“If it keeps on rainin' levee's goin' to break. When thelevee breaks I'll have no place to stay.”

|So go the lyrics in the blues classic, “When the Levee Breaks”about the Great Mississippi Flood of 1927. Later popularized by LedZeppelin, the song has unfortunately become relevant again withdevastating floods striking the region in 2016.

|In a span of eight days, more than 7 trillion gallons of water (more than threetimes as much as Hurricane Katrina) dumped on Louisiana andMississippi, damaging 40,000 homes and costing local agriculture$110 million at last count. New estimates of catastrophic lossescontinue to rise.

|Water can be a powerful destructive force, however more oftenthan not, water-related damage is caused by human error fromcorroded plumbing, frozen pipes or faulty machinery than bycataclysmic rainstorms. One of our adjusters once discovered anentire closet of contents, dresses, shoes and belts frozen in asingle block of ice.

|Adjusting water damage claims poses some risks, so here are fiveways adjusters can effectively manage them after major floodingevents like Hurricane Matthew:

|Related: After Hurricane Matthew: Here are 6 tips on how toget ready for the next one

|

Adjusters and policyholders should take special care toprotect themselves when walking through a flood-damagedenvironment. Sharp objects, live electrical wires and displacedreptiles present specific risks. (Photo: iStock)

|1. Safety is job number one

Water-damaged sites are a messy affair, often involvingcontaminants, rodents and other potential hazards. As such, it'simperative to first establish the safety of the policyholder todetermine if there is an emergency situation.

|Safety must apply to the adjuster as well. In most water-damagecases, protective clothing such as a facemask and eye protectionare necessary. Depending on the situation and potential exposure totoxins, adjusters may have to wear a half- or full-face mask withprotective filters. Depending on the water involved and the scale,gloves, boots and possibly a Tyvek suit may be required.

|Related: 5 things to do to keep employees safe whilecleaning up after a hurricane

|

A water loss can range from a Category 1 (water from a cleansource like a faucet) to a Category 3 (grossly unsanitary likeflooding from rivers or streams) according to the Institute ofInspection Cleaning and Restoration Certification. (Photo:iStock)

|2. Initial evaluation

On arrival, two pieces of information can help adjustersestablish the scale of the damage — the source of the water,whether it's from a flooded river, sewer backup or broken pipe, andthe height to which the water rose.

|When inspecting items to salvage, keep in mind the item'sporosity or ability to absorb moisture. Bookcases and otherfurniture made of porous pressed wood are usually not salvageable,while non-porous objects like glassware and ceramics are morelikely candidates for recovery.

|Non-porous items like children's plastic toys should bediscarded as they could harbor contaminants. It is better to besafe than sorry.

| Interviewing the policyholders and asking specificquestions about lost and damaged items can help expedite the claimshandling. (Photo: iStock)

Interviewing the policyholders and asking specificquestions about lost and damaged items can help expedite the claimshandling. (Photo: iStock)

3. Walkthrough with thepolicyholder

A room-by-room inspection with the policyholder can yield atremendous amount of useful information. Claims pros and claimantscan collaborate on inventory, collecting individual items' ages,prices and where they were purchased. High-value items that areless commonly found such as Oriental rugs and original artwork, mayrequire pulling in outside experts.

|Document the item's identity or provenance, brand name, modelnumbers, composition materials, purchase price and where it waspurchased. Size and construction material is essential for valuingfurniture. Material also makes a big difference in the valuation ofclothing.

|Homeowners will sometimes start cleaning up before adjustersarrive and throw out damaged items before they've been properlyrecorded. Inquire if this is the case and if any items might havebeen missed.

|The walkthrough allows the adjuster to review the recoverytimeline with the insured. An estimate of how long the process willtake and phone numbers to call with questions can be included inthis review.

|Related: Using a home inventory to document an insuranceloss

|

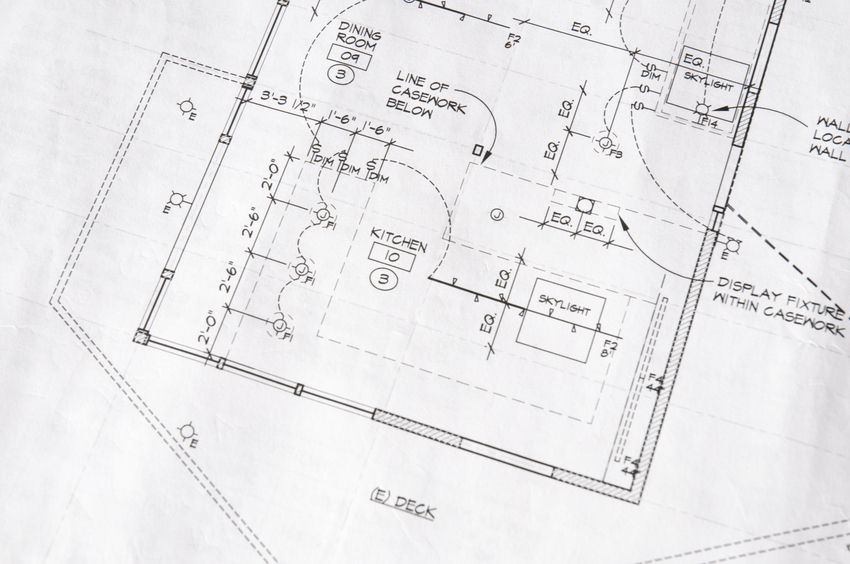

Photographs and diagrams of the damaged areas make it easierto document the damage and identify unaffected areas. (Photo:iStock)

|4. Diagramming, photographing anddocumenting

Drawing a diagram of the site is an excellent way of documentingthe damage. Using the names of rooms as provided by thepolicyholder (for example, using “Mike's room” instead of “Bedroom#1”) make them more identifiable and, likewise, make it easier toidentify the contents contained in each.

|Photographing the contents of a room is one of the mostimportant steps in assessing water damage. “Freeze the loss” bytaking plenty of pictures. Water-damaged items can be fragile andshould be handled with care. Many claims pros working atwater-damaged sites like to use voice recorders for logginginventory; that way, they can avoid using paper that may becomedamp.

|Related: 6 tips for flood survivors on avoiding fraud andother scams

| Lossclaims can frequently be segmented into specific groups so similaritems can be assessed more quickly. (Photo: iStock)

Lossclaims can frequently be segmented into specific groups so similaritems can be assessed more quickly. (Photo: iStock)

5. Organizing the inventory

Items can be organized into groups of higher and lower valuessuch as clothing, kitchen utensils, books, CDs, etc. Furniture, appliances and electronics are typically itemizedseparately, and lower value items like toiletries, office supplies,cleaning supplies, holiday decorations and food can be groupedtogether. Sorting items in this manner makes it easier to discussvalue estimates with the policyholder.

|The catastrophic flooding in Louisiana and Mississippiunderscores the fact that water damage is not a rare claim. Safelyrecording and assessing the damage at these sites is a necessaryskill for all claim adjusters.

|Scott Petlewski is training director for Needham,Massachusetts-based Enservio's Service on Site catastropheteam.

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.