South Seas tall tale. So, what is coming?We have already experienced a very hot summer and are in the middle of an active hurricane season.

|It is not only national or local disasters that keep on coming;there are personal disasters. On one 91-degree day last May, my airconditioner stopped working. That blew two days of being able towork in my upstairs office. For me, it was a mini-disaster. InJanuary, my inner-ear problem returned, creating periodic dizzyspells. Like many natural catastrophes, the direct (but not alwaysindirect) costs of personal disasters can be insured.

|“But What Does This Mean?”

|This past spring, I taught a personal risk management course atEmory University, and my students brought a whole truckload ofquestions impacting both non-insurance risk management techniquesand the typical insurance policies they each obtained but had neverread. Teaching this stuff is simple, as it consists mostly of listsand formulas, but each word in the policy is crucial. When appliedto either personal or national disasters, each word, over theentire body of the insured public, has implications that caninvolve millions of dollars. For example, consider a policy that coversonly “direct” loss or damage. What exactly does that mean? How doesthe adjuster separate the direct from the indirect? That was thesubject of my article series earlier this year on business incomeinsurance.

|Policies do not always mean what they say. For example, my classdiscussed personal auto policies, and the phrases “actual cashvalue” (ACV) and “like kind and quality” used in terms of damage tovehicles, which led to lengthy discussions. If ACV means, as manycourts have stated, “the cost to repair, or to replace new lessphysical depreciation and obsolescence,” then why are total lossessettled on the basis of fair market value, often in accordance withcitations from the NADA Book? If (as I do) you have a 16-year-old Ford Contour with less than 50,000 miles on it, andthe typical car depreciates at a rate of 10,000 to 12,500 miles(10-12.5 percent) per year, then somewhere around 100,000 to125,000 or less miles the car is shot. At that point, it is a pieceof transportation and little else; probably something that willbreak down on a hot day in the middle of the freeway in rush hourand clog the road for a good 10 miles. However, taking thetraditional definition of ACV, my car with less than 50,000 miles,despite being 16 years old, should be worth somewhere around halfthe value of a new model comparable to a Ford Contour, perhaps lessa bit for obsolescence as it lacks power windows. Of course, there is always the issue of like kindand quality. I told the class about how I had once caught thefamous news broadcaster, the late Paul Harvey, in a conflict ofinterest. He had two sponsors one day for his radio show: Allstateand General Motors (GM) Genuine Parts. Allstate, I knew, was an active participant in the I-CARprogram, which had much to say about using after-market parts inbody repairs to save money, arguing that these parts, usuallyforeign-manufactured as opposed to used parts from a junk yard,were of “like kind and quality.” I am sure the folks at GM GenuineParts, however, would have strongly disagreed. Just what does “likekind and quality” mean? More than one court has had its say, and ina few, the conclusion was “diminished value,” now claimable inseveral states.

|Coverage is Key

|Regardless of the type of claim, be it property, casualty, life,health, or surety, no adjustment can proceed without a completeunderstanding of the applicable coverage issues and how thoseissues have been addressed by the courts or legislatures in theapplicable jurisdiction. That cannot be stressed enough. The policyis meant to be read in one particular way, but often the courts orthe legislature may change what that wording means. It thereforebehooves every claims adjuster, whether employed by an insurancecompany directly or working independently, to know both the policylanguage and the law.

|The class was told that there are four types of law that have amajor impact on insurance. The first, of course, is contract law,with the policy itself being the primary contract. Also keep inmind that other contracts, such as hold harmless agreements,indemnity clauses, and exculpatory notices affect claims. Adjustersmust seek out such contractual agreements and determine how theyimpact any particular claim. Undoubtedly millions of dollars areincorrectly paid annually by adjusters who failed to find acontractual agreement that would either limit the payment, providea basis for subrogation or contribution, or would have requiredpayment to someone else who was equally ignorant of thecontract.

|Then there is tort law—the law of negligence. The formula is simple: dutyowed, breach of duty, proximate cause, and defenses. Each of those,in turn, implies scores of variation. Is the duty owed one ofslight, ordinary or a high degree of care? To what extent did thebreach of duty cause the damages? Was the breach the sole cause ofdamage, or were there contributing, exonerating or mitigatingfactors? And what is the law in the jurisdiction about contributoryor comparative negligence? Is it pure comparative, where bothparties may owe each other, or modified, where the negligence ofone party is so much greater than the other that the claim isbarred? A few states still apply the old common law rule ofcontributory negligence, but such law is often weakly applied, orleft up to a jury to decide.

|There was once a case involving bad faith where the adjuster confused coverage with liability.The insured had only minimal limits of liability in a purecomparative negligence jurisdiction. The deceased claimant, who wasa young man with a family, was considered to have been at least 50percent at fault in the vehicular accident. The adjuster decidedthat if the claimant was 50 percent at fault, then he was entitledto only 50 percent of the coverage limits. One can imagine thejoyful expression on the face of the plaintiff's attorney as heexplained that mistake to the jury. Comparative negligence applies to the damages, not thecoverage; that fatality was worth many times the policy limits, sohalf of that value would still have been far in excess of theinsured's limits.

|Something New Every Day

|What other kinds of law affect claims and coverage? One isstatutory law. That is applicable to many kinds of claims, fromworkers' compensation to the subrogation rights of the governmentin Medicaid, Medicare, and Civilian Health and Medical Program ofthe Uniformed Services (CHAMPUS) claims. There are dog bitestatutes, innkeepers laws, and environmental protection statutes,all of which affect how a claim must be handled.

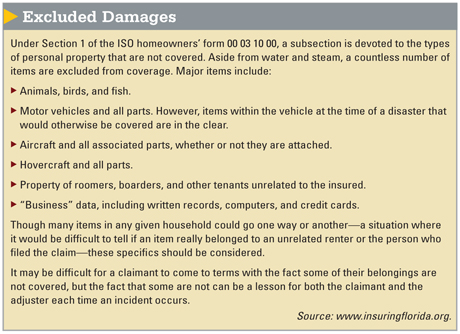

|Then there is the law of agency, or respondeatsuperior, which maintains that the master is responsible forthe act of the servant. It also means, for the adjuster, thatmisery loves company, so go out and find as many co-tortfeasors byagency as possible to contribute to a claim. That requires work:research, probing, and being a general nuisance, as insureds oftendo not fully reveal, or want to reveal, who else might be involvedin the situation. In a personal auto policy, the principal is “aninsured” under the coverage, but only to the limits of liability.In a major wreck with expensive injuries and damages, those limitscan be eroded quickly. It is amazing how often contributing sourcesare never located. Nothing in the field of claimsis static. Change is constant in statutes, contracts, courtdecisions, and especially coverage. The ISO is a business, and itsbusiness is making changes to policies to make them more accurate.I had told my class about a situation where an insured's water pipehad broken while he was out of town for the weekend. The waterspilled into his home the few days he was away, and he came home tofind his basement flooded. Then, a few weeks later, he received thewater bill—several thousand dollars for all that water. But wasn'tthe water his “personal property” under the homeowners form? Hecould not use the water—it was damaged by the leak, a coveredperil. So, wouldn't the water bill be part of the damages?

|The Final Step: Disposition of Damages

|Far too many adjusters complete this step first. Before theyhave investigated the claim, they may have provided the claimantwith a rental car or otherwise assumed that the insurance companywill take care of the charges. But does the coverage fully apply?Is the insured 100 percent liable for the damages? How does thatissue of ACV affect those damages? Are there statutes that mayimpact the claim? Next to careless documentation and unclearcommunication, disorganization of the steps of adjustment is thebiggest hazard facing an adjuster.

|A claim requires that investigation and evaluation of coveragecome first, followed by liability, and then the damages.Negotiations must take place, and a consensus of what is reallyowed should be applied. Put the cart before the horse, and amistake will occur.

|Public Enemy Number One

|People hear what they want to hear, and what is said can beeasily misunderstood. With all the smartphone communications goingon today on iPhones, BlackBerrys, and other gizmos, there may belittle permanent record of what was actually spoken, texted, ortweeted. The adjuster who fails to document all communication insome permanent format that is accessible by both parties (such asan old-fashioned letter where both parties have a copy) will be the“twit” in Twitter. Unclear communication will inevitably lead to theadjuster hearing those three most horrible words: “But you said…”

|So, with disasters coming fast and furious upon us, bothnational and personal, we must be prepared. As adjusters, we mustdo more than just show up. We have to, in the words of MichaelMescon, former Dean of the Georgia State University College ofBusiness, be dressed and ready to play. Just showing up at thescene of a catastrophe is insufficient. That is largely whathappened after Hurricane Katrina, and virtually everyone was upsetbecause neither the insureds nor some of the adjusters were fullyprepared and ready to play.

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.