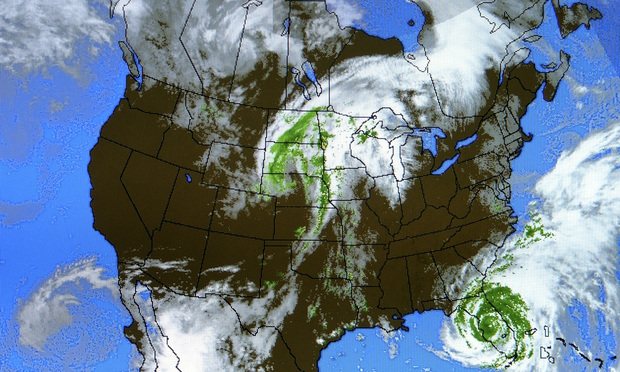

In the unfortunate event that a company or business suffers losses due to flooding, tornadoes, droughts, wildfires or hurricanes, insurance policyholders should review their policies in advance so they can be prepared to take full advantage of available coverage. (Carolina K. Smith/Adobe Stock)

In the unfortunate event that a company or business suffers losses due to flooding, tornadoes, droughts, wildfires or hurricanes, insurance policyholders should review their policies in advance so they can be prepared to take full advantage of available coverage. (Carolina K. Smith/Adobe Stock)

As commercial policyholders dry out from the havoc wreaked by this year's uncharacteristically cold winter in Texas, the relative "calm before the storm" that comes in the springtime provides an opportunity to assess insurance coverage for weather-related events. In connection with that assessment, this article provides a brief overview of both the coverages that may respond to extreme weather events, and insurance-related legal issues that may arise out of those events.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.