While the story for commercial lines in general continues toinclude overall softening conditions as excess capital and capacitydrive competition, Commercial Auto/Trucking is heading in theopposite direction, with some companies exiting parts of the marketand rates generally on the rise.

|The need for harder market conditions in Commercial Auto —particularly within certain segments — has been recognized for afew years, even if the timing was in doubt.

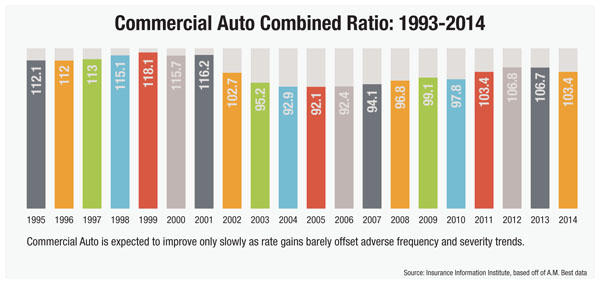

|In 2014, during a conference call to discuss Q1 results thatyear, W. Robert Berkley, then-COO and current CEO and president ofW.R. Berkley Corp., called the Commercial Transportation segment “agreat puzzle” and noted the line had long seemed ripe for ahardening that hadn't come. That same year, Fitch Ratings notedprice deterioration prior to 2011, combined with an erosion ofunderwriting standards, had led to underwriting losses andunfavorable reserve development. A recent Insurance InformationInstitute (I.I.I.) chart illustrates that the combined ratio forCommercial Auto crossed the 100 mark in 2011, and remained therethrough 2014 after eight straight years of combined ratios lowerthan 100.

|Experts recognize that the current hardening was a long time incoming. Nationwide's Paul Farrell, senior consultant, BusinessAuto, says rates had been “too squishy for too long. There's beensuch competitiveness that it's got to have a little bit of arebound.”

|“That line got pretty severely underpriced about five to eightyears ago, and they're just catching up to it,” says James Lynch,director, Information Services and chief actuary for I.I.I. “Theyfigured it out about two or three years ago as claims startedrolling in from those older years, and they've been responding as aresult.”

|Mark Plousis, vice president of Underwriting for PhiladelphiaInsurance Cos., says his company recognized the trends about 36months ago and began adjusting — weeding out poor performers,filing for rate increases where necessary, implementingloss-control measures and taking a state-by-state approach tounderwriting the line.

|“Our book is better now because of what we've done,” he says.“Unfortunately,” he adds, “the losses coming in now are probablyfrom accounts that have been off the books, but we feel that ourin-force book is in a better position than it was previouslybecause we did recognize the trends and implemented actionplans.”

|The claims picture darkens

Competitive pricing alone did not cause the shift to a hardermarket: Experts largely point to increasing claim severity as well,driven by a variety of factors. “Loss costs have risen verydramatically with Auto,” says Plousis. “The inflationary issuesthat come along with claim payments and claims expenses andlitigation have risen drastically.”

|For claim expenses, medical costs are certainly a significantcontributor, but plenty of insurance lines are subject to medicalcost inflation. What makes Commercial Auto unique?

|For one thing, the persistence of the injuries tends to be alittle longer, says Farrell. On average, claim duration is longerfrom a car or truck crash, with more lost days than on an averageWorkers' Comp claim, for example.

|Experts point to other factors increasing the severity and evenfrequency of claim incidents (Willis Towers Watson's Spring 2016“Marketplace Realities” report cites both higher frequencyand severity), such as increased activity on the roads,distracted driving and the nation's aging infrastructure.

|Apart from liability, the cost of vehicle repairs also hasrisen. Farrell says more vehicles than ever before are beingtotaled as designs are altered to meet fuel and weightstandards.

|Related: Understanding endorsements and insurance fortruckers

Litigation issues

In terms of litigation trends, Craig Dancer, Transportationpractice leader for Marsh, points out some factors that separatetrucking from many insurance lines. “We've found that plaintiffs'bars are very active,” he says. “They've created sort of a cottageindustry in going after truckers.”

|In claims involving a for-hire motor carrier and, say, apassenger vehicle, Dancer says it's not too difficult for aplaintiff's attorney to build a case against the for-hire carrier.Attorneys have access to all sorts of data on commercial fleets —such as information available from the Federal Motor Carrier SafetyAdministration — that they can use to see how an individual carrierranks against peer groups. “It becomes quite easy for a plaintiff'sattorney to say, 'Look, this guy wasn't following safety protocolscorrectly,' or, 'He wasn't fit to drive.'”

|Plousis says state laws also complicate the Commercial Autolandscape, noting that in no-fault states such as New York,Pennsylvania, New Jersey and Florida, a Commercial Auto insurer hasto pay medical bills along with potential bodily injury claims, “soyou're getting double-hit in those states. There are times in somestates where it's like dancing in a minefield. No matter what youdo, it's a difficult task.”

|Farrell likewise talks about “bizarre jurisdictional scenarios”in some states that complicate Commercial Auto liability claims.With joint and several liability rules in some states, he notes,another party in a claim could have been drunk and caused a crashby running a stop sign, but if the insured commercial driver wasgoing five miles per hour over the speed limit and is found 1%negligent, that insured could end up paying the entire claim.

|It all adds up to a market that has become more difficult forinsurers, and has become a universal issue. “I read a lot ofcompetitors' reports — annual reports and quarterly reports — andthey're all taking about the same drastic increase in severity forauto-related claims,” Plousis says.

|Lynch notes that major carriers' financial hits in this lineover the past two years have progressed to the point at which theyhave specifically referenced Commercial Auto in earnings reportsand conference calls. AIG, for example, mentioned higher CommercialAuto losses as one reason for its higher 2015 Q3 accident year lossratio. That same quarter, Zurich Insurance Group pointed to U.S.Auto liability as a reason for weaker-than-expected profitabilityin its General Insurance business.

|Willis Towers Watson says notable insurers have been restrictingtheir appetite for Commercial Auto liability and looking fordouble-digit rate increases for risks with poor lossexperience.

|Plousis says he's seen some competitors leaving the marketentirely. “There have been people entering,” he notes, “but not atthe rate people have been exiting.”

|Rebecca Roberts, managing director for Burns & Wilcox'sIndianapolis location, also says she is seeing standard carrierspull back a bit in the past few years, creating opportunities inthe Excess & Surplus lines space. “When I speak to that, Irefer to heavier classes of vehicles,” she notes. “Standard[carriers] have a lot better luck with lighter trucks.”

|The issue for some insureds then becomes whether they can affordthe deep expertise delivered by the E&S market. If theirpremiums go up too sharply, it is tough for them to stay inbusiness, says Roberts, “and I'm shocked at how many conversationslike that we've had in the last year.”

|Timothy H. Delaney, senior vice president, PassengerTransportation at Lancer Insurance Co., says the market is perhapsa bit more nuanced these days. Of carrier appetite, he says: “Thereis plenty of competition, but generally at higher rates thaninsureds were paying five to six years ago.”

|Related: Risk managers rank their top-ratedcarriers

Managing rates for clients

The tougher landscape complicates what is already a challengingline. “Commercial Auto” covers a wide range of vehicles and uses,and each segment comes with its own risks and carrier appetite.

|“Auto is especially tricky because the exposure range is sogreat,” says Farrell. “There's a certain finesse in underwritingrequired, and it ranges.”

|At one end, he explains, there is trucking, with fleets of 50tractor trailers operating out of multiple terminals across statelines and complying with federal regulations. At the other end,there could be a (non-owned) fleet of three pizza delivery vehiclesfor which the insurer intends to be the excess writer, with theindividual pizza delivery personnel carrying their own insurance.Yet sometimes the insurer can end up as the primary because itnever asked if the drivers have insurance, or if there is abusiness exclusion on the personal policy.

|Experts point to increasing rates in nearly all Commercial Autosegments — but Marsh's Dancer says trucking is seeing particularlysevere tightening in the current market, with long over-the-roadtour operators experiencing similar conditions. He says sometrucking companies are looking into alternative risk transfermethods, such as forming group captives, as they see their premiumsrise.

|Dancer says Marsh emphasizes safety and claim management for thecaptives it manages, but he says the members themselves play alarge role in enforcing that mindset. They scrutinize each other'sloss experience and try to identify any negative trends. “They'relooking at it month-to-month rather than once a year” like atraditional underwriter, he adds.

|Dancer notes there is no one solution for everyone when it comesto managing the higher cost of insurance, “but you have to be inposition to get creative.” From a broker standpoint, he says Marshis making sure its people start conversations with transportationaccounts earlier to educate them about the marketplace and the typeof renewal they are going to have. In the current rate environment,he adds, “It is a challenging discussion to have.”

|Daniel Bancroft, Transportation practice leader at Willis TowersWatson, says there are things trucking operations can do to managepremiums. He agrees that rates are on the rise, but says motorcarriers that are very safe and have good Compliance, Safety,Accountability scores from the Federal Motor Carrier SafetyAdministration are finding renewals that areconsistent.

|Bancroft says fleets should look to adopt advanced technologysuch as telematics and drive cams to improve driver safety.Companies that do so, he says, are seeing dramatic reductions infrequency and severity.

|Farrell says Nationwide does factor safety measures such as theuse of technology into its underwriting, but he says underwritershave to be careful not to issue a “seal of approval” just because acompany invested in telematics. “That factor alone is not acompelling reason to say they have it all figured it out,” he adds.The data has to be carried back to the driver to actually modifyhis or her behavior.

|Roberts notes that a focus on driver safety has more value thanjust managing insurance premiums. For large, federally regulatedfleets, the Federal Motor Carrier SafetyAdministration can shut them down if the operation isdeemed unsafe.

|Cameras are also of help to insurers during the claims process.“There has been a push to have cameras in the vehicle to record thesituation around an accident,” she notes. “Sometimes it helps usand sometimes it hurts us, but either way we know exactly whathappens in the accident. If we were at fault, we can come to anagreement faster as opposed to disputing what led up to theclaim.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.