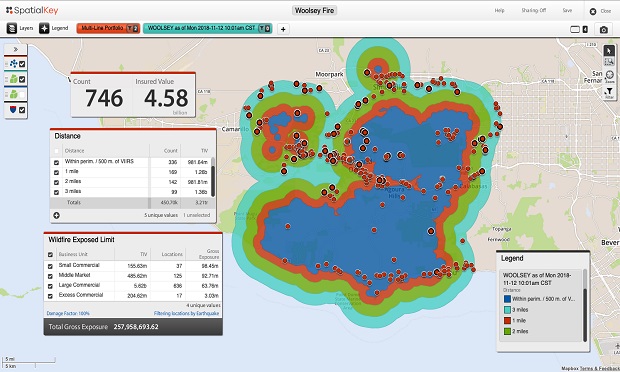

Shown above is NASA fire perimeter datafrom the Woolsey fire in California. This data has built-in buffersset at 1, 2 and 3 miles from the perimeter. Insurers can joinportfolios to understand which insureds are inside the perimeterand apply buffers and filters to understand TIV and/or policyexposed limits.

Shown above is NASA fire perimeter datafrom the Woolsey fire in California. This data has built-in buffersset at 1, 2 and 3 miles from the perimeter. Insurers can joinportfolios to understand which insureds are inside the perimeterand apply buffers and filters to understand TIV and/or policyexposed limits.

Wildfires, like tornadoes, can leave one property leveled andits neighbor unscathed — jumping houses, neighborhoods andboundaries with seemingly no rhyme or reason.

|Consider the devastation of 2018′s Camp Fire, whichconsumed everything in its path and leveled the town of Paradise.And that's distinct from what happened in Malibu with the Woolsey Fire, which hopped the PacificCoast highway.

|Now, and admittedly not soon enough, innovations in data andanalytics are helping carriers be more proactive with theirmitigation and event response operations.

|Firsthand account

Having lived in the San Francisco Bay Area, I've seen howutterly devastating wildfires can be to communities. California isrunning out of space, and people are being forced to live and workin wildland-urban interface (WUI) areas that weren't originallyplanned for development.

|There is a logical reason for why wildfire risk is intensifying,but seeing the devastation is sobering. I recall driving throughareas impacted by 2017′s Napa fire and witnessing total losses nextto areas that were completely untouched. This gave me perspectiveabout what it must have been like on the ground during thedevastation.

|Too many of my coworkers have faced similar experiences. Theyknow the fear of evacuation and the desperate hope that their homeis still be standing. That's why wildfire risk is a key focus forus at SpatialKey.

|It's a problem we're actively working to solve by collaboratingwith our partners to develop innovative, yet pragmatic, wildfiresolutions that can be quickly and easily deployed — all with theend goal of helping insurers go about their jobs of better servingand protecting insureds.

|Data and technology are helping insurers be more proactive

Understanding the potential path of a wildfire is crucial, asthey can spread incredibly fast. In fact, 2017′s NorthernCalifornia fires advanced at a rate of more than a football fieldevery three seconds.

|Wildfires move rapidly, but perimeter data has historically beengenerated slowly, especially with a lack of publicly available dataover weekends. It's no wonder insurers are often a step behind withtheir wildfire event response efforts, and frequently left in thedark during an event, not knowing which insureds have beenimpacted.

|Two years of devastating losses have caught some insurers bysurprise and established players have suffered. As such, what hastraditionally been viewed as a secondary risk has recently beenelevated to a primary risk worthy of focused attention andsolutions. Now, technology is helping to shape impactful solutions,like improved perimeter data and automated event alerts andanalytics.

|Up-to-date event perimeter data

Advancements in NASA's satellite imagery, for example, coupledwith geospatial technology, are providing insurers with up-to-dateevent perimeter data. Instead of guessing how a fire has grown andwhich insureds are impacted, carriers can get regular fire boundaryupdates in the context of their portfolios. But, while data showingburn area and active burn spots is publicly available from sourceslike NASA and GeoMac, it's not quick or easy for insurers toeffectively operationalize on their own in order to understand therelevant impact. By integrating GeoMac and NASA's Visible Infrared Imaging Radiometer Suite(VIIRS) data with SpatialKey's data enrichment andgeospatial analytics solution, insurers get faster perimeterupdates while understanding the impact to their portfolios. Withthe ability to contextualize the data, insurance professionals canvisualize exposure, apply buffers and filters, and understand TIVand/or policy exposed limits.

|With the severity of wildfire events likely to continue and"megafires" emerging as a trend, it's critical for insurers to beable to keep up with these events. Accurate and up-to-datewildfire perimeter data is one way insurers can implement a moreproactive approach.

|Automated event alerts and analysis

Up-to-date perimeter data is critical, but it's still a manualsolution that requires insurers to know that an event is happening(or has happened), and then retrieve information to understand therelevant impact. But what if the information could be proactivelydelivered to you instead? As one of our clients here at SpatialKeycommented, "We're dealing with time-sensitive situations, but themanual nature of exposure data collection, event monitoring, aswell as data research and procurement, delays our ability torespond to events expeditiously."

|Automated event alerts and analysis are changing that, and thistechnology will be a game-changer for wildfire event response byensuring carriers stay-in-the-know regarding events that haveimpacted or may impact their portfolios. Analyses areexecuted automatically based on an insurer's latest exposure data,as well as predetermined financial and peril-specific thresholds(meaning, anything hitting an insurer's inbox has been pre-screenedand is worthy of immediate attention).

|This isn't pie-in-the-sky innovation butpractical innovation that insurers are using right now.

|Moving from 'react and respond' to 'prepare and serve'

Using a combination of data and analytics solutions, insurers can more proactively monitor and mitigatewildfire risk — finally taking the guesswork out ofwhat's historically been a fast-moving and elusive risk. Insuranceorganizations are facing greater scrutiny as wildfire events becomeincreasingly volatile. As such, how effectively you prepare for andrespond to these events can either be an asset or a detriment toyour organization. The solutions discussed here can help you takesteps toward safeguarding your insureds while moving from "reactand respond" to a more proactive "prepare and serve" approach.

|Rebecca Morris ([email protected]) is director of productadoption at Spatialkey, the data enrichment and geospatialanalytics company for the P&C insurance industry.

|These opinions are the author's own.

|See also:

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.