Competitive pricing continues to characterize much of the Excess& Surplus (E&S) Lines marketplace, but many professionalswithin this market see a key distinction from soft market cycles ofthe past.

|“The E&S property & casualty market remains veryrobust,” says Tim Turner, chairman and CEO ofChicago-based RT Specialty LLC, pointing out that the market has notsignificantly contracted the way it typically would when rates dropand standard carrier appetite increases.

|Others question whether this market can even be judged by thetraditional definitions of “soft” and “hard,” noting that themyriad risks in today's E&S marketplace — and how the insuranceindustry underwrites them — has created more nuance in pricingtrends. “You have to think of the market in terms of micro segmentstoday, because it doesn't move in one monolithic directionanymore,” notes Matthew Power, executive vice president and head ofstrategic development for Boston-based LexingtonInsurance Co., which is owned by American International GroupInc.

|Whether it's a traditional soft market or a more segmented one,experts agree the E&S marketplace is not contracting, and theypoint to a number of potential reasons why: better non-admittedforms and products than in the past; high demand for thespecialized expertise E&S carriers and their wholesaledistribution partners provide, especially as the economy evolvesand new industries emerge; increased caution among standardcarriers on riskier, longer-tail lines; and a broader evolution inP&C where the lines between the standard and E&S marketsare beginning to blur.

|On that last point, Mark Smith, chief underwriting officer forChevy Chase, Maryland-based underwriting manager Victor O. Schinnerer& Co. Inc., says, “If you look at where we were in themid-1990s — you had the standard market, you had the E&Smarket, and you had the Lloyd's market, which is obviously part ofthe E&S market. They were really distinct.

|“But now, through mergers & acquisitions activity, most ofthe really big companies have an E&S arm, and they also havetheir own syndicate in Lloyd's,” he notes. “So at this point, theE&S market is kind of blurred from the standard market.”

|As a result, Smith notes that clients may be more at ease todaybuying coverage through the nonadmitted market from brand namesthey recognize, especially in lines such as Cyber Liability,catastrophe-exposed Property or Professional lines.

|“I almost don't define the E&S market and traditional marketas two different marketplaces,” says Mike Andler, head of U.S.Property Risk for Lockton. He adds that if you consider thehistorical risks in the E&S space, “I would say there's a lotmore blending now. Carriers in the E&S space and thetraditional — let's call it 'admitted' — market, they're playingtogether on a lot of risks.”

|Related: John Nelson on how Brexit will impact Lloyd's ofLondon [video]

|David M. Gross, managing director/casualty broker at Burns &Wilcox Brokerage, also says the products in the non-admitted marketare better now, rivaling standard market products, and policywording is more in line with wording in standard market ISOpolicies.

|Last year, experts who spoke to National Underwriter Property &Casualty about the E&S marketplace emphasized theneed for specialization to survive and thrive in today's landscape.This year, professionals point to that demand for specializationand expertise as a major reason why the E&S marketplacecontinues to grow.

|For Power, a significant driver of this demand comes from therapid speed of change in the economy overall. “The world around usis changing at a pretty unprecedented pace,” he says. “As newbusiness models and new technologies evolve, new associatedliabilities emerge in tandem.”

|He points to the rapid growth in emerging industries likerobotics, genomics, micro materials and others, and he says theE&S industry, with its freedom of rate and form, is uniquelypositioned to meet new marketplace demands. “There was a time whenthe E&S industry was viewed solely as a market of last resort —a safety valve for the greater P&C industry,” says Power. Itstill serves in that capacity, he adds, but it is also a place“where creativity and innovation take place at a much more advancedlevel than in the admitted markets.”

|Related: Leading writers in 11 key P&Cmarkets

||Excess capital drives the need for specialization in theE&S market (Photo: Shutterstock).

|Impacts on distribution

The demand for specialization drives a thriving wholesaledistribution system as well. “There's a lot more product that goesthrough wholesale-only channels now today than there ever was,”Turner observes.

|Turner and James Drinkwater, president of the brokerage divisionat Charlotte, North Carolina-based AmWINS Group, bothpoint out this is in stark contrast to the soft market of the1990s, and Drinkwater says wholesale brokers today have done “aphenomenal job” providing in-demand expertise to retailclients.

|For carriers distributing through wholesalers, says Turner,“It's to their advantage. It's less expensive for them. They knowwhat the advantage is now.” He adds, “New capital is very muchgravitating toward E&S distribution because it's cheaper to doso.”

|Building out the necessary expertise in-house can be expensive,Turner explains, especially given the limited amount of availablespecialty talent. “But there's a huge demand for it because it'sless expensive to distribute and broker through those channels inspecialty. So it's a great time to be a technical specialist in theE&S marketplace — as a retailer, as a wholesaler, as a[managing general underwriter], as an underwriter.”

|A final reason cited for the healthy size of the E&Smarketplace in this competitive environment is an apparent changein the appetite of standard carriers. “I think [standard carriershave] reached a point in this market where they're being much morecautious,” says Smith.

|“Our discussions with them on new-program development andcurrent programs have been more cautious than they have been in thepast,” he continues. “We're still talking about growth andexpansion, but you can see an increase in their attention todiscipline and rate maybe more this year than in the last couple ofyears.”

|Pricing and rate environment

According to Drinkwater, standard carriers are very aggressiveon the property side (which has seen relatively benign lossactivity in recent years) and in Product Liability and somecasualty business.

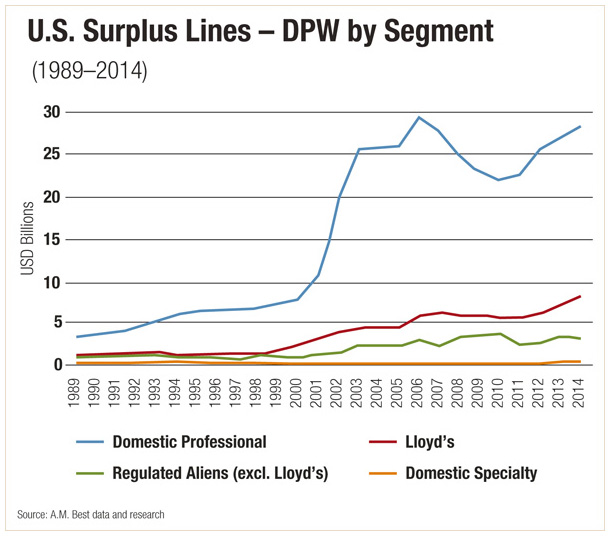

|As Gross describes it, standard carriers are competing forbusiness but not as much in pure E&S lines. “Over the last 20to 25 years, the E&S marketplace has increased dramatically,”he says. “I think standards have figured out what they can writeand what they can write well, and then you have the E&S playersthat do well” in their lanes.

|Both Gross and Turner note that standard carriers have beenburned in previous soft markets when venturing into longer-tailE&S lines, which may be influencing their decision-making thistime around.

|Derek Broaddus, senior vice president of the excess casualtydivision at Switzerland-based Allied World, agrees thatcompetition from standard carriers has not been as pronouncedcompared to previous cycles — noting there are plenty of E&Scarriers competing against each other.

|Related: Cyber insurance's increased profile leads to moreofferings and more buyers

|While pricing is soft in spots, Broaddus says there's anotherelement at play that does not get talked about as much: “There'sduress under this market,” he says, adding that some renewals (andeven non-renewals) look like what would be seen in an increasedrate environment.

|“This isn't a cycle that would be a prototypical soft-marketcycle. It's not across-the-board downward pricing,” says Broaddus.“The traditional idea that we're in a 'soft' market, which is theentrance of standards, the reduction of pricing, with an abundanceof capital — is not what's happening right now.”

|Power points to another reason why pricing no longer seems tomove in one uniform direction: “The size of the industry has grownto a point of complexity,” he says, “and that drives some of thethinking.”

|He also points to underwriters' ability to drill down intospecific lines of business, stating that data and advanced modeling“play key roles and allow us to get to a point where we understandmicro-changes within books of business and react to them in realtime.”

|Related: NAPSLO Q&A: Executive Director BradyKelley

||While competitive, the E&S market is onlyexpanding.

|Broaddus says the difficult part when it comes to defining thismarket is that both realities — the soft pricing on some risks andthe harder pricing on others — can be the case on the same day forthe same broker.

|The harder pricing is perhaps more consistent in certain lines —such as trucking, New York City contracting, some tougherhabitational risks and some auto fleet business, Broaddus says. Butin other cases pricing may vary by region or risk by risk. And thepatterns are not always predictable. Sometimes, Broaddus notes,harder pricing is seen in expected classes, but other times thereare deals that brokers feel are adequately structured, but stillbecome surprises.

|Future of E&S

While still competitive in many respects, experts are mostlyoptimistic about the opportunities in the E&S market. “I'm verybullish on the market,” says Drinkwater. “We've seen positiveresults each and every month of this year, and there's plenty ofopportunity and growth in many lines.” He believes the E&Sspace will likely continue to evolve and attract increased capacityand better talent.

|Most experts cite Cyber Liability as a key area of growth, evenas the market becomes crowded with both E&S and standardplayers. Turner notes that Cyber is still an E&S play for themore challenging risks, and when it comes to handcrafting solutionsto emerging risks. The standard market, by contrast, is writingsome of the more basic Cyber coverages.

|Andler likes the opportunities in Property, even with a numberof players and the continued presence of alternative capital there.He says pricing is competitive and it is “definitely a buyer'smarket,” but adds that combined ratios are still healthy and anytype of significant catastrophe loss activity will put pressure onrates.

|Gross says traditional E&S lines, such as construction(particularly in the South and in New York City), restaurants,taverns, nightclubs, habitational risks, etc. — are allgrowing.

|“Many say the market is as competitive as they've ever seen it,”observes Brady Kelley, executive director of the National Association ofProfessional Surplus Lines Offices. Nonetheless, he adds, themarket is not shrinking. “Despite what I hear about rate declines,I hear a lot of optimism about opportunities that exist for ourmarket,” such as the continued economic recovery and emerging risksin need of solutions that the E&S marketplace is ideally suitedto provide.

|Adds Power, “I think the E&S industry is hands down the mostexciting sector within the P&C business.”

|Related: Seeing marijuana through the haze andmyths

|Save

|Save

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.