How might commercial insurers avoid a race to the bottom onprice in an increasingly commoditized middle market?

|The answer may be the adoption of a new business model in whichcarriers go beyond offering standard insurance policies and relatedrisk-management services to become the hub in a comprehensivenetwork of business support solutions.

|To gain firsthand insights into how middle-market insurers coulddifferentiate themselves by bundling an array of non-traditionalservices, the Deloitte Center for Financial Services surveyed 800 buyers, spread evenly across fiveindustries and four business size categories. We also queried 100agents and brokers with a large chunk of their business generatedby this segment.

|Related: Post-acquisition insurance agency and brokeragecompliance

|Behind the numbers

We asked both buyers and intermediaries to look at theirinsurers in an entirely new light — as a source of servicesadjacent and even unrelated to insurance that could help policyholders protect their assets as wellas manage and grow their business.

|Nine out of 10 buyers surveyed said they would “welcome” thechance to receive broader business-support services through theirinsurance company, while 86 out of 100 intermediaries indicatedthey would appreciate the opportunity to add such features to theirsales repertoire.

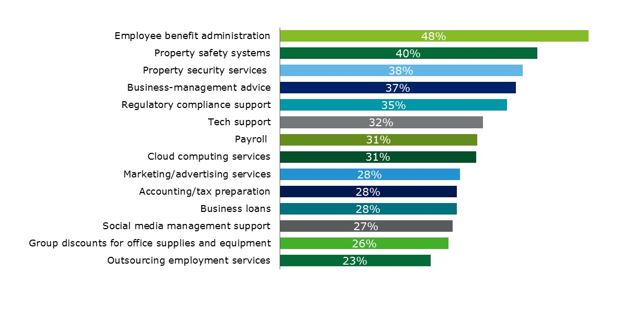

|While some possibilities seemed much more popular than othersamong buyers, at least one out of four surveyed expressed interestin each of the options provided (see figure 1).

Figure 1: Percentage of buyersinterested in receiving non-insurance business services viainsurers

Source: Deloitte Center for Financial Services, MiddleMarket Insurance Consumer Survey, 2017

|Employee benefit administration was the clearfavorite, chosen by nearly one-half of respondents. Property safetysystems and security services were the second and third choices,respectively. Business-management advice, regulatory compliancehelp, and tech support were also picked by about one in threerespondents.

|A host of other possibilities, ranging from group discounts foroffice supplies and equipment, to business loans, payroll, andcloud computing services drew considerable interest as well.

|Related: Survey finds insurers not fully realizing benefitsof analytics

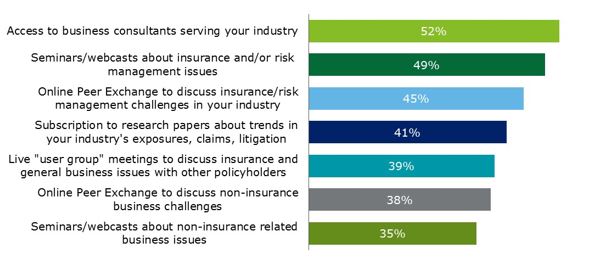

|In addition, when it came to being offered educational andbusiness networking opportunities through their insurers, at leastone out of three buyers expressed interest in each of the optionspresented.

|Access to consultants focused on their particular industry andseminars or webcasts about insurance and risk management issues ranked highest, checked off byabout half of those surveyed (see figure 2).

Figure 2: Percentage of buyersinterested in receiving educational/networking services viainsurers

Source: Deloitte Center for Financial Services, MiddleMarket Insurance Consumer Survey, 2017

|Next steps

What might it take for middle-market insurers to execute such aprofound business model transformation?

|To start, carriers need to get their distribution force solidlyon board. Agents and brokers will likely want to know exactly whatis expected of them and how they will be remunerated.

|Beyond the potential for more revenue, however, insurers shouldmake the case that they are looking not just to bolster their ownvalue, market share, retention rates, and bottom line with theseadditional offerings, but to strengthen a customer's connection totheir intermediaries as well.

|Related: Digital transformation: 8 best practices forinsurers

|The goal should be for middle-market agents and brokers tobecome broader business consultants, providing clients withcustomized, concierge services.

|To make this work, insurers will also need to build relationships withnon-insurance service providers. Indeed, the ability to createand maintain a comprehensive (and preferably exclusive) servicesnetwork would be a critical differentiator for insurers followingthis path.

|Carriers that don't feel comfortable creating a hub of their owncould decide to join another facilitator's network of providers,becoming the insurance spoke in someone else's services wheel.

|Market pulse

The options laid out in this Deloitte research report are in line with abroader movement across industries toward bundling a wide varietyof customized products and services and creating a diverseecosystem under one central facilitator.

|For example, many cable television companies aiming todiscourage customers from casually switching carriers orcord-cutting are now offering telephone, Wi-Fi, cloud storage, homesecurity, and cellular phone services as a package.

|Related: CRM challenges in insurance — agents vs.carriers

|Indeed, such brand extensions into associated and even unrelatedproducts and services are a fairly routine growth strategy for mostindustries, yet the vast majority of insurers have yet to explorethat business model in depth.

|Given the emerging competitive realities of the middle market,as well as how more consumers are gravitating toward greaterconvenience and one-stop shopping in other aspects of theirbusiness and personal lives, now may be the time to give bundling ashot before someone beats them to the punch.

|To learn more about the challenges facing insurers inrealizing such a transformation and how they might overcome them,please download “Building new ecosystems in middle-market insurance.”

|Sam J. Friedman is insurance research leader withDeloitte's Center for Financial Services in New York. For manyyears, he was the Editor in Chief of National Underwriter's P&Cedition. He can be reached by sending email to [email protected], or follow Sam on Twitter at@SamOnInsurance.

|The opinions expressed here are his own.

|See also:

||Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.