One role of an insurance professional is to think on behalf of commercial lines prospects and customers — and communicate with them about the risks their small businesses face now and going forward.

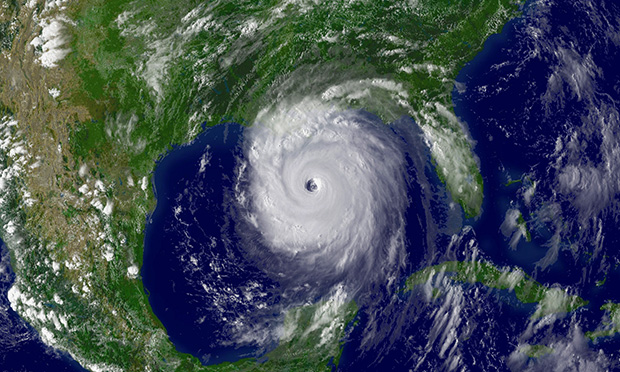

Independent agents must keep an eye up to see other risks that stand in front of customers, even amidst an unprecedented economic turndown due to the coronavirus pandemic. One, in particular, is flood risk, and it tends to be underinsured for businesses after liability, property, workers' compensation, and other risks.

Federal forecasters at NOAA (National Oceanic and Atmospheric Administration) recently released a 2020 spring forecast for flooding. It projects major to moderate flooding in 23 states, impacting 128 million people.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In