(Bloomberg) -- Travelers Cos. wasburned again by Mother Nature.

|Alan Schnitzer has been contending with volatile weather sincebecoming chief executive officer in late 2015, extending a trend ofrecent years in which storm seasons last longer than usual andstrike regions that previously weren’t considered vulnerable.

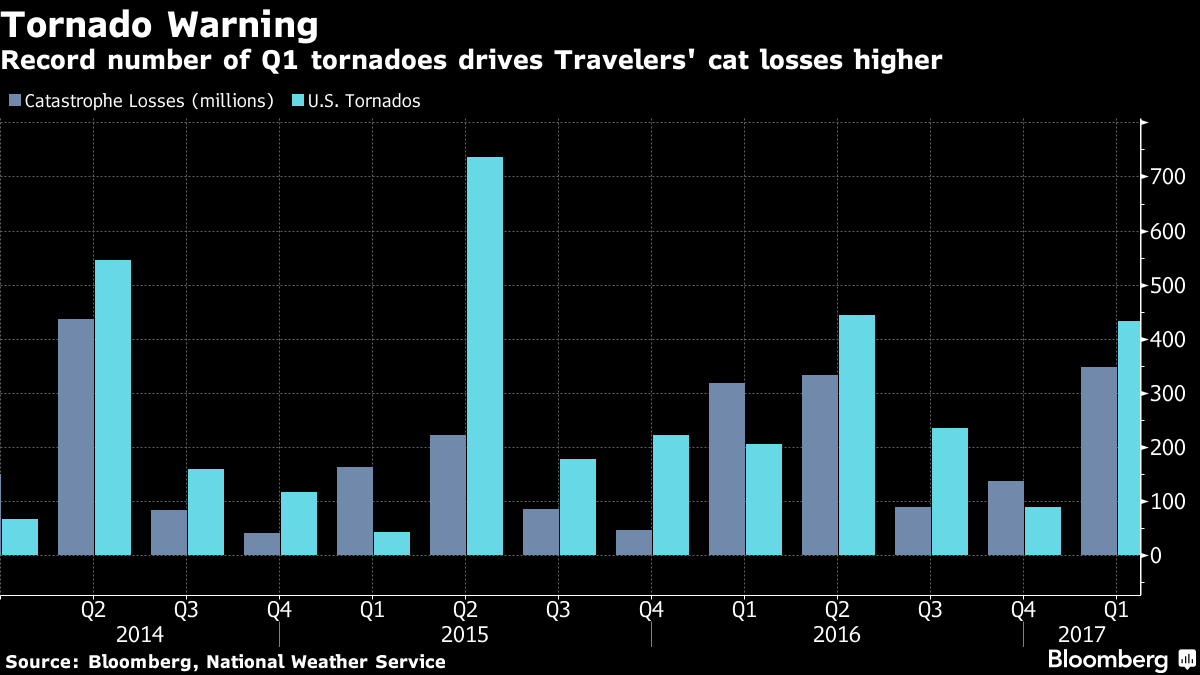

|There were more than 400 tornadoes in the first quarter inthe U.S., quadruple the three-year average, according to National Weather Service data.

|The causes for the rising costs are in dispute. Some blameclimate change. Increased development along coastlines or near forestshave added to risks from hurricanes and wildfires. Whateverthe reason, the industry is seeking to raises prices as companiesfrom American International Group Inc. to XL Group Ltd. encounterunusually high costs.

|“During the past decade, the U.S. has experienced significantshifts in the frequency, severity and location of naturaldisasters,” Mike Consedine, CEO of the National Association ofInsurance Commissioners, said in a statement last month.

|Travelers, the lone property-casualty insurer in the Dow JonesIndustrial Average, slipped $2 to $118.40 in early trading at 7:57a.m. in New York. The company dropped about 1.7 percent from Dec.31 through Wednesday, after posting annual gains every year sincethe end of 2008.

|Tornadoes, hail

Net income for the first quarter dropped to $617 million, or $2.17a share, from $691 million, or $2.30, a year earlier, NewYork-based Travelers said Thursday in a statement. It was the fifthyear-over-year decline in six quarters. Operating profit was $2.16a share, missing the $2.35 estimate of 20 analysts surveyed byBloomberg.

Results reflect the “unusually high first-quarter catastrophelosses that arose from a record number of tornado and hail events,” Schnitzer said in the statement.Pretax catastrophe costs jumped to $347 million from $318 million ayear earlier.

|Allstate Corp., the largest publicly traded U.S. home and autoinsurer, said separately Thursday that catastrophes cost thecompany more than half a billion dollars in March alone. TheNorthbrook, Illinois-based company is scheduled to report completefirst-quarter results on May 2.

|Related: New tool evaluates climate risk forinsurers

|Travelers in recent months said it would raise rates for carinsurance to offset losses from higher frequency of accidentclaims, a move that’s helped Allstate and Progressive Corp. improveprofitability. Travelers’ policy sales rose 5.3 percent to $6.5billion.

|The insurer charged domestic business customers 2.8 percent moreat renewal during the quarter, according to a presentation. Thatcompares with a 2.3 percent increase in the fourth quarter.

|Private equity

The gain from reserves was $81 million, narrowing from $180 milliona year earlier. Insurers regularly reassess the money they’ve setaside for future claims and can scale back or raise the amountbased on their expectation of losses.

Investment income rose to $610 million, from $544 million ongains from private-equity holdings. Insurers hold premiums beforepaying claims, allowing them to build huge portfolios dominated bybonds. Companies have been diversifying, however, for moreattractive returns in an era when fixed-income yields are nearhistoric lows.

|

Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.