The 2017 natural disaster season was the worst on record. Hurricanes Harvey, Irma and Maria cost an incredible $265 billion in combined destruction and affected vast swaths of Florida, Texas and the rest of the Gulf Coast. The particularly catastrophic year kickstarted conversations about reinsurance premiums and their ability to accurately reflect risk.

While reinsurance premiums have remained relatively flat, assuming the reinsurance market's future stability could in and of itself be catastrophic, there's no guarantee that prices will remain static.

Given that past pricing pressures have dictated premium rates for about a decade, it's time for insurance carriers to more effectively drive reinsurance negotiations using accurate data sets that can better reflect risk and lead to more favorable terms.

Here are three strategies carriers should consider to aid them in reinsurance negotiations.

Related: Swiss Re says adding anchor shareholder would be 'attractive'

Account for remodeling activity

While reinsurance and remodels seemingly have little in common, this market trend can directly impact a property's risk of loss. Many homeowners are investing in major updates, including new roofs, plumbing, electrical improvements and more — all of which have the benefit of mitigating carrier risk.

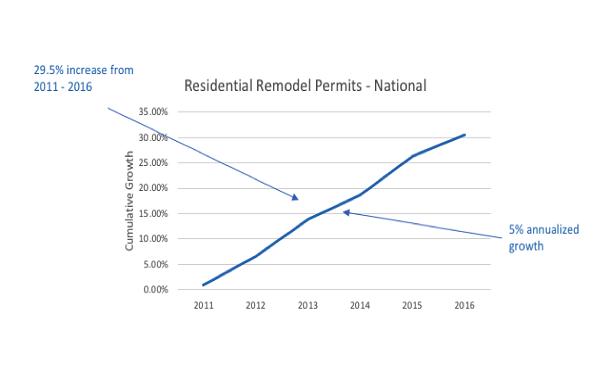

According to a recent report by BuildFax, home remodeling is at an all-time high and has increased by nearly 30% in the last six years. This seemingly unimportant housing trend has a major impact on reshaping the entire housing stock to better withstand storms.

In hurricane-prone areas like Florida, these improvements often include massive risk-reducing features like impact glass, cladding or other protections against high winds. By understanding trends and accounting for property improvements over time, carriers can more effectively assess risk and hedge overpaying for reinsurance.

Related: What to know about homeowners' insurance if property value spikes

Beware of default settings

In many cases, carriers who aren't privy to property changes across their book will default to “year built” as a proxy for property condition. However, this can lead to artificially high reinsurance premiums because it does not account for home improvements that reduce property risks.

For example, roof condition is highly predictive of loss; however, roof age is difficult to capture through traditional means like homeowner reporting. In the last 10 years, Florida experienced a 110.6% surge in new roof installations, representing an average annual increase of 8.9%, according to a new BuildFax study. That's a significant amount of properties with the untapped potential to reduce exposure — and reinsurance premium costs by extension — across portfolios.

Ignorance of roof updates and other major structural improvements represents a missed opportunity during reinsurance negotiations, potentially leading to inaccurate PML calculations. By leveraging roof data and other data sets to more accurately calculate year built, carriers can gain portfolio-wide insight into property conditions and be well-prepared for reinsurance negotiations.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.